How Can You Successfully Build a Digital Asset Exchange for Tokenized Real-World Assets?

Building a digital asset exchange for tokenized real-world assets presents an exciting opportunity in the evolving landscape of blockchain technology and finance. As traditional assets like real estate, art, and commodities become digitized, the demand for platforms that facilitate their trading is rapidly increasing. To successfully create such an exchange, one must begin with a solid understanding of regulatory compliance, ensuring adherence to legal frameworks that govern digital assets. Additionally, incorporating robust security measures is crucial to protect users and their investments from potential threats.

User experience should be at the forefront of design, providing a seamless interface that enables easy navigation and efficient transactions. Integrating advanced technologies like smart contracts can enhance automation and transparency, further building user trust. Moreover, effective marketing strategies will attract users to the platform, emphasizing the unique benefits of tokenized assets, such as liquidity and fractional ownership. By addressing these key components, entrepreneurs can lay a strong foundation for a successful digital asset exchange that not only meets current market needs but also adapts to future trends in the digital economy.

Table of ContentUnderstanding Tokenized Real-World AssetsKey Components of a Digital Asset Exchange

Why You Should Invest in RWA Digital Asset Exchange Platform?

Developing a Business Model

Marketing and User Acquisition

Compliance and Risk Management

Launching the Exchange

Future Trends and Innovations

ConclusionUnderstanding Tokenized Real-World Assets

Tokenized real-world assets represent a groundbreaking shift in how we perceive and interact with traditional assets, such as real estate, art, and commodities. By converting these tangible assets into digital tokens on a blockchain, they become more accessible, divisible, and tradable, offering a host of benefits. RWA Tokenization enhances liquidity, allowing investors to buy and sell fractions of assets that were previously illiquid, such as high-value properties or collectibles. This democratization of investment opens up opportunities for a broader range of investors who may not have the capital to invest in whole assets.

Additionally, the transparency and security provided by blockchain technology ensure that ownership records are immutable and easily verifiable, significantly reducing the risk of fraud. Smart contracts can automate various processes, such as transactions and compliance, streamlining operations and minimizing costs. Moreover, tokenized assets can facilitate cross-border trading, breaking down geographical barriers and expanding market reach.

As this innovative approach continues to gain traction, it holds the potential to transform asset ownership, investment strategies, and the overall financial landscape, paving the way for a more inclusive and efficient economy.

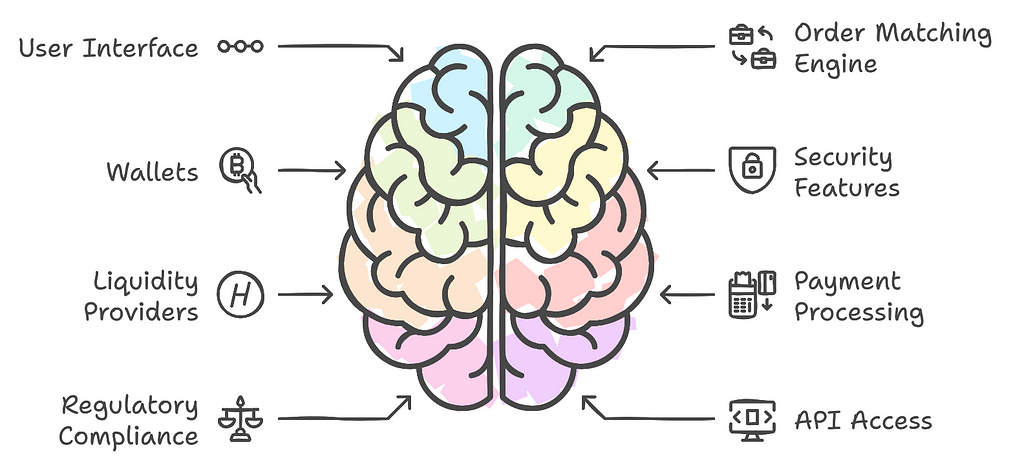

Key Components of a Digital Asset ExchangeA digital asset exchange (DAX) is a platform that facilitates the buying, selling, and trading of digital assets, such as cryptocurrencies, tokens, and other digital commodities. Here are the key components of a digital asset exchange:

➥ User Interface (UI):

➥ User Interface (UI):- The front-end design that users interact with. It should be intuitive and user-friendly, providing features like real-time market data, charts, and order book access.

