PEPE’s Quick Bounce to $0.000010 Unrealistic, Key Indicators Reveal

The price of Pepe (PEPE), the Ethereum-based frog-themed meme coin, seems stable today. Like many other cryptos, PEPE has endured a long period of decline.

Currently, the token trades at $0.0000079, which is a 32% 30-day decrease. To erase these losses, the price has to return to $0.000010 at least. But can it?

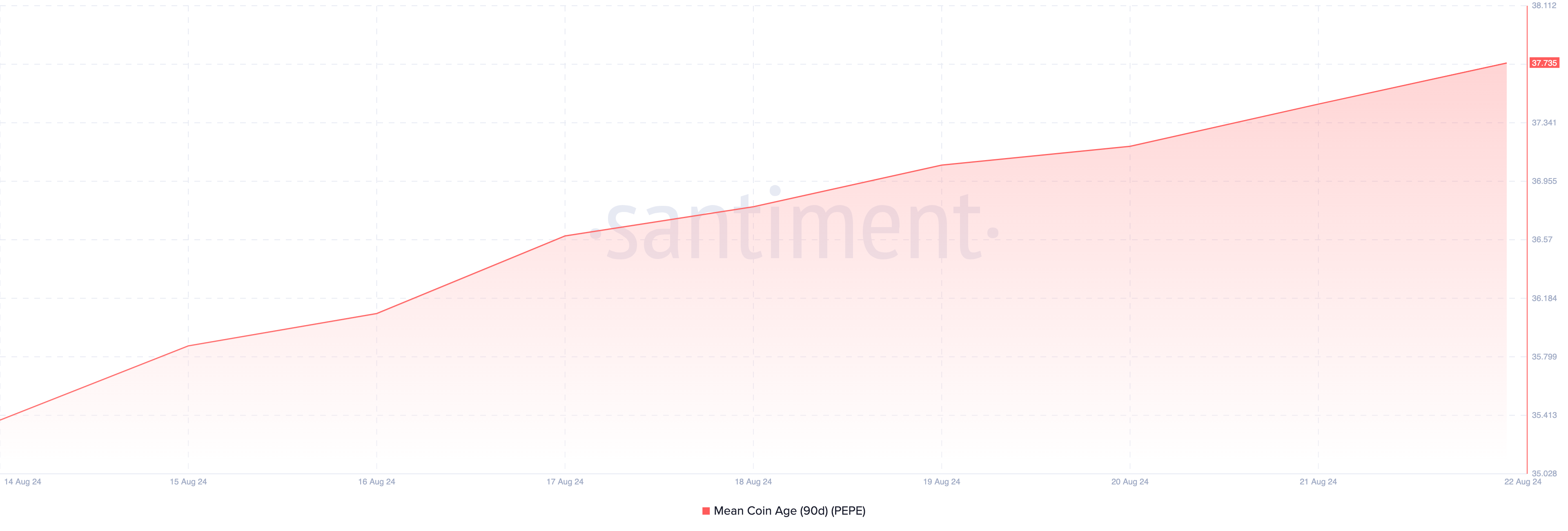

Pepe Dormant Tokens Have Come Out of Their ShellA 90-day increase in a meme coin’s Mean Coin Age (MCA) indicates that more previously dormant tokens are being moved back into circulation. MCA measures the average age of all tokens on a blockchain and provides insights into holder behavior.

Typically, when MCA decreases, it signals that investors are moving their assets out of long-term storage and into cold wallets, demonstrating faith in the coin’s long-term value.

However, an increase, like what’s happening with PEPE, suggests that long-held coins are being reintroduced into the market. This usually leads to heightened transaction activity and can be a precursor to sell-offs, as holders release tokens they previously held onto for a long time.

