Stablecoins: The Bridge Between Crypto and Traditional Finance

Pione3rs — Issue #26

Pione3rs — Issue #26TL;DR:

- Web3 platforms face rising acquisition costs and low user retention due to reliance on airdrops and shallow engagement strategies.

- Klink builds an infrastructure layer coordinating user activity and partner growth through verifiable, incentive-driven actions across chains.

- Users earn by completing meaningful tasks without needing to stake or trade via quests personalized through AI and tracked with on-chain/off-chain integrations.

- Klink offers a programmable reward layer and conversion tracking tools for protocols, enabling campaigns tied to real outcomes like deposits, product usage, or governance.

- Klink monetizes through performance-based fees, transactional flows, and embedded SDK/API usage, without relying on speculative token dynamics.

Driving User Participation and Protocol Growth Through AI-Driven Infrastructure

The Hidden Challenges of Web3 User GrowthThe promise of Web3 is clear: decentralized platforms, innovative financial models, and user ownership. Yet, most Web3 projects struggle with the same fundamental issues: low activation rates, monetization challenges, and unsustainable user acquisition costs. While decentralized finance (DeFi) and crypto rewards have introduced new ways to generate income, they have not solved the industry’s core business problems.

One of the biggest hurdles is low user activation rates. Many platforms attract significant traffic, but only a small fraction of users become first-time depositors or buyers. The result? Massive inefficiencies in marketing and operations, where platforms burn capital without seeing meaningful returns. This inefficiency extends to monetization, as many platforms still rely heavily on trading fees or asset swaps, failing to create sustainable revenue streams from non-trading users.

Compounding these issues is the rising cost of user acquisition (CAC), which has surged 222% over the past eight years. With competition increasing, platforms are spending more to attract users while struggling to break even on customer lifetime value (LTV). Fraudulent activity further complicates the situation, as bots and low-quality accounts dilute real user engagement, making it even harder to acquire high-value customers.

Even when platforms successfully onboard users, retention and engagement remain major pain points. Many users simply disengage without continuous incentives, forcing companies to spend even more on marketing to maintain existing traction. This cycle of high costs, low retention, and poor monetization has made Web3 growth increasingly unsustainable.

Klink is tackling these issues head-on by providing a platform for partners to amplify their crypto projects, offering tools to drive their adoption whilst also facilitating an earnings ecosystem for the community.

Klink Finance: An AI-Optimized Web3 Earnings HubKlink is building an infrastructure layer that abstracts and coordinates user acquisition, engagement, and rewards across the fragmented Web3 landscape. The platform addresses inefficiencies in how projects currently bootstrap growth, largely through siloed airdrops or one-off incentives, with a more composable, data-driven approach.

At the core of Klink’s design is a two-sided system:

- On the user side, it aggregates earning opportunities (quests, airdrops, token allocations) across chains, automates reward tracking via a unified wallet layer, and uses AI to recommend actions based on user behavior and on-chain history.

- On the partner side, it provides primitives to define off-platform conversion actions and verify them cryptographically or via tracking integrations. This shifts the model from speculative acquisition to performance-based participation.

Klink rethinks the earning stack in Web3 by decoupling rewards from asset ownership or financial risk. Instead of staking or trading, users earn by completing verifiable tasks across protocols, interacting with dApps, testing new features, or contributing to governance. These interactions are structured as “quests” tied to trackable on-chain and off-chain events.

The platform consolidates fragmented multi-chain activity via an integrated wallet layer, automating airdrop claims, token distributions, and participation tracking across networks. This simplifies user experience while enabling rewards to flow based on behavior, not wallet size.

Klink also incorporates AI-driven personalization. Quests aren’t static listings, they’re dynamically assembled based on user profiles, historical engagement, and cohort behavior. The goal is to reduce noise and fatigue by surfacing only contextually relevant actions that match users’ experience level and interests.

A planned IDO module further expands participation: Early-stage allocations are linked to engagement metrics instead of pure speculation. This creates an access model driven by reputation and activity, not capital.

For Web3 Businesses: Incentive-Led Conversion Layer With Deep TrackingOn the protocol/business side, Klink functions as a middleware layer for structuring user acquisition and engagement around measurable actions. Most growth efforts in Web3 remain top-of-funnel, airdrop announcements, and social campaigns but lack the tooling to drive or verify downstream conversion. Klink introduces a programmable reward layer built around real outcomes: staking, deposit, feature usage, or retention milestones.

