Ripple Reports Strong Q3 as Institutional Players Drive XRP Demand Higher

Ripple experienced notable growth in the third quarter. The firm saw a boost in transaction volume on the XRP Ledger and an increase in institutional interest in its XRP token.

This development comes as the firm continues to fight its case against the US Securities and Exchange Commission (SEC).

Ripple’s XRP Finds Institutional Traction as Trading Volumes SurgeRipple reported heightened institutional interest in XRP, partly driven by the US SEC’s waning credibility in the crypto space. Several financial heavyweights, including the Chicago Mercantile Exchange (CME), introduced new XRP offerings over the quarter. CME unveiled an XRP reference price, while Bitnomial announced plans for an XRP futures product.

Further, prominent firms like Bitwise, Canary, and 21Shares filed to launch exchange-traded funds (ETFs) centered on XRP. Also, Grayscale introduced an XRP Trust alongside efforts to transition its Digital Large Cap Fund, which includes BTC, ETH, SOL, XRP, and AVAX, into an ETF.

Read more: XRP ETF Explained: What It Is and How It Works

Ripple CEO Brad Garlinghouse noted that these filings are a testament to strong institutional demand for XRP products. According to him, the SEC’s prolonged challenges in regulating crypto have weakened its stance, further diminishing its influence over the sector.

“The message from the market is clear — institutional interest in XRP products is stronger than ever…The SEC’s war on crypto has lost battle after battle — their continued disregard for the court’s authority will further erode the SEC’s credibility and reputation,” Garlinghouse stated.

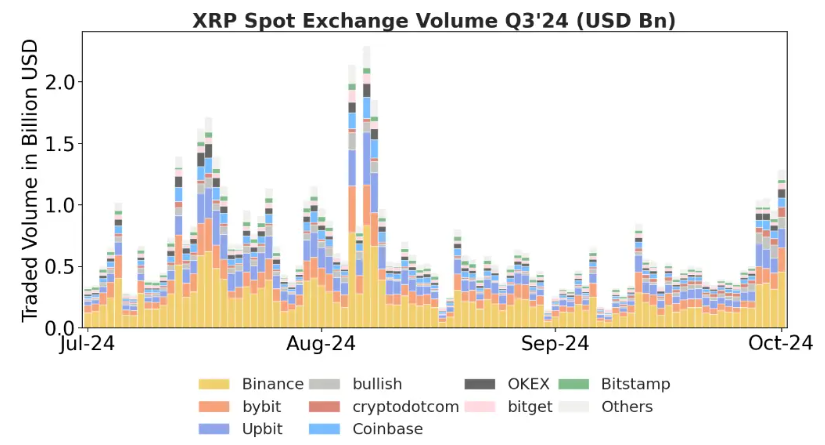

Meanwhile, the rise in institutional interest led to elevated XRP trading volumes. Average daily volumes (ADV) on top exchanges ranged between $600 million and $700 million, with a 27% increase in the XRP/BTC ratio over the quarter. Ripple explained that trading on Binance, Bybit, and Upbit, averaged around $750 million during the early part of Q3 before stabilizing mid-quarter and rising again in September’s final days.

Ripple’s XRP Volume. Source: Ripple

Ripple’s XRP Volume. Source: Ripple

Moreover, the XRP Ledger network also saw its transaction volume nearly double during the period. According to the report, the network’s total transactions rose from 86.4 million in Q2 to 172.6 million in Q3 2024. Ripple clarified that this increase was primarily due to microtransactions, often less than 1 XRP each, likely part of a spam campaign.

“Despite the increase in activity, much of it involved small-volume transactions, so total on-chain volume did not see a significant rise. The uptick was primarily driven by microtransactions (<1 XRP), which appeared to be part of a spam messaging campaign,” Ripple explained.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

Additionally, the Total Value Locked (TVL) within Ripple’s Automated Market Makers (AMMs) more than doubled. During the period, it rose from $8.5 million to $16.2 million. However, average transaction costs on the network dropped, with fees declining by 32% from 0.00394 XRP to 0.00269 XRP per transaction.

The post Ripple Reports Strong Q3 as Institutional Players Drive XRP Demand Higher appeared first on BeInCrypto.