Pepe 90-Day Mean Coin Age. Source: Santiment

Pepe 90-Day Mean Coin Age. Source: Santiment

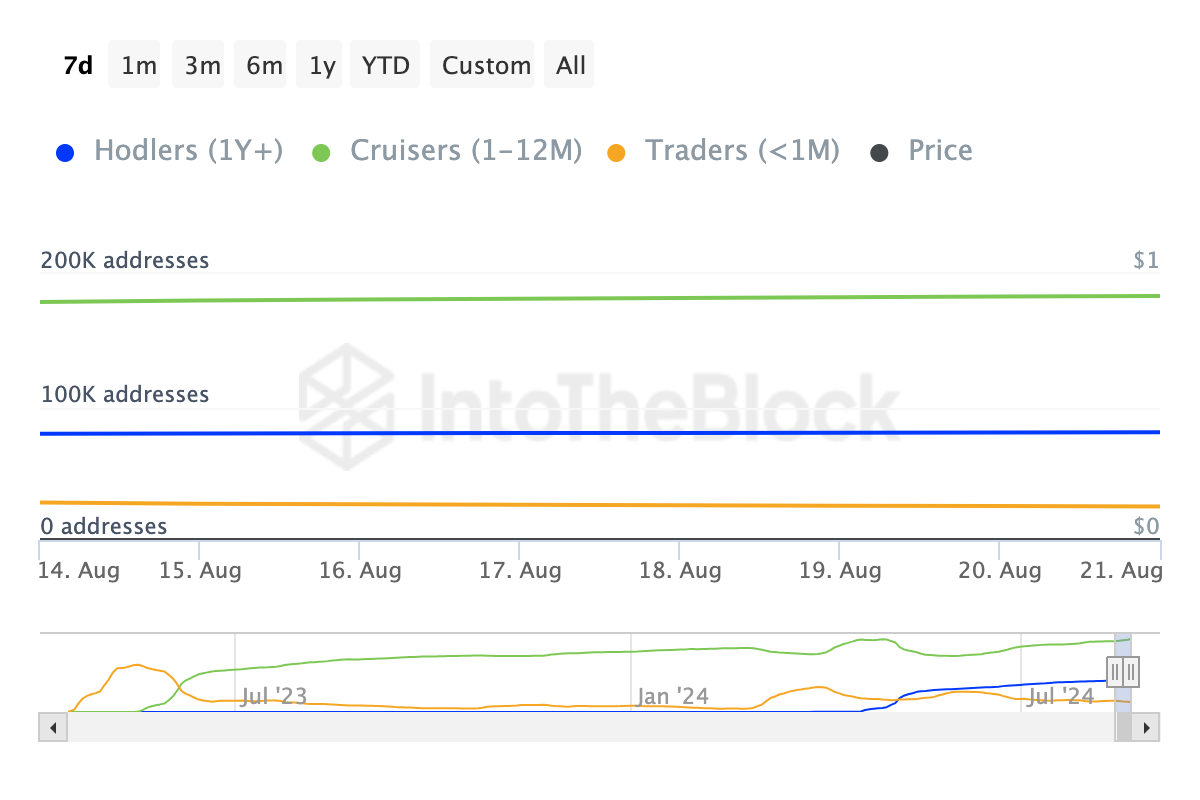

If the trend continues, the recent stability of the token could be at risk. On-chain data shows a decline in the number of addresses accumulating PEPE over the past 30 days, which is a concerning signal for short-term momentum.

Typically, a rise in short-term holders suggests increased demand, often leading to price growth as more traders accumulate positions. Conversely, a reduction in short-term holders usually points to weakening demand, which can result in either stagnant price action or a decline.

In PEPE’s case, if fewer short-term holders continue accumulating, this could either lead to prolonged sideways movement or further price drops, especially if dormant tokens continue to be unlocked and sold.

