Ripple’s 800 Million XRP Lock, Bull Rally Ahead?

The post Ripple’s 800 Million XRP Lock, Bull Rally Ahead? appeared first on Coinpedia Fintech News

The overall cryptocurrency market is once again gaining momentum. Amid this, Ripple has locked 800 million XRP tokens in escrow. This substantial locking of XRP occurred in three different transactions, as reported by the blockchain transaction tracker, Whale Alert.

Source: X (Previously Twitter)

800 Million XRP Locked,

Source: X (Previously Twitter)

800 Million XRP Locked,

In general, this substantial locking of XRP is often considered a bullish sign as it creates more stability and confidence in the market. Additionally, it is Ripple’s long-term strategy for managing token distribution.

With such a notable amount of XRP locked, it raises the question of whether this will create buying pressure in the market or if we are about to experience a significant rally in the coming days.

XRP Price MomentumAs of now, XRP is trading near $0.622 and has experienced a price decline of 1.45% over the past 24 hours. During the same period, its trading volume declined by 50%, indicating lower participation from traders and investors, potentially due to the high volatility in the market.

XRP Technical AnalysisAccording to the expert technical analysis, XRP is struggling to break the strong resistance level near $0.65. Additionally, the formation of a daily candlestick pattern at the resistance level indicates a price reversal, as a bearish engulfing candle has formed.

Source: Trading View

Source: Trading View

If XRP breaks this level and closes a daily candle above the $0.65 level, there is a strong possibility that it could soar by 12% to reach the $0.74 level in the coming days. Despite this bullish outlook, the asset is still in an uptrend as it trading above the 200 Exponential Moving Average (EMA) on a daily time frame.

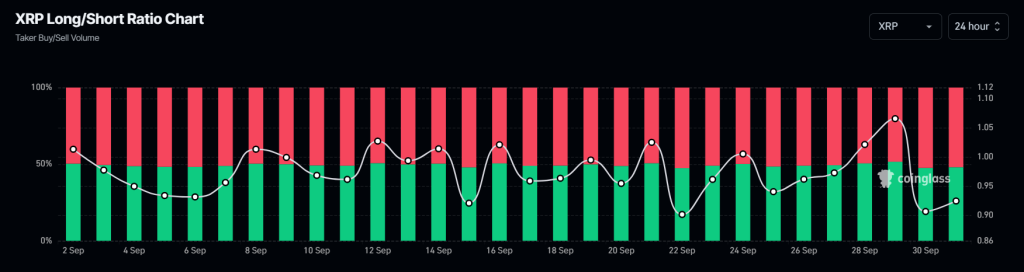

XRP’s On-Chain MetricsBesides positive outlooks by technical analysis, on-chain metrics indicate a bearish sentiment. According to on-chain analytics firm Coinglass, XRP’s Long/Short ratio currently stands at 0.924, indicating a strong bearish sentiment among traders.

Source: Coinglass

Source: Coinglass

Additionally, its future open interest has declined by 4.5% and has been steadily falling, indicating potential liquidation of positions amid recent volatility in the market.

At present, 52% of top traders hold short positions, while 48% hold long positions. Analyzing all these data, it appears that bears are currently dominating the asset, and XRP’s struggles will continue until it breaks the $0.65 level.