Is Tokenization as a Service the Key to Unlocking Liquid Investments from Illiquid Assets?

Tokenization as a Service (TaaS) is rapidly emerging as a game-changing solution for transforming illiquid assets into liquid investments. By converting physical assets such as real estate, artwork, or collectibles into digital tokens on a blockchain, TaaS provides a streamlined, efficient means of trading and owning assets. This innovative approach enables fractional ownership, allowing multiple investors to buy shares of a high-value asset, thereby lowering the barriers to entry and increasing accessibility for a broader range of investors.

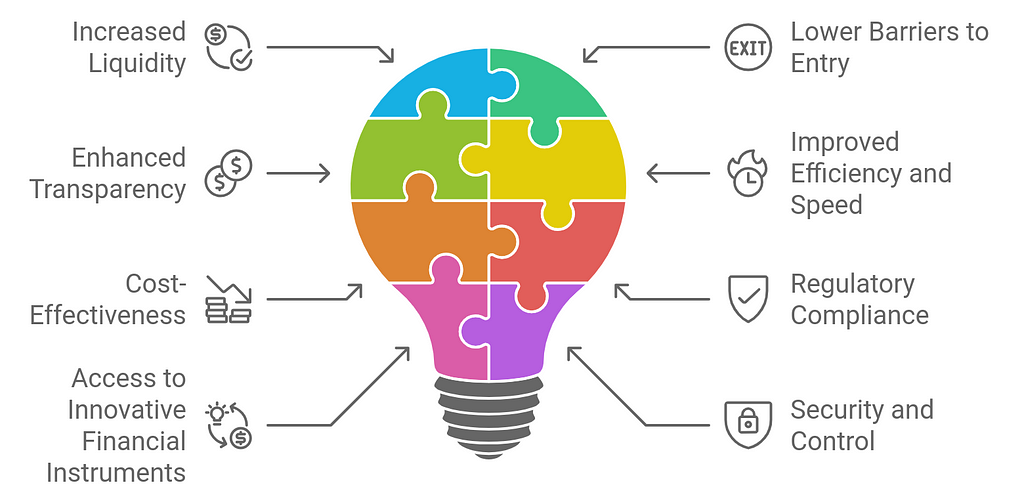

Fig: Tokenization as a Service

Fig: Tokenization as a ServiceMoreover, TaaS enhances transparency and security, as transactions are recorded on a decentralized ledger, reducing the risks of fraud and ensuring authenticity. As traditional markets face increasing challenges, TaaS offers a new pathway for liquidity, enabling asset owners to unlock capital tied up in illiquid investments. This paradigm shift not only benefits investors seeking diversification but also empowers asset owners to monetize their holdings more effectively.

With its potential to democratize access to investment opportunities, Tokenization as a Service is paving the way for a more inclusive and efficient financial landscape, making it a crucial element in the evolution of modern investment strategies.

Table of ContentWhat is Tokenization?Understanding Tokenization as a Service

Key Features of TaaS Platforms

Advantages of Using TaaS for Investors and Asset Owners

The Role of Tokenization as a Service

How Tokenization as a Service (TaaS) Works?

Top 5 Success Stories in Real World Asset Tokenization

Unlocking Liquidity through TaaS

Regulatory Considerations

Future of Tokenization and Liquid Investments

ConclusionWhat is Tokenization?

Tokenization is the process of converting rights to an asset into a digital token on a blockchain, allowing for easier management, transfer, and ownership of that asset. This innovative approach enables both tangible assets, like real estate and artwork, and intangible assets, such as intellectual property and financial instruments, to be represented digitally. By breaking down assets into smaller, tradable units, tokenization facilitates fractional ownership, allowing multiple investors to hold shares in high-value items, which increases accessibility and liquidity.

The use of blockchain technology ensures transparency, security, and immutability of transaction records, significantly reducing the risk of fraud. Additionally, tokenization streamlines the buying and selling process, eliminating the need for intermediaries and lowering transaction costs. As a result, it opens up new opportunities for investment and financing, enabling asset owners to unlock capital that would otherwise be tied up in illiquid assets. Overall, tokenization is reshaping the way assets are perceived, owned, and traded in the modern economy, driving innovation across various sectors.