Read more: 5 Best Pepe (PEPE) Wallets for Beginners and Experienced Users

Pepe Addresses by Time Held. Source: IntoTheBlock

PEPE Price Prediction: The Bounce Could Be Hindered

Pepe Addresses by Time Held. Source: IntoTheBlock

PEPE Price Prediction: The Bounce Could Be Hindered

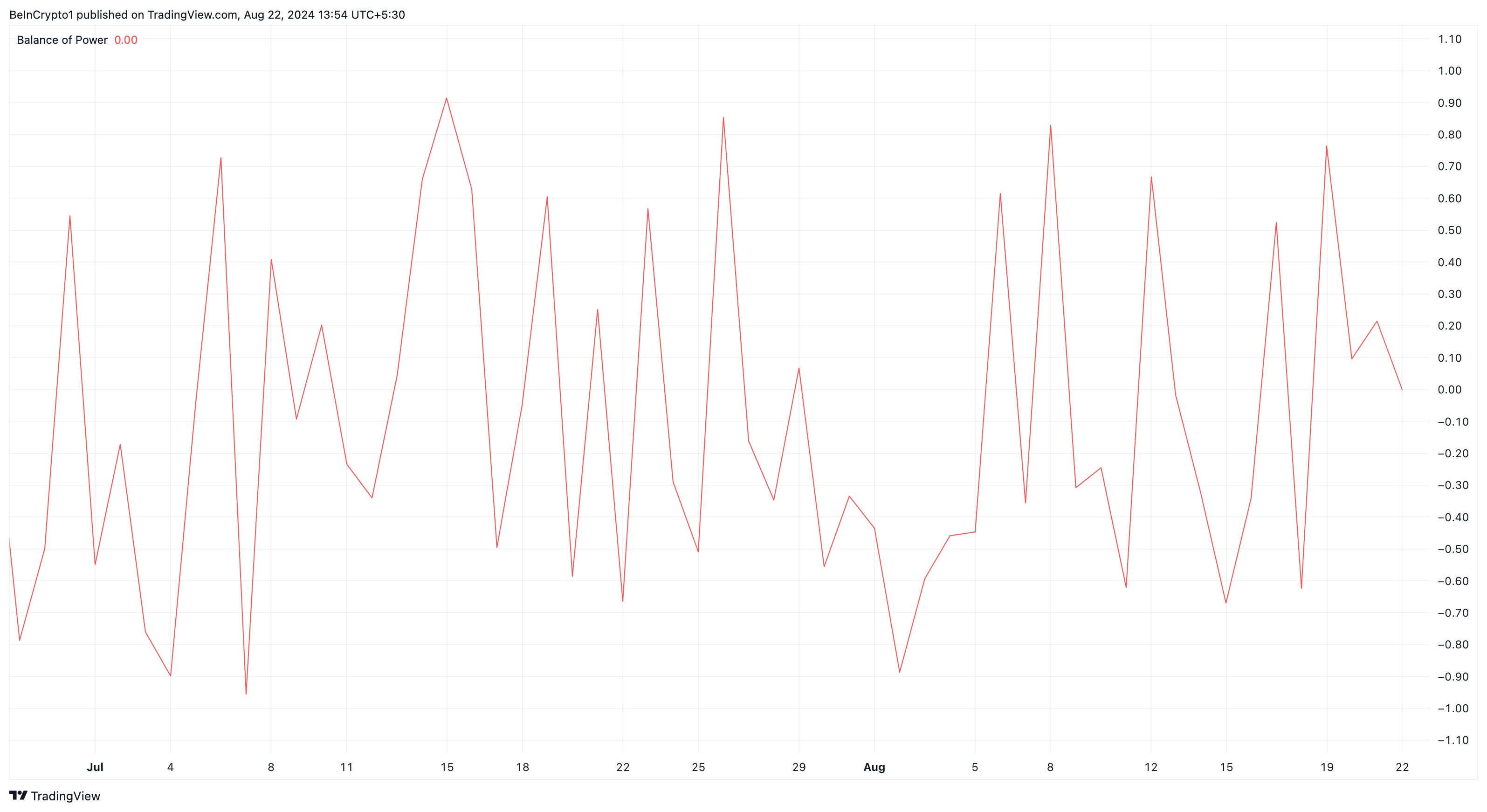

From a technical standpoint, the lack of significant buying volume is one factor hindering a notable price jump for PEPE. On many occasions, the cryptocurrency experiences substantial respite when buyers accumulate in large volumes.

But over the past few weeks, and till the time of writing, this has not happened. Further, the Balance of Power (BoP) on the daily chart has turned downwards and is negative. The BoP is a price-based technical indicator that measures the strength of buyers and sellers in the market.

Positive values of the indicator suggest bullish dominance, while negative ones infer bearish control. As such, it appears that PEPE, despite its slight bounce, remains within reach of another rejection.

Pepe Balance of Power. Source: TradingView

Pepe Balance of Power. Source: TradingView

An assessment of the chart also reveals that the token trades below the demand zone between $0.0000085 and $0.0000088, suggesting that the recent upswing has yet to be validated. The token is also below the 20-day Exponential Moving Average (EMA).

The EMA measures trend direction, and the price being below the indicator is a bearish sign. Should this remain the same, PEPE’s price might retrace to $0.0000070 once more. However, a break above the indicator could invalidate this thesis. If this is the case, the price might increase.

Read more: Pepe (PEPE) Price Prediction 2024/2025/2030

PEPE Daily Analysis. Source: TradingView

PEPE Daily Analysis. Source: TradingView

In addition, there is ongoing speculation that Coinbase might list the meme coin, fueled by the exchange’s creation of a dedicated page on its website. If this listing materializes, it could trigger a significant rally for PEPE, potentially pushing its price back to $0.000010 or higher.

The post PEPE’s Quick Bounce to $0.000010 Unrealistic, Key Indicators Reveal appeared first on BeInCrypto.