Healthcare Provider SMBs Receive 25% of Payments Late

Increasingly, small- to mid-sized businesses (SMBs) operating in the healthcare field are using real-time payment technology to improve cash flow efficiency.

Thirty-eight percent of the healthcare SMBs PYMNTS Intelligence surveyed for “Small Business Real-Time Payments Barometer: Healthcare Edition” said real-time payments were their most-used payment method, with instant bank account-to-account payments (15%) and instant PayPal (13%) topping the list of preferred real-time methodologies.

PYMNTS Intelligence surveyed nearly 650 healthcare providers that generated less than $10 million in annual revenue for the report. The goal was to explore if and how these smaller healthcare firms use real-time payments.

Real-time payments are payments that are processed instantly and continuously, 24/7 year-round. Transactions are typically completed within seconds of being initiated — although they can take up to 30 minutes, depending on the banking systems and security protocols put in place. However, regardless of how long it takes to send the funds, they are immediately available for the recipient once the transaction is complete.

This velocity appeals to healthcare SMBs. Of the 83% who said they sent or received real-time payments in the last year, 61% said they specifically used real-time payments because of the speed at which payments are settled.

The speed explains much of the appeal of real-time payments, but their impact goes beyond near-instant settlement and ease of use. Healthcare provider SMBs were also likelier to report very or extremely healthy balance sheets if they used real-time payments. This was especially true if they used instant bank account-to-account payments or instant PayPal as their primary payment method.

Healthy balance sheets are important for smaller businesses because they often operate on tighter budgets and have fewer resources to handle disruptions.

Customers and vendors making late payments can add pressure to the balance sheet because the overdue payments complicate cash flow management and make extra work for those on accounts receivable (AR) teams.

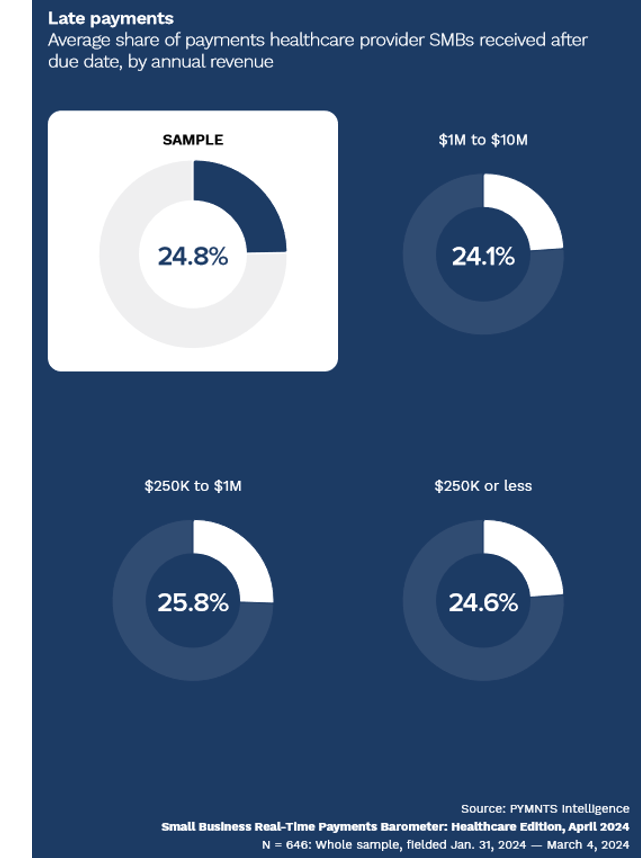

SMB healthcare providers receive 25% of their payments late, on average, with little variation across revenue brackets. Additionally, 75% of survey respondents said not receiving payments instantly created other problems, such as friction related to tracking payments and optimizing cash flow.

However, PYMNTS Intelligence data revealed that real-time payments can reduce the impact of late payments by eliminating long processing times. Respondents also said instant payments improved the health of their balance sheets, particularly if they used instant bank account-to-account transfers or instant PayPal.

The post Healthcare Provider SMBs Receive 25% of Payments Late appeared first on PYMNTS.com.