- The core component responsible for matching buy and sell orders. It processes trades in real-time and ensures liquidity on the exchange.

- Digital wallets for storing users’ assets securely. They can be hot wallets (online) for quick access and cold wallets (offline) for enhanced security.

- Robust security measures including two-factor authentication (2FA), encryption, and withdrawal whitelists to protect user accounts and funds from hacks and fraud.

- Relationships with liquidity providers ensure that the exchange has enough liquidity to execute trades quickly and efficiently.

- Integration with various payment methods (credit/debit cards, bank transfers, etc.) to facilitate easy deposits and withdrawals for users.

- Adherence to local and international regulations, including Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures.

- Application Programming Interfaces (APIs) for developers to connect their applications to the exchange, allowing automated trading and data retrieval.

- The various combinations of digital assets that can be traded against each other (e.g., BTC/ETH, BTC/USD).

- System for managing user accounts, including registration, verification, and account management features.

- Tools for users to analyze market trends, including historical data, price charts, and indicators to make informed trading decisions.

- A support system (live chat, email, FAQs) to assist users with issues, queries, and feedback.

- If applicable, smart contracts automate trading processes on decentralized exchanges (DEXs), allowing peer-to-peer transactions without intermediaries.

- Mobile applications or responsive designs that allow users to trade and manage their assets on the go.

Each of these components plays a vital role in the overall functionality, security, and user experience of a digital asset exchange.

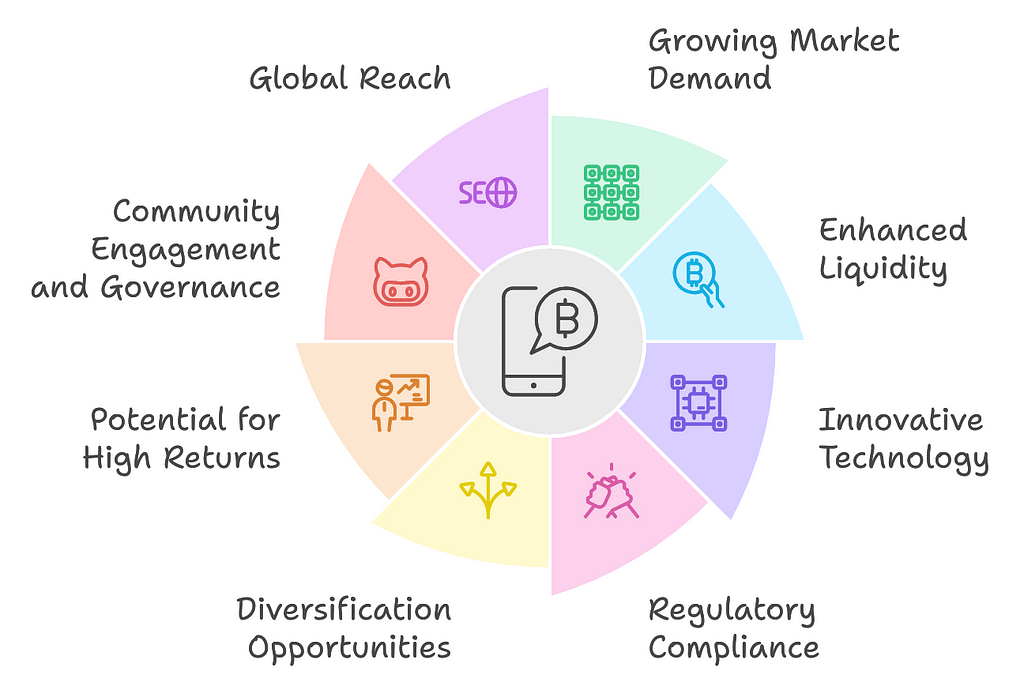

Why You Should Invest in RWA Digital Asset Exchange Platform?Investing in a digital asset exchange platform focused on real-world assets (RWA) presents numerous advantages. Here are compelling reasons why you should consider this investment opportunity:

1. Growing Market Demand

1. Growing Market Demand- Increased Interest in Tokenization: The demand for tokenized assets is rising as investors seek alternatives to traditional investment methods. This trend indicates a growing market for platforms that facilitate such transactions.