Understanding Tokenization as a ServiceTokenization as a Service (TaaS) is a cloud-based solution that enables businesses to tokenize assets without needing extensive technical expertise or infrastructure. By leveraging blockchain technology, TaaS providers facilitate the creation, management, and trading of digital tokens representing real-world assets, such as real estate, art, or commodities. This service allows companies to focus on their core operations while outsourcing the complexities of tokenization to specialized providers. TaaS simplifies the process of converting assets into tokens, offering features like compliance management, security protocols, and integration with existing financial systems.

Additionally, TaaS enhances liquidity by enabling fractional ownership, making high-value investments accessible to a broader audience. With TaaS, organizations can tap into new revenue streams, attract diverse investors, and increase asset liquidity, ultimately driving growth and innovation. As the demand for digital assets continues to rise, Tokenization as a Service is emerging as a vital tool for businesses looking to navigate the evolving financial landscape and capitalize on the benefits of blockchain technology.

Key Features of TaaS PlatformsTokenization as a Service (TaaS) platforms provide businesses with the tools and infrastructure needed to tokenize real-world assets (RWAs) efficiently and compliantly. Here are the key features that define effective TaaS platforms:

1. User-Friendly Interface

1. User-Friendly Interface- Intuitive Dashboard: TaaS platforms typically offer an easy-to-navigate dashboard that allows users to manage their tokenization projects seamlessly.

- Guided Workflow: Step-by-step processes help users understand how to create, issue, and manage tokens, catering to both technical and non-technical users.

- Pre-Built Smart Contracts: TaaS platforms often provide customizable templates for smart contracts that can be tailored to specific asset types and regulatory requirements.

- Automated Execution: Smart contracts can automate processes such as transactions, dividend distributions, and compliance checks, reducing the need for manual intervention.

- KYC/AML Integration: Built-in Know Your Customer (KYC) and Anti-Money Laundering (AML) tools enable compliance with regulatory requirements, ensuring that only verified users can participate in token offerings.

- Regulatory Compliance Framework: TaaS platforms typically include features to ensure compliance with local and international laws governing tokenization.

- Multi-Asset Support: TaaS platforms can support the tokenization of various asset types, including real estate, art, commodities, and financial instruments.

- Portfolio Management Tools: Users can manage their tokenized assets through comprehensive portfolio management features, tracking performance and making adjustments as needed.

- Robust Security Protocols: TaaS platforms employ advanced security measures, including encryption, multi-factor authentication, and secure key management to protect assets and user data.

- Audit Trails: Comprehensive logging and audit capabilities help track all transactions and activities on the platform, enhancing transparency and accountability.

- Built-in Marketplaces: Some TaaS platforms offer integrated marketplaces for trading tokenized assets, allowing for liquidity and greater accessibility for investors.

- Secondary Market Support: Facilitation of secondary trading options enables users to buy and sell tokenized assets easily.

- Multi-Chain Compatibility: Many TaaS platforms support multiple blockchain networks (e.g., Ethereum, Binance Smart Chain) to provide flexibility in choosing the underlying technology.

- Interoperability Features: These platforms often include tools for ensuring interoperability between different blockchain networks and traditional financial systems.

- Token Customization: Users can create custom tokens with specific attributes, such as voting rights, profit-sharing, or access permissions, tailored to the asset being tokenized.

- Variety of Token Standards: Support for various token standards (e.g., ERC-20, ERC-721, ERC-1155) allows for a wide range of tokenization possibilities.

- Real-Time Analytics: TaaS platforms provide analytics tools to monitor asset performance, investor engagement, and transaction history in real time.

- Customizable Reporting: Users can generate detailed reports for regulatory compliance, internal audits, and performance tracking.

- Customer Support: TaaS platforms typically offer robust customer support to assist users with technical issues, compliance questions, and general inquiries.

- Community Forums and Documentation: Access to forums, tutorials, and comprehensive documentation fosters user engagement and knowledge sharing.

