Shiba Inu (SHIB) Tops the Crypto Market with 20% Gain, What’s Next?

The post Shiba Inu (SHIB) Tops the Crypto Market with 20% Gain, What’s Next? appeared first on Coinpedia Fintech News

On September 27, 2024, the overall cryptocurrency market experienced a price reversal amid this Shiba Inu (SHIB) outperformed major cryptocurrencies with its impressive performance. According to the coinmarketcap data, SHIB has experienced a significant price surge of over 20% in the last 24 hours and is currently trading near the $0.0000187 level.

SHIB Current PerformanceDuring the same period, its trading volume has skyrocketed by 220%, which indicates significant participation from traders and investors amid the recent breakout. With this significant price, you might be wondering whether the SHIB price rally will continue or if we may see a price correction in the coming days.

Shiba Inu Technical Analysis and Key LevelsAccording to CoinPedia’s technical analysis, with its impressive price jump, SHIB recently gave a breakout of a long descending trendline and reached a strong resistance level of $0.000020. If it breaks through this hurdle and closes a daily candle above the $0.0000213 level, SHIB could soar by 35% to reach the $0.0000285 level and even higher if the sentiment remains unchanged.

Source: Trading View

Source: Trading View

Additionally, SHIB is currently trading above the 200 Exponential Moving Average (EMA) on a daily timeframe, indicating an uptrend. This breakout and the price above the 200 EMA have shifted the overall market sentiment.

This breakout appears to be a strong bullish breakout for SHIB and has created bullish hope among investors and traders, as it has been in a downtrend since March 2024.

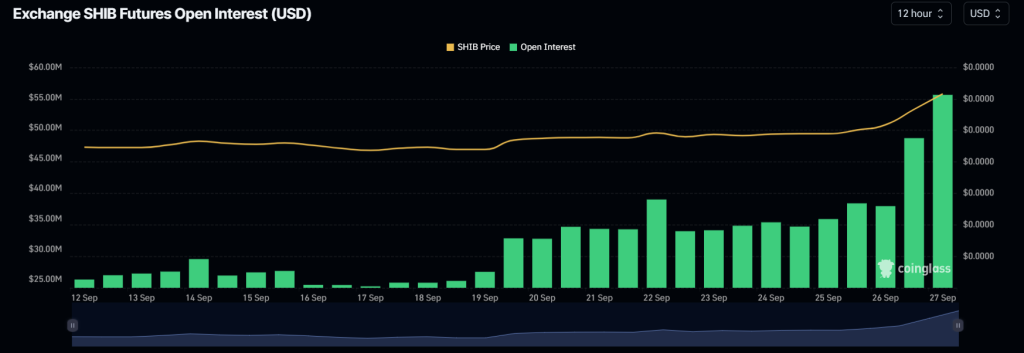

Bullish On-Chain MetricsAs of now, Coinglass’s SHIB Long/Short ratio currently stands at 1.015, indicating bullish market sentiment among traders. Additionally, its future open interest has skyrocketed by 39%, potentially indicating that bulls are betting more on long positions than short ones.

Source: Coinglass

Source: Coinglass

Traders often consider the combination of rising open interest and a long/short ratio above 1, when building long positions. Currently, 50.53% of top traders hold long positions, while 49.47% hold short positions.