A key technical differentiator is Klink’s off-platform conversion verification. Through custom tracking integrations and on-chain signals, projects can define high-intent actions that occur outside of Klink’s front end yet still tie those actions to verifiable rewards.

Users might complete a task within a DeFi protocol or game and have rewards distributed via Klink’s settlement layer. Soon, the Offer Integration Layer (OIL) will allow quests to be embedded directly into external UIs, wallets, CEXs, and games. Transforming Klink from a destination site to a distributed incentive network. This shifts Web3 growth mechanics from centralized discovery to embedded coordination.

To ensure integrity, Klink applies bot detection and Sybil resistance using a combination of heuristics, social graph analysis, and behavioral fingerprinting. Rather than brute-force KYC, the system filters low-quality engagement with machine learning models trained on historical campaign patterns.

The result is a more sustainable growth loop: instead of burning capital on undifferentiated airdrops, protocols can direct rewards toward verified users who complete meaningful actions, driving LTV, not just impressions.

Klink’s Business ModelKlink’s revenue model is structured around verified user actions, not passive exposure. At its core, the platform acts as a programmable coordination layer where protocols fund engagement through outcome-driven campaigns, staking, product onboarding, and usage milestones rather than speculative airdrops or broad top-of-funnel marketing.

Projects deploy campaigns on Klink by defining specific actions that map to their growth metrics. Revenue is generated when these actions are completed and verified via tracking hooks or on-chain proofs. This performance-based model allows Klink to avoid the misalignment common in Web3 advertising, where engagement is often decoupled from long-term retention or value creation.

From the user side, monetization is layered into transactional activity and tool usage. As users complete tasks, swapping assets, onboarding via fiat, or claiming multi-chain rewards, Klink captures protocol-level fees while also reinforcing its position as an aggregator of engagement flows. Instead of relying on extractive tokenomics, Klink’s design emphasizes utility-driven participation that recurs over time.

Looking ahead, features like the Offer Integration Layer and IDO launch access create additional monetization vectors. By embedding reward logic directly into third-party interfaces, Klink expands its reach and creates new fee surfaces, from SDK/API usage to dynamic quest routing- without diluting user experience. The goal is not to monetize attention but to orchestrate aligned actions across ecosystems.

The $KLINK token plays a supporting role within this model, used to unlock advanced earning opportunities for users, fund incentive campaigns for partner protocols, and participate in governance decisions that shape platform mechanics. Rather than being a speculative centerpiece, it serves as an embedded utility that reinforces coordination across the ecosystem.