Tokenization as a Service (TaaS) platforms are designed to simplify the process of tokenizing real-world assets while ensuring compliance and security. By leveraging these key features, businesses can effectively tokenize their assets, unlock new revenue streams, and enhance investor engagement. Choosing a TaaS platform with the right combination of features is crucial for successfully navigating the evolving landscape of digital asset management.

Advantages of Using TaaS for Investors and Asset OwnersTokenization as a Service (TaaS) platforms offer numerous benefits for both investors and asset owners. By leveraging TaaS, stakeholders can unlock new opportunities and enhance their investment and asset management strategies. Here are the key advantages:

1. Increased Liquidity

1. Increased Liquidity- Fractional Ownership: TaaS allows asset owners to tokenize their assets into smaller units, enabling fractional ownership. This increases liquidity by making it easier for investors to buy and sell portions of high-value assets.

- Access to Global Markets: Tokenized assets can be traded on various marketplaces, providing investors access to a broader range of opportunities and enhancing overall liquidity.

- Affordable Investment Opportunities: By offering fractional ownership, TaaS reduces the minimum investment required for high-value assets, making them accessible to a wider range of investors.

- Diverse Asset Classes: Investors can diversify their portfolios by accessing a variety of asset classes, including real estate, art, commodities, and more, without significant capital outlay.

- Immutable Records: Transactions are recorded on a blockchain, providing a transparent and immutable record of ownership and transactions. This builds trust among investors and asset owners.

- Real-Time Monitoring: Investors can track the performance and value of their tokenized assets in real time, enhancing visibility into their investments.

- Streamlined Processes: TaaS platforms automate many aspects of the tokenization process, including KYC/AML checks and transaction settlements, leading to faster execution and reduced administrative overhead.

- Reduced Paperwork: The digitization of assets minimizes the need for physical documentation, expediting processes like transfers and sales.

- Lower Transaction Fees: By using blockchain technology and smart contracts, TaaS platforms can significantly reduce transaction fees compared to traditional asset trading and management methods.

- Operational Efficiency: Automation and digital processes reduce the costs associated with managing and transferring assets, benefiting both asset owners and investors.

- Built-In Compliance Tools: TaaS platforms typically include integrated KYC/AML processes and compliance frameworks, ensuring that all transactions adhere to regulatory requirements and protecting investors from legal risks.

- Ongoing Updates: These platforms often keep up with changing regulations, helping asset owners and investors remain compliant with relevant laws without extensive manual effort.

- New Investment Opportunities: TaaS facilitates the creation of innovative financial products, such as tokenized real estate funds or asset-backed tokens, allowing investors to explore new investment avenues.

- Enhanced Yield Generation: Asset owners can leverage tokenization to create new revenue streams, such as offering tokens that provide dividends or revenue-sharing agreements.

- Secure Asset Custody: TaaS platforms employ advanced security measures, including encryption and multi-signature wallets, to protect assets and investor information.

- Ownership Control: Investors maintain control over their tokens and can transact directly on the blockchain, reducing reliance on intermediaries.

- Investor Participation: Tokenization can enable asset owners to engage directly with their investors, fostering a sense of community and providing avenues for feedback and collaboration.

- Voting Rights and Governance: Investors may have the opportunity to participate in governance decisions, such as voting on asset management strategies or major changes.

- Cross-Border Transactions: TaaS platforms facilitate global transactions, enabling investors from different jurisdictions to access asset opportunities without the complications of traditional cross-border transactions.

- Diverse Investor Base: Asset owners can attract a more diverse investor base by making their offerings available to global investors.

Tokenization as a Service (TaaS) provides significant advantages for both investors and asset owners. By enhancing liquidity, lowering barriers to entry, and improving transparency, TaaS platforms can transform how assets are managed and traded, creating new opportunities and fostering a more inclusive investment landscape. Embracing TaaS not only enhances operational efficiency but also empowers stakeholders to participate in the evolving digital economy.

