Stablecoin Market Hits $176 Billion: Tether and USDC Take the Lead!

The post Stablecoin Market Hits $176 Billion: Tether and USDC Take the Lead! appeared first on Coinpedia Fintech News

The stablecoin market has surged past $176 billion, reaching levels last seen in 2022. With Tether (USDT) and USD Coin (USDC) leading the way, this rise shows how stablecoins are quickly gaining traction in the crypto space. Here’s what’s behind the growth and what it means for the future.

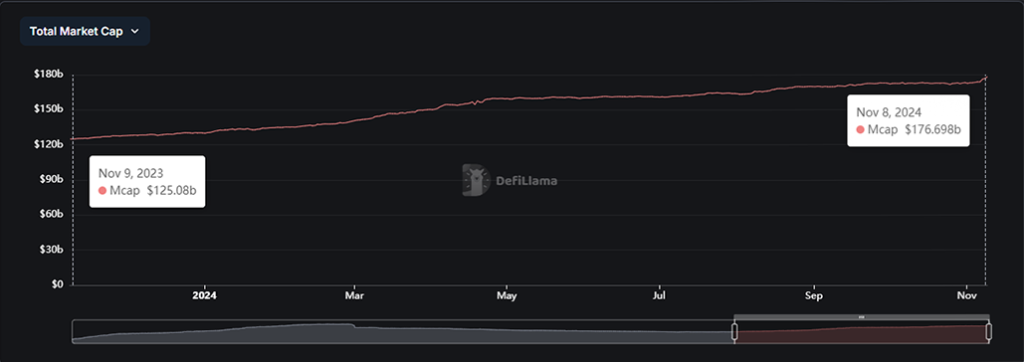

Tether’s Hold on the MarketStablecoins have seen a remarkable 41.27% growth in market cap over the last year. From $125.08 billion on November 9, 2023, it has surged to $176.698 billion on November 9, 2024. Tether (USDT) dominates this space, holding 69.17% of the market share, with a market cap of $123 billion.

While its 24-hour trading volume has slightly dropped, Tether continues to be the key liquidity provider for crypto traders. In fact, its market cap grew by 2.24% just in the past week, showing steady demand.

The Stablecoin of Choice!

Tether remains the go-to stablecoin, particularly in times of market uncertainty. Traders turn to it as a safe, reliable asset for quick transactions. Its stability makes it an essential tool in the crypto market, and Tether’s dominance remains firmly in place.

USDC Gains MomentumNot far behind, USD Coin (USDC) saw its market cap grow by 7.06%, reaching $37 billion. This steady climb points to a growing acceptance of USDC, as more people choose it for transactions and storage of value. While Tether holds the largest share, USDC is catching on fast, especially with those who value its strong reputation for stability.

The growth of USDC signals a shift in how stablecoins are being used. They’re no longer just tools for traders—they’re becoming important for everyday digital transactions.

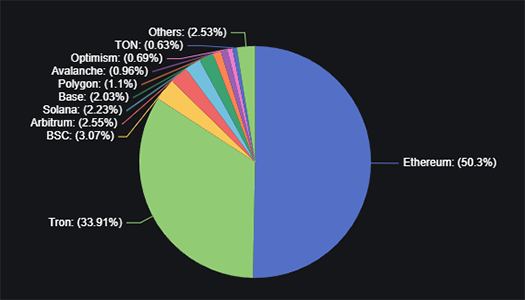

.article-inside-link { margin-left: 0 !important; border: 1px solid #0052CC4D; border-left: 0; border-right: 0; padding: 10px 0; text-align: left; } .entry ul.article-inside-link li { font-size: 14px; line-height: 21px; font-weight: 600; list-style-type: none; margin-bottom: 0; display: inline-block; } .entry ul.article-inside-link li:last-child { display: none; } Ethereum and Tron as Stablecoin HubsEthereum is the dominant platform for stablecoins, holding more than half of the total market at $89 billion. Its strong infrastructure makes it an ideal platform for stablecoin transactions. Behind Ethereum, Tron holds 33.9% of the market, with $60 billion in stablecoins, mostly USDT. While Ethereum leads, Tron’s presence is growing, especially among users who rely on USDT.

Binance Smart Chain (BSC) is also part of the stablecoin story, holding 3.07% of the total stablecoin supply, with USDT as the main stablecoin on this network. Each platform offers unique strengths, and the demand for stablecoins across multiple chains shows their broad appeal.

Stablecoins Are Here to StayThe stablecoin market continues to grow, with Tether and USDC leading the way, supported by platforms like Ethereum and Tron. As demand rises, stablecoins will likely play an even more significant role in the future of digital finance.

They’re helping shape the way people interact with the crypto world, making it more stable and accessible to everyone.