- Expanding Asset Classes: Real-world assets, such as real estate, art, and commodities, are increasingly being tokenized, allowing broader participation from retail and institutional investors.

- Fractional Ownership: Tokenization allows for fractional ownership of high-value assets, making them accessible to a larger pool of investors and enhancing liquidity in traditionally illiquid markets.

- 24/7 Trading: Digital asset exchanges operate round the clock, offering liquidity and trading opportunities that traditional markets cannot match.

- Blockchain Advantages: Utilizing blockchain technology ensures transparency, security, and immutability of transactions, fostering trust among users.

- Smart Contracts: Automating transactions through smart contracts reduces the need for intermediaries, lowering costs and speeding up processes.

- Evolving Frameworks: As regulatory environments become clearer and more defined, compliant platforms will be well-positioned to capture market share and attract institutional investments.

- Trust and Credibility: Platforms that prioritize compliance build credibility with users, making them more attractive for long-term investment.

- Access to Diverse Assets: RWA digital asset exchanges provide investors with access to a wider range of asset classes, helping them diversify their portfolios.

- Alternative Investment Avenues: Investing in tokenized real-world assets offers a hedge against traditional market volatility and inflation.

- Emerging Market Growth: The tokenization of real-world assets is a relatively new market, with significant growth potential. Early investors in successful platforms may see substantial returns as adoption increases.

- Increased Valuation Opportunities: As the platform scales and attracts more users, its valuation is likely to increase, providing lucrative exit strategies for investors.

- Decentralized Governance Models: Many digital asset exchanges adopt community-driven governance, allowing investors to have a say in the platform’s future direction, fee structures, and new features.

- User-Centric Development: Engaging with the community can lead to better platform enhancements that align with user needs and preferences.

- Cross-Border Trading: Digital asset exchanges can facilitate cross-border transactions, tapping into a global user base and capitalizing on the increasing interest in digital assets worldwide.

- Localized Opportunities: By offering localized solutions, such as language support and regulatory compliance, platforms can cater to diverse markets.

- Market Education: Platforms often invest in educating users about tokenization and digital assets, fostering a more informed investor base that is likely to engage actively.

- Building Trust: By providing educational resources, platforms enhance user confidence, making them more likely to invest and trade on the platform.

- Adoption of Emerging Technologies: Investing in a digital asset exchange that embraces innovations such as AI, machine learning, and advanced analytics positions you at the forefront of technological advancements in finance.

- Resilience to Market Changes: As the financial landscape evolves, platforms that adapt to changes and innovate continuously will be better positioned for long-term success.

Investing in a digital asset exchange platform focused on real-world assets offers a unique opportunity to tap into a growing market, benefit from technological advancements, and engage in a diverse investment landscape. With the potential for high returns, enhanced liquidity, and a commitment to regulatory compliance, such platforms are well-positioned for sustained growth and success in the rapidly evolving world of digital finance.

