TAMING THE BULL: A NOVICE’S GUIDE TO PROFITABILITY

I’ve always been surrounded by “finance gurus,” but I never really had an interest in investing, at least not until 2020. I constantly heard my friends mention the “bull run” and how they were planning vacations after profiting from their investments. With zero knowledge on what it meant and a few dollars to spare, I decided to dip my toes into this unfamiliar world. My strategy was simple: buy whatever they recommended and sell off when they tell me too.

Unknowingly, my timing couldn’t have been better. Following their advice, I found myself riding a wave of unusual profits, and my investments grew fatter by the day.

Today, I’m no longer the novice investor I once was. I’ve learned the ropes, created my strategy, and navigated the highs and lows of the market. Now, I’m here to share my story and impart a crucial lesson: the importance of strategic positioning for the upcoming bull run.

But from a former novice investor to a new investor who has no idea what the term “bull run” means or how to take advantage of it, walk with me.

The Concept of the Bull Run & It’s Impacts:A bull run is simply a period of sustained and significant upward trend in the prices of financial assets (stocks, cryptocurrencies, or commodities). During a bull run, market participants are generally optimistic, which leads to increased buying activity and rising asset prices. This positive approach stems from strong economic indicators, favorable corporate earnings, or positive developments in the market.

Impact of the bull market:

- Increased Investor Confidence: The bull run gives investors a confidence boost as they secure consistent gains in their investments. This often leads to a continuous cycle of buying as more investors are attracted to the market.

- Higher Valuations: Rising prices during a bull run lead to higher valuations for assets, making it more challenging for investors to find undervalued opportunities and overvalue some assets.

- Economic Expansion: Bull markets often occur within periods of economic growth and expansion. This positive market sentiment encourages spending, investment, and overall economic activity.

- Portfolio Boost: Investors holding assets during a bull run experience significant gains in their portfolios. This positively speeds up wealth accumulation and creates a positive feedback loop of increased spending and investment.

The 2020/2021 Bull Run saw BTC break its previous ATH of $20,000 and rise to a new ATH of over $64,000 by April of 2021. The catalysts for the run included:

- BTC Halving

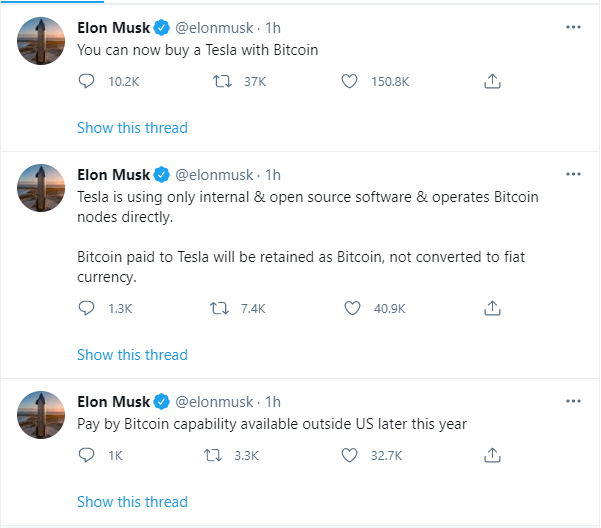

- Institutional investments from hedge funds and traditional financial institutions signaled a major shift in the perception of Bitcoin from a speculative asset to a legitimate component of diversified investment portfolios.

- Adoption of BTC as a payment option during the 2020 lockdown.

Why do we expect a bull run? Below are a few catalysts for the bull run:

- The Historical BTC Halving Event: Historically, previous halving events have been a major catalyst for the beginning of a bull run. The year leading up to the event was the best time to accumulate assets ahead of the explosive upside potential of the year following the halving.

- Tokenization of RWAs: The tokenization of real-world assets would see traditional assets come onto the blockchain, which would cause a significant increase in liquidity inflow to the market, and fractionalization would also help increase accessibility to the market.

- Bitcoin ETF Approval: The approval means there’s easier access for institutional and retail investors. This would increase the liquidity inflow into the market because demand would also increase.

Now that all the “technical jargon” behind the bull run is out of the way, how do we best position ourselves to earn the most in this cycle?

Tactical approach to ensuring profitability in the bull run:

- Stay Updated: A proactive approach that requires you to regularly monitor market trends, news, and developments to make informed investment decisions during the bull run. By staying updated on factors like economic indicators, regulatory changes, corporate earnings reports, and industry news, you can adapt your strategies accordingly and seize profitable opportunities as they arise.

- Riding the Trend: Riding the trend means buying assets that are already gaining value and holding onto them as their prices continue to rise, with the aim of maximizing profits by staying in line with the prevailing market trend.

- Setting Profit Targets: This means deciding in advance the prices at which to sell assets to secure gains. This ensures profitability by avoiding emotional decisions and sticking to a trading plan. It requires having an exit point based on analysis, like technical indicators or fundamental factors, and adjusting targets as needed. It’s a proactive strategy to manage risk and lock in gains during market upswings.

- Diversify your Portfolio: A smart strategy would be to diversify your investments across multiple narratives that are gaining traction. Investors are tasked with finding projects (investment opportunities) that would do well under each narratives and going all in. A few narratives that would lead this bull run include: RWAs, BRC-20, Game-Fi, and AI Tokens.

In conclusion, while riding the bull may sound exciting, remember that investing is not a path without bumps — it’s a strategic exercise. So, take action, but also remember that none of the insights shared here are financial advice. DYOR (Do Your Own Research) and tread cautiously. Stay informed, stay positioned, and smash your profit targets.

To stay in the loop on the latest happenings in the world of Web 3.0 and DeFi, follow me on twitter for the juiciest tidbits, regular updates, and useful insights.

TAMING THE BULL: A NOVICE’S GUIDE TO PROFITABILITY was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.