Riot Platform’s Takeover Bid for Bitfarms Ends with Settlement and Board Changes

On September 23, 2024, Riot Platforms issued an official statement detailing a settlement agreement with Bitfarms Ltd., effectively bringing an end to Riot’s unsolicited bid to acquire the company.

As part of this agreement, Riot has withdrawn its requisition for a special meeting of Bitfarms’ shareholders, and several board-level changes were made to ensure a smoother strategic review process for Bitfarms.

Riot’s Acquisition Hurdles: The Poison Pill Strategy that Reshaped NegotiationsAccording to the statement, Bitfarms has appointed Amy Freedman to its Board of Directors. This appointment comes as Andrés Finkielsztain resigned as part of the settlement.

Freedman, a key figure in corporate governance, will join the Board’s Governance and Nominating Committee and Compensation Committee. The agreement allows her to participate in any special committees of independent directors that may be constituted in the future.

Read more: 5 Best Platforms To Buy Bitcoin Mining Stocks in 2024

Riot has indicated to monitor its stake in Bitfarm closely. However, the firm has yet to plan any immediate takeovers.

“Immediately prior to, and immediately after, the entering into of the Agreement, Riot beneficially owned 90,110,912 common shares (the ‘Common Shares’) of Bitfarms, representing approximately 19.9% of the issued and outstanding Common Shares (as calculated based on information provided by the Company),” the firm’s official statement reads.

BeInCrypto reported that Riot made an unsolicited offer of $950 million in May to acquire Bitfarms. On June 20, Bitfarms implemented a shareholder rights plan, commonly known as a “poison pill,” to prevent a hostile takeover.

The strategy aimed to protect Bitfarms’ shareholders. It triggered specific rights if any party, including Riot, attempted to acquire more than 15% of Bitfarms’ shares before September 10, 2024, or 20% after that date.

As a result, the company was able to buy time to explore other strategic alternatives, such as business combinations or a potential sale. Riot’s increased share purchases, which saw its stake rise to 19.9%, only intensified concerns over jeopardizing shareholder interests.

“Riot’s actions, including a proposal received on April 22, 2024, and its subsequent market purchases to increase its stake, have been deemed to undervalue Bitfarms by the Special Committee of Independent Directors. This committee believes that Riot’s continued acquisition of shares disrupts the integrity of the strategic review process and could hinder maximizing shareholder value,” Bitfarms stated earlier this year.

Despite the settlement, Riot retains the option to reconsider its stake in Bitfarms in the future. Its continued interest in the company, as outlined in its early warning report, could lead to new proposals or further discussions depending on Bitfarms’ performance and overall market conditions. For now, however, both companies appear focused on their respective strategies.

Read more: Best Crypto Mining Stocks to Buy or Watch Now

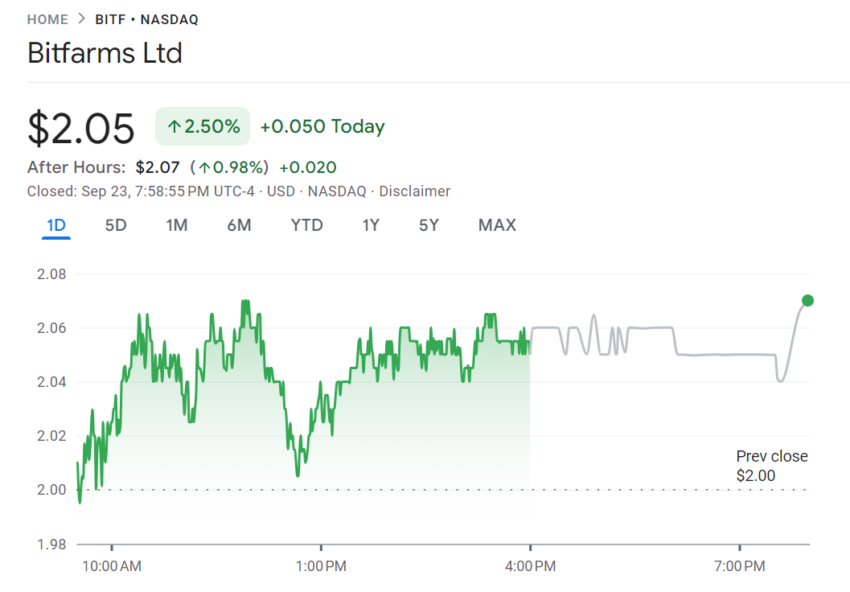

BITF Price Performance. Source: Google Finance

BITF Price Performance. Source: Google Finance

As of the settlement date, Bitfarms’ stock (BITF) was trading at $2.05, reflecting a 2.05% increase. However, year-to-date, the stock has seen a 27.82% decline.

The post Riot Platform’s Takeover Bid for Bitfarms Ends with Settlement and Board Changes appeared first on BeInCrypto.