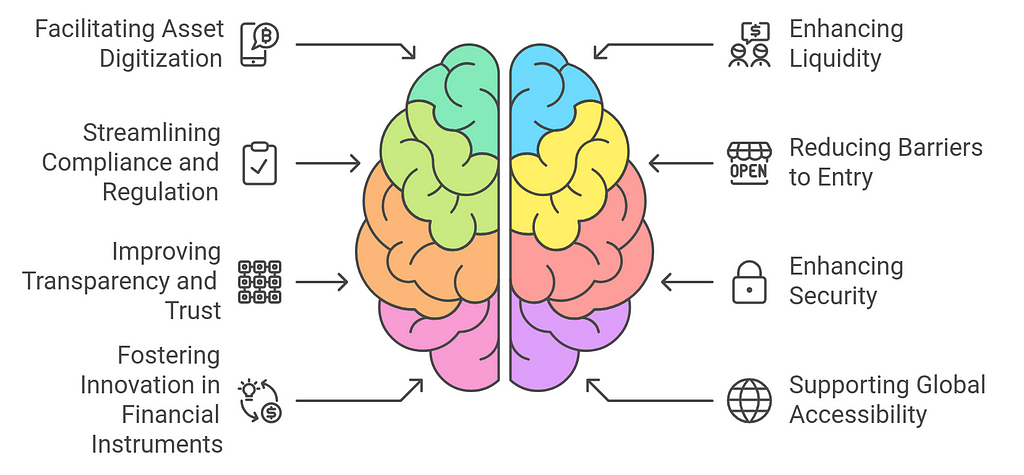

The Role of Tokenization as a ServiceTokenization as a Service (TaaS) plays a pivotal role in the evolving landscape of asset management and investment, facilitating the digitization of real-world assets (RWAs). This innovative approach leverages blockchain technology to create a more efficient, transparent, and accessible financial ecosystem. Here’s a closer look at the key roles that TaaS plays:

1. Facilitating Asset Digitization

1. Facilitating Asset Digitization- Transforming Physical Assets: TaaS platforms enable the conversion of tangible assets, such as real estate, art, or commodities, into digital tokens. This process simplifies ownership transfer and management.

- Fractionalization of Assets: By breaking down assets into smaller, tradable units, TaaS allows a wider range of investors to participate in markets that were previously inaccessible due to high capital requirements.

- Creating Liquid Markets: TaaS platforms increase liquidity by providing a marketplace for tokenized assets, allowing investors to buy and sell tokens easily.

- Secondary Market Support: Investors can trade tokenized assets on secondary markets, enhancing the overall liquidity of these investments compared to traditional assets.

- Integrated Compliance Tools: TaaS platforms often come with built-in KYC (Know Your Customer) and AML (Anti-Money Laundering) processes, helping to ensure that all transactions comply with relevant regulations.

- Regulatory Adaptability: By staying updated with evolving regulations, TaaS providers help asset owners and investors navigate the complex legal landscape associated with tokenization.

- Lower Investment Thresholds: TaaS enables fractional ownership, allowing investors to enter markets with lower capital, thus democratizing access to high-value assets.

- Diverse Asset Classes: Investors can explore a wide range of asset classes, diversifying their portfolios without significant financial commitments.

- Immutable Records: The use of blockchain technology ensures that all transactions and ownership records are transparent and tamper-proof, fostering trust among investors and asset owners.

- Real-Time Tracking: TaaS platforms provide real-time data on asset performance and ownership status, allowing stakeholders to monitor their investments closely.

- Robust Security Protocols: TaaS platforms utilize advanced security measures, such as encryption and multi-signature wallets, to protect assets and sensitive information.

- Reduced Counterparty Risk: Direct transactions on the blockchain minimize reliance on intermediaries, thereby reducing counterparty risks associated with traditional asset transfers.

- Creation of New Financial Products: TaaS enables the development of innovative financial instruments, such as asset-backed tokens or tokenized funds, expanding investment opportunities.

- Yield Generation Opportunities: Asset owners can leverage tokenization to create revenue-sharing models or dividend-paying tokens, providing new ways to generate returns.

- Cross-Border Transactions: TaaS platforms facilitate seamless cross-border transactions, allowing investors from various jurisdictions to access and invest in tokenized assets.