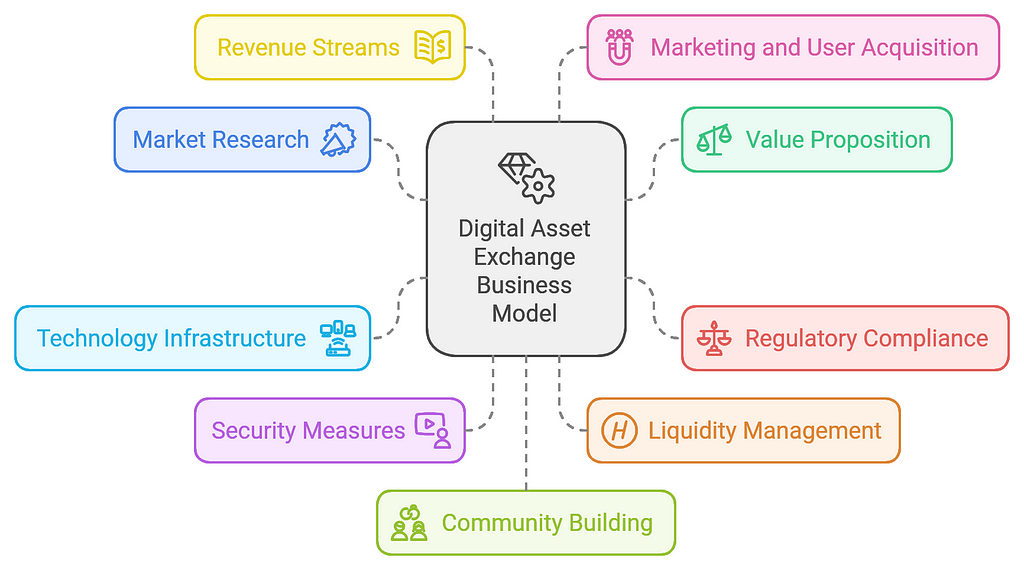

Developing a Business ModelBuilding a digital asset exchange (DAX) for tokenized real-world assets requires a well-thought-out business model that addresses the unique challenges and opportunities in this space. Here’s a comprehensive approach to developing a successful business model:

1. Market Research and Analysis

1. Market Research and Analysis- Identify Target Market: Research potential users, such as investors, institutions, and asset owners, to understand their needs and preferences.

- Competitor Analysis: Analyze existing exchanges and platforms dealing with tokenized assets to identify strengths, weaknesses, and market gaps.

- Tokenization Benefits: Highlight how tokenization increases liquidity, accessibility, and transparency in real-world asset markets.

- Unique Features: Offer unique functionalities like fractional ownership, real-time trading, and robust security to differentiate your platform.

- Legal Framework: Ensure compliance with local and international regulations regarding securities, asset trading, and cryptocurrency.

- Licensing: Obtain necessary licenses to operate legally in different jurisdictions.

- Blockchain Platform: Choose a reliable blockchain for token issuance and trading (e.g., Ethereum, Binance Smart Chain, or a specialized platform).

- User-Friendly Interface: Develop an intuitive and responsive interface that provides easy navigation and access to market data.

- Multi-Factor Authentication (MFA): Implement robust security protocols to protect user accounts and assets.

- Cold Storage: Use cold wallets for long-term storage of tokenized assets to reduce the risk of hacks.

- Liquidity Providers: Establish partnerships with liquidity providers to ensure sufficient trading volume and tighter spreads.

- Market Making: Consider employing market makers to enhance liquidity on the platform.

- Transaction Fees: Charge fees on trades executed on the platform, which can vary based on the asset class or transaction volume.

- Listing Fees: Charge asset issuers for listing their tokenized assets on the exchange.

- Subscription Models: Offer premium features or analytics tools for advanced traders and institutional clients.

- Educational Content: Provide resources and tutorials to educate users about tokenized assets and the trading process.

- Referral Programs: Encourage existing users to refer new customers through incentive-based programs.

- Partnerships: Collaborate with financial institutions, real estate companies, and other relevant sectors to promote your exchange.

- User Engagement: Foster a community around your platform through forums, webinars, and social media.

- Feedback Mechanisms: Implement systems for users to provide feedback, which can help improve the platform and build loyalty.

- Global Reach: Plan for international expansion by considering regulatory requirements in different jurisdictions.

- Asset Diversification: Expand the range of tokenized assets available on the platform, including real estate, art, and other physical assets.

- Analytics and Monitoring: Use data analytics to monitor user behavior and trading patterns, allowing for continuous platform enhancements.

- Adapt to Trends: Stay updated on market trends and regulatory changes to adapt your business model as necessary.

Successfully building a digital asset exchange for tokenized real-world assets involves a comprehensive approach that balances technological innovation, regulatory compliance, and user-centric design. By focusing on creating a secure, transparent, and efficient platform, you can capitalize on the growing demand for tokenized assets while fostering trust and engagement within your user community.

