Solana Long Liquidations Top $64 Million Amid Price Decline

Solana (SOL) has been in a downward spiral over the past week. Since reaching a new all-time high of $264.63 on November 22, SOL has encountered a surge in selling pressure. This has caused its price to drop by almost 10% in the past seven days.

This decline has led to an uptick in long liquidations in the SOL futures market. With strengthening bearish sentiments, Solana long traders may face more losses. Here is why.

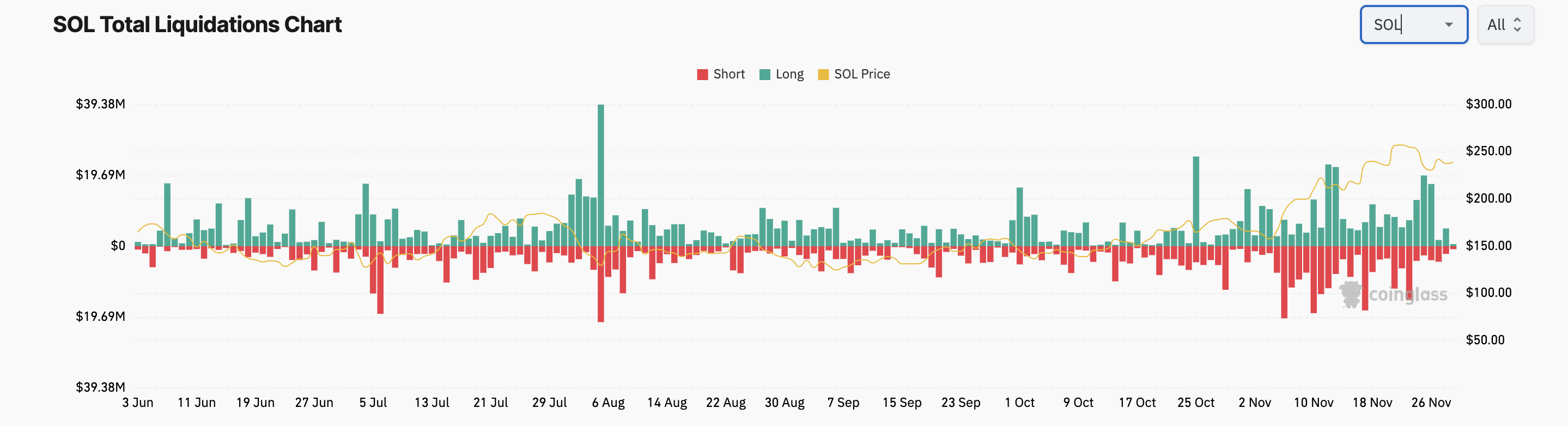

Solana’s Market Activity Faces DeclineOver the past week, SOL’s 8% price drop has wiped out $64 million in long positions from its derivatives market.

Solana Long Liquidations. Source: Coinglass

Solana Long Liquidations. Source: Coinglass

Long liquidations occur when traders who have opened positions in favor of a price rally are forced to sell the asset at a lower price to cover their losses as the price falls. This happens when the asset’s price decreases beyond a certain level, forcing traders with long bets to exit the market.

This is a bearish signal for SOL because as Solana long traders attempt to avoid further losses to their investments, their selling pressure can increase and contribute to further downward movement in the market.

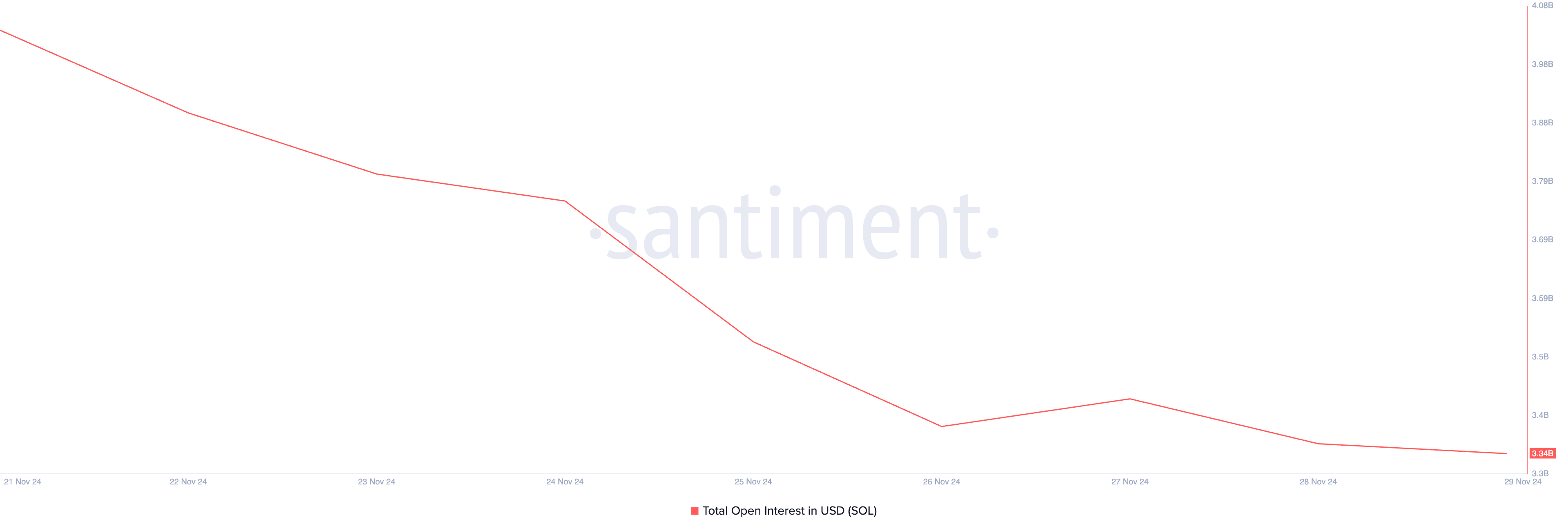

Notably, the decline in SOL’s price has led to a significant drop in activity in its derivatives market. This is reflected in the coin’s open interest, which currently rests at a weekly low of $3.34 billion.