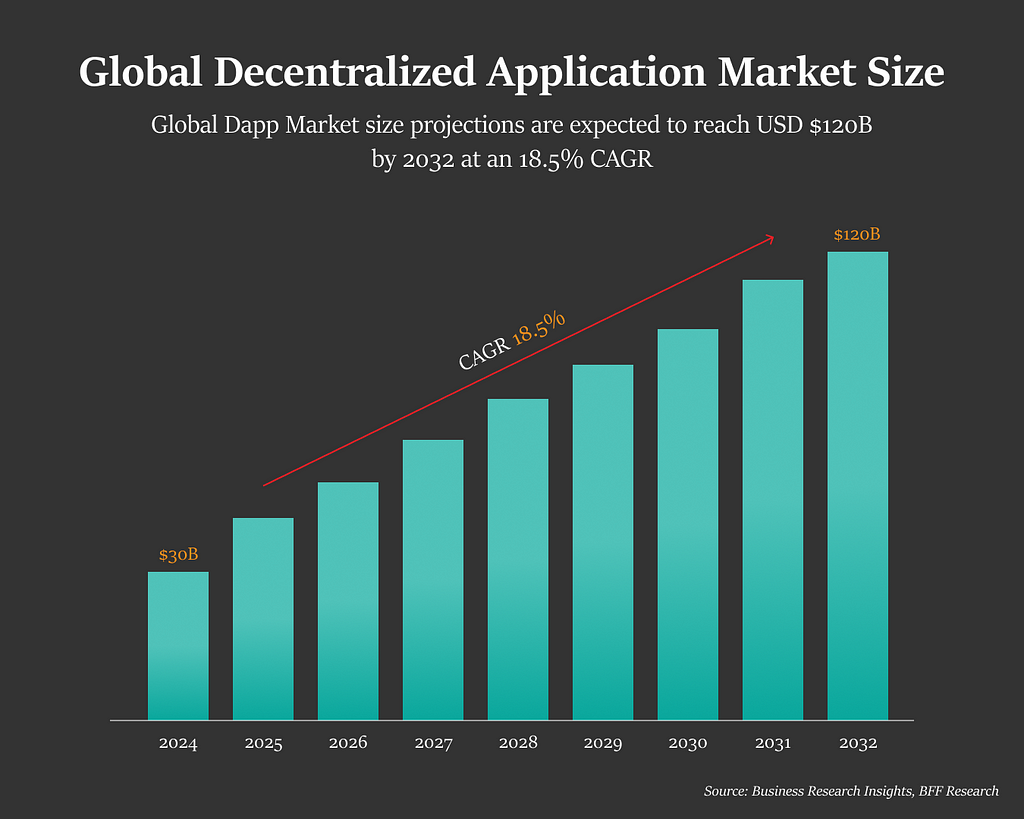

Industry Analysis: Where Klink Stands in the Web3 Growth LandscapeWeb3 is no longer in its experimental phase. The industry is moving toward mass adoption, with decentralized applications (DApps) projected to grow from $30B in 2024 to $120B by 2032, reflecting a CAGR of 18.5%. At the same time, the Web3 marketing sector is expanding rapidly, expected to grow from $1.96B in 2024 to $12.87B by 2032 (26.5% CAGR).

Yet, despite this rapid expansion, the way Web3 platforms grow and engage users is fundamentally shifting. The first wave of Web3 adoption relied on airdrops, speculative incentives, and aggressive user acquisition campaigns, but these strategies have failed to create lasting engagement.

Take token airdrops, for example, which were once considered a breakthrough method for onboarding users. In its early days, airdrops helped projects like Uniswap and 1inch build communities by rewarding early adopters. However, this model quickly became unsustainable as users began treating airdrops as quick profit opportunities rather than long-term incentives.

As the Web3 market matures, platforms recognize that long-term engagement is more valuable than short-term acquisition. The next wave of growth isn’t about onboarding as many users as possible, it’s about keeping them engaged through structured incentives, gamified interactions, and AI-powered retention strategies.

Rather than handing out tokens with no built-in mechanism for ongoing participation, projects now integrate loyalty programs, user tiers, and dynamic reward systems that evolve over time. This shift mirrors traditional customer retention strategies that have been effective in Web2, where brands use points, memberships, and personalized experiences to keep users coming back.

For Web3-native projects, this means rethinking engagement strategies beyond just airdrop-based acquisition. Instead of rewarding passive users who cash out instantly, successful platforms design earning ecosystems where rewards are tied to participation and long-term contribution.

Klink represents this new wave of Web3 engagement, one that goes beyond simple acquisition and focuses on AI-driven, personalized retention strategies. By dynamically adjusting incentives based on real user behavior, Klink ensures that rewards serve as engagement multipliers rather than short-lived promotions.

The Founders Behind KlinkChris James Murphy, co-founder, has spent his career driving entrepreneurship and supporting tech scale-ups in expanding to new markets. He has successfully built and exited a company in the U.S. market and brings cross-functional expertise in commercial development, digital strategy, partnerships, and capital raising.

Philip Jonitz, co-founder, has guided companies from early-stage to pre-IPO. His experience spans startups, investors, and corporates in the financial sector, including roles with Techstars, Deutsche Börse (German Stock Exchange), RaisinDS, and Motu Ventures.

ConclusionKlink offers a structured alternative to traditional Web3 growth loops, replacing speculative incentives and shallow engagement with verifiable actions, embedded rewards, and data-driven coordination. Its architecture enables both users and protocols to participate in more meaningful, outcome-oriented interactions.

If you’re building in Web3 and thinking about scalable user activation or high-signal participation, Klink’s infrastructure is worth exploring. For more details, visit Klink Finance or join the community discussions.

References

This is a repost of Pione3rs Issue #26 written by Aly Madhavji on TheStreet.com on May 8, 2025.

Driving User Participation and Protocol Growth Through AI-Driven Infrastructure was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.