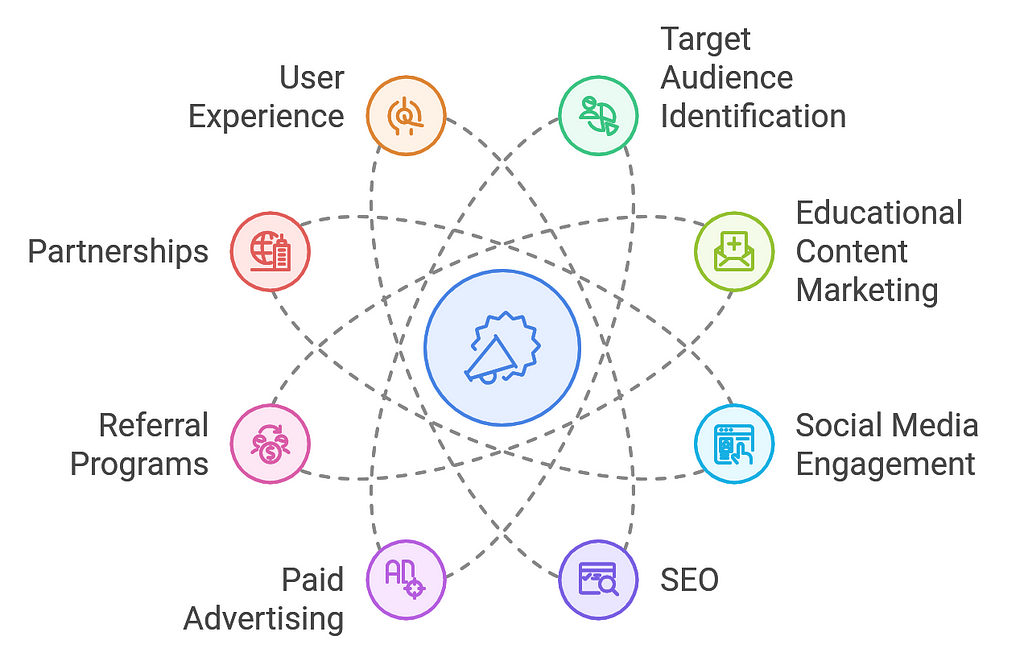

Marketing and User AcquisitionSuccessfully marketing and acquiring users for a digital asset exchange (DAX) focused on tokenized real-world assets involves a multifaceted strategy that combines education, engagement, and targeted outreach. Here’s a comprehensive approach to marketing and user acquisition:

1. Identify Target Audience

1. Identify Target Audience- Segmentation: Define key user segments, such as retail investors, institutional investors, asset owners, and businesses looking to tokenize their assets.

- User Persona Development: Create detailed profiles for each segment to tailor marketing messages effectively.

- Informative Resources: Develop blogs, whitepapers, e-books, and videos explaining tokenization, blockchain technology, and the benefits of using your exchange.

- Webinars and Workshops: Host online events featuring industry experts to discuss the potential of tokenized assets and demonstrate your platform’s features.

- Engagement Strategies: Use platforms like Twitter, LinkedIn, and Facebook to engage with potential users. Share news, updates, and educational content regularly.

- Community Building: Create dedicated groups or forums for discussions around tokenization and investment strategies.

- Keyword Strategy: Optimize your website and content for keywords related to digital assets, tokenization, and cryptocurrency trading.

- Backlinking: Collaborate with industry blogs and websites to build backlinks, enhancing your site’s authority and visibility.

- Targeted Ads: Use pay-per-click (PPC) advertising on platforms like Google Ads and social media to reach specific demographics interested in investing in tokenized assets.

- Retargeting Campaigns: Implement retargeting ads to re-engage users who have previously visited your site but did not register or trade.

- Incentives for Referrals: Create a referral program that rewards existing users for bringing new users to the platform, incentivizing growth through word-of-mouth.

- Industry Partnerships: Collaborate with financial institutions, real estate companies, and technology firms to expand your reach and credibility.

