SunPump Surge Shifts Focus from Solana to Tron

Solana’s Pump.fun has recorded its lowest number of launches in five months, signaling a decline in the meme coin economy on the blockchain. However, the drop in launches might reflect a shift in focus amid the growing buzz around Tron blockchain’s SunPump.

Crypto markets are buzzing over Justin Sun’s SunPump, as the Tron executive rolls out strategies to attract more stakers, expand market share, and enhance profits.

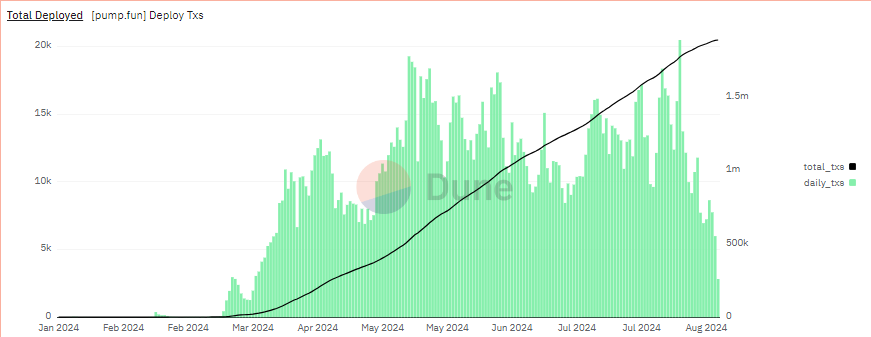

Solana-based Pump.fun Launches DropAccording to Step Finance’s Solana Floor analysis tool, the number of launches on Pump.fun has hit its lowest point in 151 days. The platform averaged 15,217 daily launches between August 5 and 11. By the week ending August 25, the average had dropped to 8,003 daily launches, marking a 47% decline in activity.

“On August 25, pump.fun recorded 5,987 deploy transactions, its lowest number of token launches since March 28. This dramatic decline in activity suggests that the market’s appetite for new tokens is dying, with traders feeling overwhelmed by an oversaturated memecoin economy,” the report read.

Data from Dune Analytics supports this trend, showing a decrease in trade volumes among traders in the Solana meme coin market.

Read more: What Is TRON (TRX) and How Does It Work?

Solana Blockchain’s Pump.fun Meme Coin Deployments Transactions, Source: Dune Analytics

Solana Blockchain’s Pump.fun Meme Coin Deployments Transactions, Source: Dune Analytics

Along with the decline in transactions, revenues generated by the platform have also taken a hit. The report notes an average of 5,880 SOL per day during the week ending August 11. In the week ending August 25, Pump.fun’s daily revenue averaged just 3,539 SOL, marking a nearly 40% drop in revenue within two weeks.

“While the drop in average daily revenue is larger between weeks ending on the 18th and the 25th, this is largely due to outsized activity on the day of the Musk/Trump