- Global Investor Base: Asset owners can attract a diverse range of investors by making their tokenized assets available to a worldwide audience.

- Control Over Asset Management: TaaS allows asset owners to maintain control over their assets while accessing capital from a broader investor base.

- Community Engagement: Tokenization can foster a sense of community among investors, providing them with voting rights and opportunities to participate in asset governance.

- Access for Underserved Markets: TaaS can help bridge the gap for underserved communities by providing access to investment opportunities that were previously out of reach.

- Educational Resources: Many TaaS platforms offer educational resources to help investors understand tokenization and navigate the investment landscape.

Tokenization as a Service (TaaS) plays a transformative role in the financial ecosystem by simplifying asset management, enhancing liquidity, and promoting accessibility. By leveraging blockchain technology, TaaS platforms empower both investors and asset owners, driving innovation and fostering a more inclusive and efficient market. As the adoption of TaaS continues to grow, it is likely to reshape the future of investing and asset management, creating new opportunities for all stakeholders involved.

How Tokenization as a Service (TaaS) Works?Tokenization as a Service (TaaS) provides a structured framework for converting real-world assets (RWAs) into digital tokens using blockchain technology. This process facilitates greater liquidity, accessibility, and efficiency in asset management and trading. Here’s a step-by-step overview of how TaaS works:

1. Asset Selection and Valuation

1. Asset Selection and Valuation- Identifying the Asset: The process begins with the asset owner selecting the real-world asset they wish to tokenize, which can include real estate, art, commodities, or financial instruments.

- Valuation: A thorough valuation of the asset is conducted to determine its market value, ensuring that the token accurately reflects the asset’s worth.

- Token Type Selection: Asset owners and TaaS providers decide on the type of token to create (e.g., utility token, security token, or asset-backed token) based on the intended use and regulatory considerations.

- Smart Contract Development: Custom smart contracts are created to govern the token’s functionality, including rules for ownership transfer, profit-sharing, and compliance requirements.

- KYC/AML Processes: Before issuance, TaaS platforms typically conduct Know Your Customer (KYC) and Anti-Money Laundering (AML) checks on potential investors to ensure compliance with relevant regulations.

- Regulatory Approval: Depending on the asset type and jurisdiction, the tokenization process may require regulatory approvals or adherence to specific legal frameworks.

- Blockchain Selection: The appropriate blockchain network (e.g., Ethereum, Binance Smart Chain) is selected for the tokenization process, based on factors such as scalability, security, and interoperability.

- Token Minting: The digital token is minted on the chosen blockchain, representing ownership of the underlying asset. Each token is linked to a specific number of asset units (e.g., 1 token = 1% ownership of the asset).

- Investor Marketing and Education: TaaS platforms often assist asset owners in marketing the token offering to potential investors, providing educational resources about the asset and the benefits of tokenization.

- Issuance to Investors: Tokens are distributed to investors during the initial offering, either through direct sales or crowdfunding mechanisms.

- Integration with Exchanges: Once issued, tokens can be listed on various cryptocurrency exchanges or marketplaces, allowing for secondary trading and liquidity.

- Peer-to-Peer Transactions: Investors can buy, sell, or trade their tokens directly on the blockchain, enhancing liquidity and market accessibility.

- Real-Time Monitoring: Investors can track their tokenized assets through the TaaS platform, which provides real-time data on performance, value, and transaction history.

- Governance and Voting Rights: Depending on the token structure, investors may have rights to participate in governance decisions, such as voting on management strategies or distributions.

- Ongoing Compliance Monitoring: TaaS platforms continuously monitor transactions to ensure compliance with KYC, AML, and other regulatory requirements, helping to mitigate risks.

- Reporting Obligations: Asset owners may be required to provide regular reports to regulators and investors about asset performance, compliance status, and financial distributions.

- Profit Distribution: If the token represents a revenue-generating asset, profits can be distributed to token holders based on the terms outlined in the smart contract (e.g., dividends, rental income).

- Asset Appreciation: As the underlying asset appreciates in value, so too may the value of the tokens, providing potential capital gains for investors.