- Influencer Marketing: Engage with influencers in the blockchain and finance sectors to promote your exchange to their followers.

- Press Releases: Issue press releases about significant milestones, partnerships, or platform updates to gain media coverage and visibility.

- Thought Leadership: Position your team as industry experts by contributing articles to reputable publications and participating in panel discussions at conferences.

- Seamless Onboarding: Ensure that the registration and onboarding process is quick, simple, and intuitive to reduce friction for new users.

- Customer Support: Provide excellent customer support to assist users with queries and concerns, building trust and encouraging user retention.

- User Feedback: Implement systems to collect user feedback regularly to understand their needs and pain points, allowing for continuous platform improvement.

- A/B Testing: Experiment with different marketing strategies, landing pages, and content to identify what resonates best with your audience.

- Regional Campaigns: Tailor marketing efforts to specific geographic regions, taking into account local regulations and cultural factors.

- Multi-Language Support: Offer your platform and marketing materials in multiple languages to attract a broader audience.

- Sponsorships: Sponsor or participate in industry conferences and events to network with potential users and industry leaders.

- Trade Shows: Set up booths at relevant trade shows to showcase your platform and educate attendees about tokenized assets.

Building a successful marketing and user acquisition strategy for a digital asset exchange focused on tokenized real-world assets requires a combination of education, targeted outreach, and continuous engagement. By creating valuable content, leveraging partnerships, and prioritizing user experience, you can effectively attract and retain users while establishing your platform as a trusted player in the market.

Compliance and Risk ManagementCompliance and risk management are crucial components in the successful operation of a digital asset exchange for tokenized real-world assets. As this market continues to evolve, regulatory frameworks are becoming more defined, requiring exchanges to adhere to various laws governing anti-money laundering (AML), know your customer (KYC), and data protection. Implementing robust compliance measures is essential not only for legal adherence but also for building trust among users and investors. Failure to comply can lead to severe penalties, reputational damage, and loss of business.

In parallel, effective risk management strategies must be developed to identify, assess, and mitigate potential risks associated with digital assets. This includes cybersecurity threats, market volatility, and operational risks that could impact the platform’s functionality and user trust. Employing advanced technologies, such as machine learning algorithms, can enhance the monitoring of transactions for suspicious activity, enabling proactive responses to potential threats.

Additionally, regular audits and assessments of internal controls will help ensure that compliance and risk management practices remain effective and up-to-date. By prioritizing these elements, exchanges can create a secure and trustworthy environment that promotes user confidence and fosters long-term success in the digital asset landscape.

Launching the ExchangeLaunching a digital asset exchange (DAX) for tokenized real-world assets involves careful planning and execution to ensure a successful entry into the market. Here’s a step-by-step guide to effectively launch your exchange:

1. Pre-Launch Preparation

1. Pre-Launch Preparation- Finalizing Technology Stack: Ensure that the technology infrastructure is robust, scalable, and secure. This includes the trading engine, wallets, and user interface.

- Regulatory Compliance: Verify that you have met all legal requirements, including licensing, KYC (Know Your Customer), and AML (Anti-Money Laundering) regulations.

- Beta Testing: Conduct thorough testing of the platform through a beta program. Invite a select group of users to test the system, providing feedback on usability, functionality, and security.

- Load Testing: Simulate high traffic scenarios to ensure the platform can handle expected trading volumes without performance issues.

- Liquidity Providers: Establish relationships with liquidity providers to ensure sufficient trading volume upon launch.

- Asset Partners: Collaborate with asset owners or issuers to secure tokenized assets for trading on your platform.

- Pre-Launch Campaigns: Generate buzz before the official launch through teasers, countdowns, and early sign-up incentives.

- Content Marketing: Share informative content about tokenization and the advantages of your exchange to build awareness and educate potential users.

- Virtual or Physical Launch Event: Host an event to introduce your exchange to the public. This could include presentations, demonstrations, and Q&A sessions.

- Press Coverage: Invite journalists and industry influencers to cover the launch, providing them with press kits and access to key personnel.

- Simple Registration Process: Design an easy-to-follow registration and onboarding process that minimizes friction for new users.