Solana Open Interest. Source: Santiment

Solana Open Interest. Source: Santiment

Open interest refers to the total number of outstanding contracts (futures or options) that have not been settled or closed. When open interest drops during a price decline, traders are closing their positions. This indicates reduced market participation and a lack of conviction in the asset’s positive price movement.

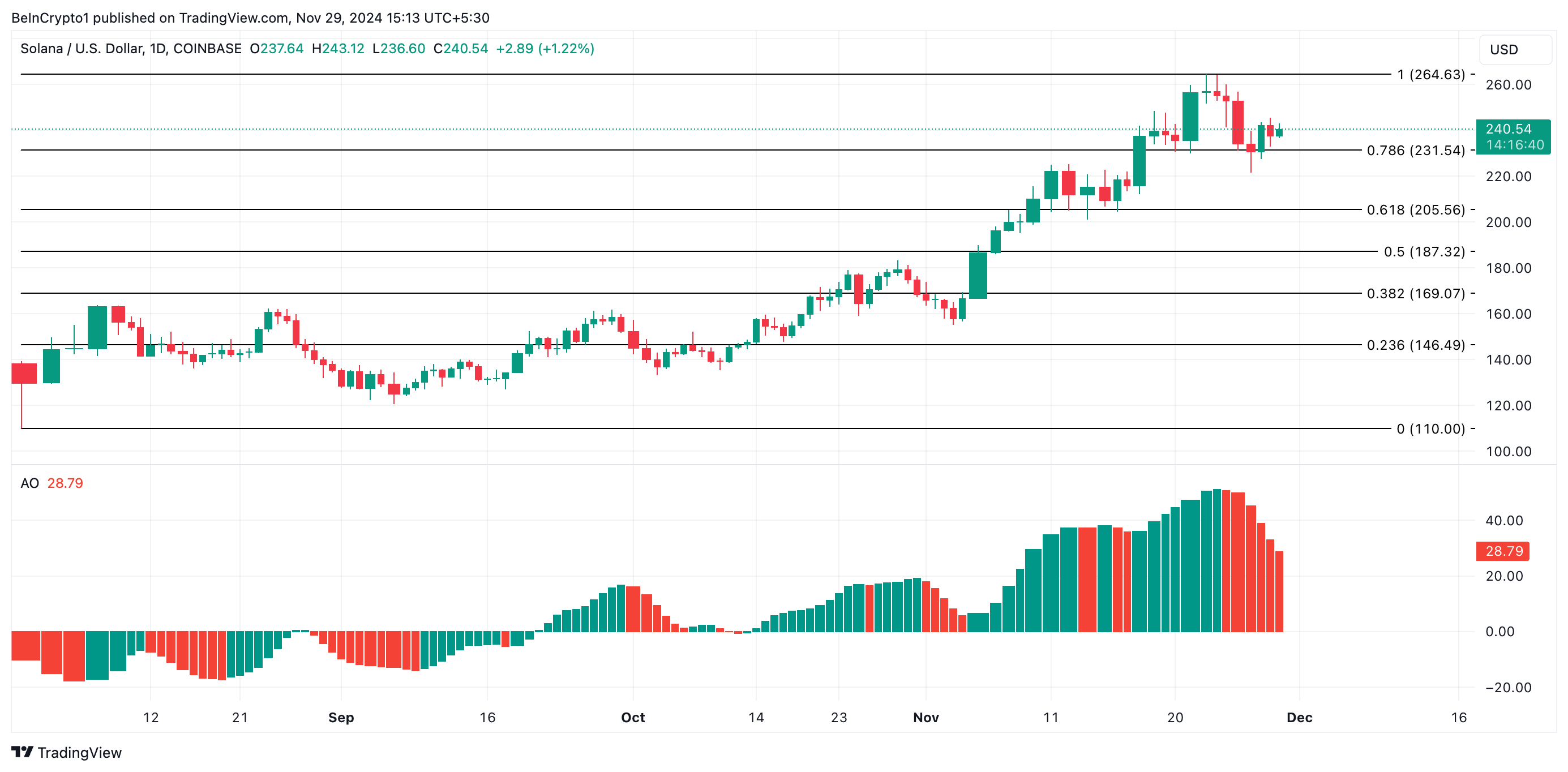

SOL Price Prediction: Bears Dominate the MarketSolana’s Awesome Oscillator confirms the uptick in bearish bias toward the coin. As SOL’s price records a decline over the past week, the indicator has returned red histogram bars.

The Awesome Oscillator identifies an asset’s price trends and potential reversal points. When it returns red bars, it indicates that the shorter-term momentum is weaker than the longer-term momentum, suggesting a possible bearish trend or a decline in bullish momentum.

If selling activity gains more momentum, SOL’s price will break below the crucial support level, formed at $231.54. A dip below this price point will send SOL’s price downward to $205.56.

Solana Price Analysis. Source: TradingView

Solana Price Analysis. Source: TradingView

On the other hand, if buying pressure gains momentum, SOL’s price will climb toward its all-time high of $264.63.

The post Solana Long Liquidations Top $64 Million Amid Price Decline appeared first on BeInCrypto.