Tokenization as a Service (TaaS) streamlines the process of digitizing real-world assets, making it more accessible and efficient for both asset owners and investors. By leveraging blockchain technology, TaaS platforms enhance liquidity, compliance, and transparency in asset management and trading. As the TaaS ecosystem continues to evolve, it holds the potential to reshape the landscape of investment and asset ownership, creating new opportunities for diverse stakeholders.

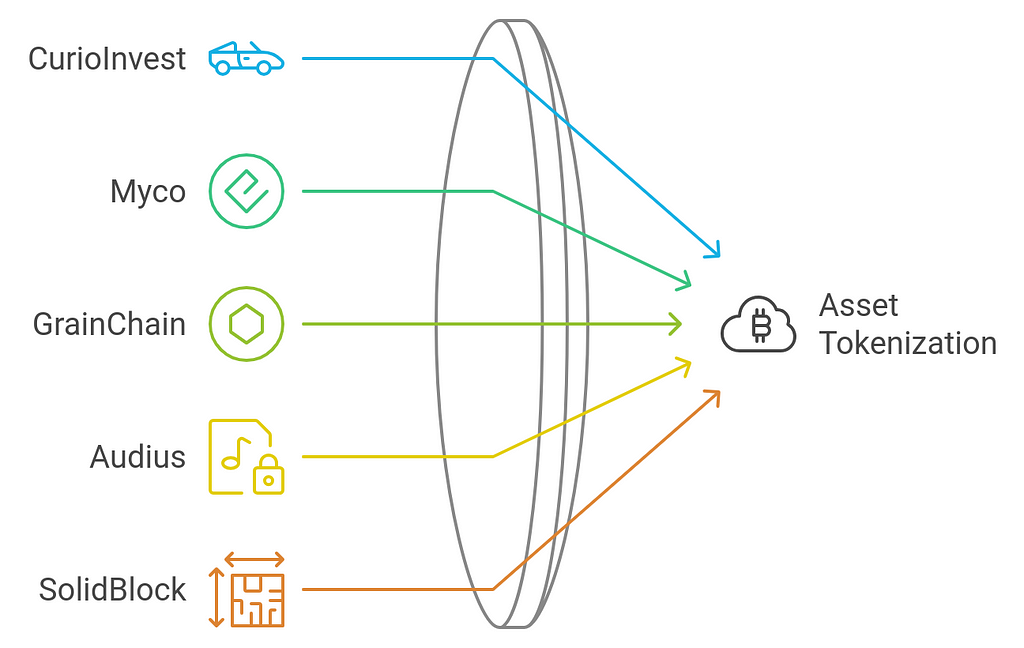

Top 5 Success Stories in Real World Asset TokenizationTokenization of real-world assets (RWAs) has gained significant traction in recent years, with various projects demonstrating the potential to revolutionize asset management, increase liquidity, and enhance accessibility. Here are five notable success stories in the realm of real-world asset tokenization:

1. Real Estate Tokenization: CurioInvest

1. Real Estate Tokenization: CurioInvest- Overview: CurioInvest is a platform that allows users to invest in luxury cars through tokenization. Each car is tokenized into shares, enabling fractional ownership.

- Success Factors: By leveraging blockchain technology, CurioInvest has democratized access to high-value luxury vehicles, allowing investors to purchase tokens representing ownership in high-end cars. This approach not only increases liquidity but also attracts a diverse investor base.

- Impact: The project has successfully raised funds for multiple luxury cars, showcasing how tokenization can transform the automotive investment landscape.

- Overview: Myco is a platform that enables the tokenization of fine art, allowing users to invest in art pieces by purchasing tokens that represent fractional ownership.

- Success Factors: By combining art investment with blockchain technology, Myco provides a secure and transparent way for investors to gain exposure to the art market without needing substantial capital. The platform also includes features for provenance tracking and art valuation.

- Impact: Myco has successfully tokenized multiple pieces of art, making it easier for individuals to participate in the art investment market and promoting liquidity in this traditionally illiquid asset class.

- Overview: GrainChain is a blockchain-based platform focused on the agricultural industry, enabling the tokenization of grain and other commodities.