- Educational Resources: Provide tutorials, FAQs, and guides to help users navigate the platform and understand how to trade tokenized assets.

- 24/7 Support Channels: Offer multiple support channels, including live chat, email, and phone support, to assist users with any issues they encounter.

- Community Engagement: Foster an active community through forums or social media groups where users can ask questions, share experiences, and offer feedback.

- Real-Time Monitoring: Implement tools to monitor platform performance, user activity, and security threats in real time.

- User Analytics: Analyze user behavior and trading patterns to understand how users are engaging with the platform and identify areas for improvement.

- Feedback Loop: Create mechanisms for users to provide feedback post-launch. Regularly analyze this feedback to enhance the user experience.

- Iterative Updates: Plan for ongoing updates and improvements based on user feedback, market trends, and technological advancements.

- User Retention Strategies: Develop loyalty programs, referral incentives, and regular engagement campaigns to retain users and encourage them to trade frequently.

- Performance Marketing: Utilize targeted advertising campaigns to attract new users based on insights gained from early adopters.

- Adapt to Regulatory Changes: Stay informed about changes in regulations affecting your exchange and be prepared to adapt your operations accordingly.

- Feature Expansion: Based on user demand and market trends, plan for the introduction of new features, trading pairs, or tokenized assets.

- Geographic Expansion: Consider expanding to new markets based on demand and regulatory feasibility.

Launching a digital asset exchange for tokenized real-world assets requires meticulous planning, effective marketing, and a commitment to user experience and security. By following these steps, you can position your exchange for success in a competitive and rapidly evolving market, fostering trust and engagement among your user base.

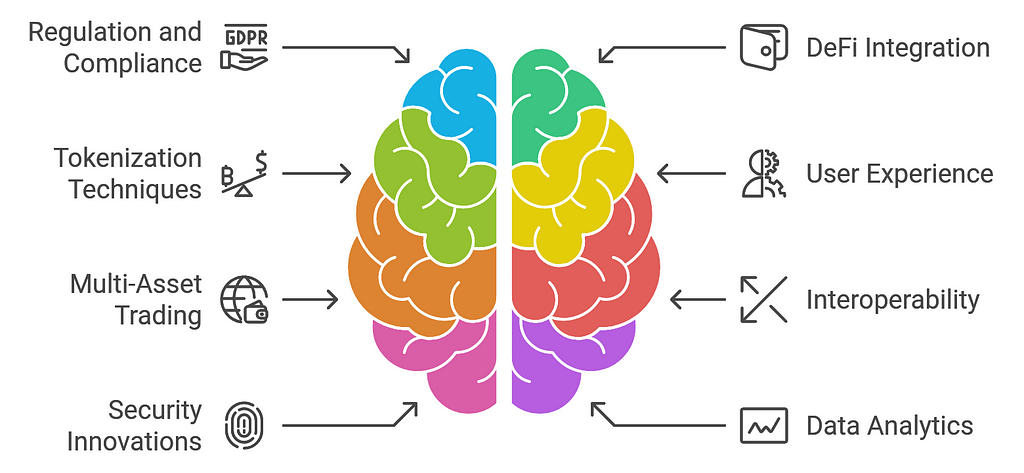

Future Trends and InnovationsBuilding a digital asset exchange (DAX) for tokenized real-world assets requires staying ahead of the curve by incorporating future trends and innovations. Here’s a look at potential developments that could shape the landscape of digital asset exchanges and enhance their functionality:

1. Increased Regulation and Compliance

1. Increased Regulation and Compliance- Global Standardization: Expect more unified regulatory frameworks globally, which will enhance trust and security in exchanges dealing with tokenized assets.

- Automated Compliance Tools: Implementing automated tools for KYC and AML processes to streamline compliance and improve user experience.

- DeFi Protocols: Integrating DeFi features such as lending, borrowing, and yield farming can attract users looking for diverse investment opportunities.

- Liquidity Pools: Allow users to provide liquidity for trading pairs and earn rewards, enhancing the overall liquidity of the platform.

