Riot Platforms Adds $69 Million in Bitcoin, Boosting Holdings to 17,429 BTC

Bitcoin miner Riot Platforms has purchased 667 BTC worth $69 million, according to recent SEC filings. The acquisition was made at an average price of $101,135 per Bitcoin.

With this purchase, Riot’s total Bitcoin holdings have climbed to 17,429 BTC, which, at today’s price, is valued at approximately $2 billion.

Riot initially shifted its business focus to Bitcoin mining in 2018, operating from its Oklahoma facility. The company has since expanded its strategy, mirroring MicroStrategy Chairman Michael Saylor’s approach to Bitcoin purchase and initiating share buybacks to increase crypto reserves.

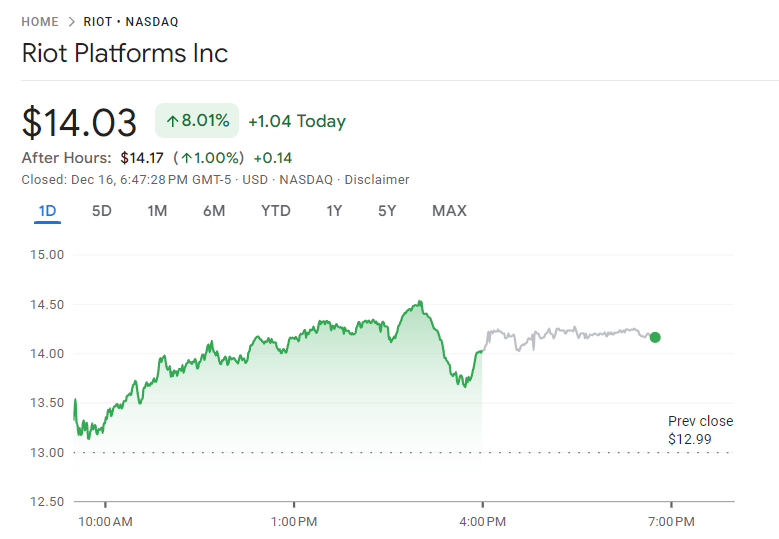

Following the announcement, Riot’s stock price surged nearly 8% today. The firm’s combined mining operations and strategic Bitcoin acquisitions have significantly boosted its BTC yield.

Also, Riot reported a 36.7% Bitcoin yield for Q4 so far and a year-to-date yield of 37.2%. This yield metric highlights the growth in BTC holdings relative to share dilution.

RIOT Stock Price on December 16. Source: Google Finance

RIOT Stock Price on December 16. Source: Google Finance

The approach of raising capital through share rights for Bitcoin purchases remains a topic of debate. However, major miners like Riot and Marathon Digital (MARA) have continued this practice.

Last week, MARA acquired 11,774 BTC for $1.1 billion, using funds from a zero-coupon convertible note offering.

Meanwhile, MicroStrategy also announced its latest Bitcoin purchase today. The company acquired 15,350 BTC for $1.5 billion at an average price of $100,386 per BTC.

With this purchase, MicroStrategy now holds $27.1 billion worth of BTC. The company reported a Q4 Bitcoin yield of 46.4% and a year-to-date yield of 72.4%, reflecting its aggressive Bitcoin purchase strategy.

MicroStrategy’s stock (MSTR) has mirrored Bitcoin’s strong performance this year, rising nearly 500% year-to-date. The growth has placed Michael Saylor’s company among the top 100 publicly traded firms in the United States.

“Everyone buys Bitcoin at the price they deserve. BTC doesn’t wait. It simply transfers wealth to those who see,” Michael Saylor recently wrote on X (formerly Twitter).

Saylor has long encouraged public companies to add Bitcoin to their portfolios. Despite his multiple proposals, Microsoft shareholders recently rejected a proposal to include Bitcoin in its treasury.

However, its competitor, Amazon’s shareholders, have taken a different stance. They proposed allocating part of Amazon’s $88 billion cash reserves to Bitcoin as a hedge against inflation.

The post Riot Platforms Adds $69 Million in Bitcoin, Boosting Holdings to 17,429 BTC appeared first on BeInCrypto.