- Success Factors: The platform connects farmers, buyers, and investors, facilitating the trading of tokenized commodities. By using smart contracts, GrainChain streamlines transactions and ensures transparency in the supply chain.

- Impact: GrainChain has successfully implemented its solution in various agricultural markets, enhancing the efficiency of commodity trading and providing farmers with better access to financing through tokenized assets.

- Overview: Audius is a decentralized music streaming platform that allows artists to tokenize their music and receive direct payments from listeners.

- Success Factors: By leveraging blockchain technology, Audius empowers artists to monetize their music directly, bypassing traditional music industry intermediaries. Artists can issue tokens that grant fans access to exclusive content and experiences.

- Impact: Audius has garnered millions of users and thousands of artists on its platform, demonstrating how tokenization can disrupt traditional revenue models in the music industry and enhance artist-fan engagement.

- Overview: SolidBlock specializes in tokenizing real estate assets, enabling fractional ownership and investment in commercial properties.

- Success Factors: By creating a marketplace for tokenized real estate, SolidBlock enhances liquidity and democratizes access to real estate investments. The platform also integrates compliance features, ensuring adherence to regulations.

- Impact: SolidBlock has successfully tokenized several high-value properties, providing investors with new opportunities in real estate and helping property owners access capital through tokenization.

These success stories highlight the transformative potential of tokenization in various sectors, from real estate and art to commodities and music. By leveraging blockchain technology, these projects have enhanced liquidity, democratized access to high-value assets, and created new investment opportunities for a broader range of investors. As the adoption of tokenization continues to grow, we can expect to see even more innovative solutions emerge, reshaping traditional asset management and investment landscapes.

Unlocking Liquidity through TaaSTokenization as a Service (TaaS) is rapidly transforming the financial landscape by unlocking liquidity in various asset classes, particularly those that have traditionally been illiquid. Through the digitization of real-world assets (RWAs), TaaS enables easier buying, selling, and trading of assets, providing numerous benefits for investors and asset owners alike. Here’s how TaaS unlocks liquidity:

1. Fractional Ownership

1. Fractional Ownership- Breaking Down Barriers: TaaS allows high-value assets such as real estate, art, or luxury goods to be divided into smaller, tradable units (tokens). This fractionalization lowers the barriers to entry for investors, enabling them to invest in assets they otherwise couldn’t afford.

- Increased Market Participation: By making it possible for more investors to participate in high-value asset markets, TaaS enhances demand, which in turn increases liquidity.

- Cross-Border Transactions: TaaS platforms leverage blockchain technology to facilitate cross-border transactions seamlessly. Investors from various regions can access tokenized assets without the complications of traditional financial systems.

- Diverse Investor Base: The global nature of TaaS attracts a diverse range of investors, increasing the potential market for tokenized assets and enhancing liquidity.

- Secondary Markets: TaaS platforms often provide integrated marketplaces where tokenized assets can be traded. This creates a robust secondary market, allowing investors to buy and sell tokens easily.

- Peer-to-Peer Transactions: By enabling direct transactions between investors on the blockchain, TaaS reduces reliance on intermediaries, facilitating faster and more cost-effective trading.

- Automated Transactions: Smart contracts can automate the execution of transactions, ensuring that trades are settled quickly and efficiently. This reduces the time and costs associated with manual processes, making trading more appealing.

- Real-Time Settlements: TaaS platforms can offer near-instantaneous settlement of trades, providing liquidity to investors who may need quick access to cash or capital.

- Immutable Records: Transactions recorded on a blockchain are transparent and tamper-proof, enhancing trust among participants. Investors are more likely to engage in markets where they feel secure about the authenticity and history of the assets.

- Reduced Counterparty Risk: By minimizing reliance on intermediaries, TaaS decreases counterparty risks associated with traditional asset transfers, making it safer for investors to trade.

- Creation of Derivative Instruments: TaaS can facilitate the development of new financial products, such as tokenized derivatives or options, which can enhance liquidity by providing additional avenues for trading.