- Fractional Ownership Models: Leveraging advanced tokenization methods to allow fractional ownership of high-value assets (e.g., real estate, art) can open up investment opportunities to a broader audience.

- Dynamic Asset Valuation: Implementing oracles and AI-based solutions for real-time asset valuation to enhance transparency and user confidence.

- AI-Driven Personalization: Using artificial intelligence to offer personalized trading experiences, tailored recommendations, and automated trading options based on user behavior.

- Intuitive Interfaces: Continuously improving user interfaces to ensure ease of use, especially for newcomers to digital assets.

- Cross-Asset Trading: Allowing users to trade various asset classes, including cryptocurrencies, tokenized stocks, commodities, and NFTs (Non-Fungible Tokens), from a single platform.

- Unified Wallets: Offering a multi-asset wallet solution that can hold and manage various tokenized assets securely.

- Blockchain Interoperability: Developing systems that enable seamless transactions and trading across different blockchain networks, enhancing liquidity and access to a broader range of tokenized assets.

- Atomic Swaps: Utilizing atomic swaps for direct peer-to-peer trading of different cryptocurrencies without relying on a centralized intermediary.

- Multi-Signature Wallets: Implementing multi-signature technology for enhanced security of asset storage and transactions.

- Biometric Authentication: Utilizing biometric technology (fingerprints, facial recognition) for user authentication to bolster security measures.

- Real-Time Market Insights: Providing users with advanced analytics tools, including market sentiment analysis and predictive modeling, to help them make informed trading decisions.

- Blockchain Analytics: Utilizing blockchain analysis tools to monitor transactions, identify patterns, and detect potential fraudulent activities.

- Green Asset Initiatives: Promoting tokenized assets related to sustainable projects (e.g., renewable energy) to attract socially responsible investors.

- Carbon Credits Trading: Exploring opportunities in trading tokenized carbon credits as part of environmental sustainability efforts.

- Automated Trading Bots: Developing AI-driven trading bots that can execute trades based on market conditions, trends, and user-defined strategies.

- Sentiment Analysis Tools: Implementing tools that analyze social media and news sentiment to provide users with insights into market movements.

- Decentralized Autonomous Organizations (DAOs): Allowing users to participate in governance decisions related to platform development, fee structures, and new feature implementations.

- User Voting Mechanisms: Implementing voting systems that empower users to influence the future direction of the exchange.

- Enhanced Educational Resources: Offering comprehensive educational programs, tutorials, and certification courses to help users understand the complexities of tokenized assets and trading strategies.

- Community Engagement Programs: Creating initiatives to engage users through forums, discussions, and events to promote knowledge sharing and collaboration.

The future of digital asset exchanges for tokenized real-world assets is promising, with numerous trends and innovations poised to reshape the industry. By embracing these developments and integrating cutting-edge technologies, exchanges can enhance user experience, ensure regulatory compliance, and provide a diverse range of investment opportunities. Staying agile and responsive to market changes will be crucial for long-term success in this rapidly evolving landscape.

ConclusionIn conclusion, successfully building a digital asset exchange for tokenized real-world assets requires a multifaceted approach that prioritizes compliance, security, user experience, and technological innovation. By navigating the complex regulatory landscape and ensuring that the platform adheres to legal requirements, founders can establish a credible and trustworthy exchange. Robust security measures are essential to safeguard against threats, as the protection of user assets fosters confidence in the platform. An intuitive user interface enhances engagement, making it easier for users to trade and manage their tokenized assets.

Additionally, leveraging smart contracts and blockchain technology can streamline operations, reduce costs, and enhance transparency. As the market for digital assets continues to grow, effective marketing strategies are vital for attracting and retaining users, emphasizing the unique advantages of tokenized assets. Ultimately, a well-rounded approach that combines these elements will not only position a digital asset exchange for success in the competitive landscape but also contribute to the broader acceptance and integration of tokenized real-world assets in the global economy. By staying adaptable and responsive to market trends, entrepreneurs can pave the way for future growth and innovation in this dynamic field.

How Can You Successfully Build a Digital Asset Exchange for Tokenized Real-World Assets? was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.