- Yield-Generating Tokens: Asset owners can issue tokens that provide dividends or revenue-sharing opportunities, creating continuous cash flow for investors and increasing overall market interest.

- Built-in Compliance Tools: Many TaaS platforms include KYC (Know Your Customer) and AML (Anti-Money Laundering) processes that ensure compliance with regulations, making it easier for institutional investors to participate without concerns about legal ramifications.

- Transparent Reporting: Regular reporting features provide investors with insights into asset performance and compliance status, fostering confidence and encouraging more trading activity.

- Data-Driven Decision Making: TaaS platforms often offer analytics tools that provide investors with real-time data on asset performance, market trends, and trading volumes. This information can help investors make informed decisions and enhance market participation.

- Price Discovery: Increased trading activity leads to better price discovery for tokenized assets, which can help establish fair market values and encourage liquidity.

Tokenization as a Service (TaaS) is a game-changer for unlocking liquidity in traditional and alternative asset classes. By leveraging blockchain technology, TaaS platforms enhance accessibility, reduce barriers to entry, and facilitate faster, more transparent transactions. As TaaS continues to evolve, it is likely to reshape the investment landscape, offering new opportunities for investors and asset owners alike while driving overall market liquidity.

Regulatory ConsiderationsRegulatory considerations are crucial for the successful implementation of Tokenization as a Service (TaaS) in the financial ecosystem. As tokenized assets often blur the lines between traditional securities and digital currencies, regulatory frameworks must evolve to address these complexities. Companies offering TaaS need to comply with existing laws related to securities, anti-money laundering (AML), and know your customer (KYC) requirements to ensure legal operation.

Additionally, jurisdictions vary in their approach to blockchain technology and digital assets, making it essential for TaaS providers to stay informed about local regulations and adapt their services accordingly. Engaging with regulators and participating in industry discussions can help shape favorable policies and promote a secure environment for tokenization.

Moreover, transparency and adherence to regulatory standards can enhance trust among investors, ultimately fostering a more robust market for tokenized assets. Navigating these regulatory challenges is vital for the growth and sustainability of TaaS in the evolving financial landscape.

Future of Tokenization and Liquid InvestmentsThe future of tokenization and liquid investments is poised for significant transformation as technology and market dynamics evolve. With the increasing adoption of blockchain technology, tokenization is set to become a mainstream solution for enhancing asset liquidity. As more assets, including real estate, art, and even intellectual property, are tokenized, the barriers to entry for investors will continue to diminish, leading to broader participation in investment opportunities.

Furthermore, advancements in regulatory frameworks are likely to provide clearer guidelines for tokenized assets, fostering greater confidence among investors and institutions. The integration of decentralized finance (DeFi) with tokenization will also enable innovative financial products, allowing investors to leverage their tokenized assets in various ways, such as lending or staking. As these developments unfold, tokenization has the potential to create a more inclusive financial landscape, where diverse asset classes are easily accessible, and liquidity is enhanced, ultimately reshaping traditional investment paradigms for a global audience.

ConclusionIn conclusion, Tokenization as a Service (TaaS) represents a revolutionary approach to enhancing liquidity in traditionally illiquid assets, offering a myriad of benefits for investors and asset owners alike. By digitizing assets and enabling fractional ownership through blockchain technology, TaaS not only democratizes access to high-value investments but also fosters a more inclusive financial ecosystem. As investors increasingly seek diverse portfolios and opportunities to unlock trapped capital, TaaS provides the necessary tools to facilitate seamless trading and transparent ownership. The ability to securely tokenize assets mitigates risks associated with fraud and enhances transaction efficiency, making it an attractive solution for both seasoned investors and newcomers.

Furthermore, as regulatory frameworks continue to evolve, the acceptance of TaaS is poised to grow, further validating its potential in the marketplace. Ultimately, Tokenization as a Service is not merely a trend; it is a transformative force that is reshaping the investment landscape, enabling greater liquidity, accessibility, and innovation. As we move forward, embracing this technology will be crucial for unlocking the full potential of illiquid assets and driving the future of investment strategies.

Is Tokenization as a Service the Key to Unlocking Liquid Investments from Illiquid Assets? was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.