Top 16 Natural Language Processing (NLP) Services & Solutions

As the financial sector evolves, AI agents are at the forefront of this transformation, ushering in a new era of efficiency and innovation. These intelligent systems are reshaping how financial institutions operate by automating complex tasks, enhancing decision-making, and providing deep insights into market trends. AI agents streamline operations by managing routine processes, detecting fraud, and predicting market movements with unprecedented accuracy.

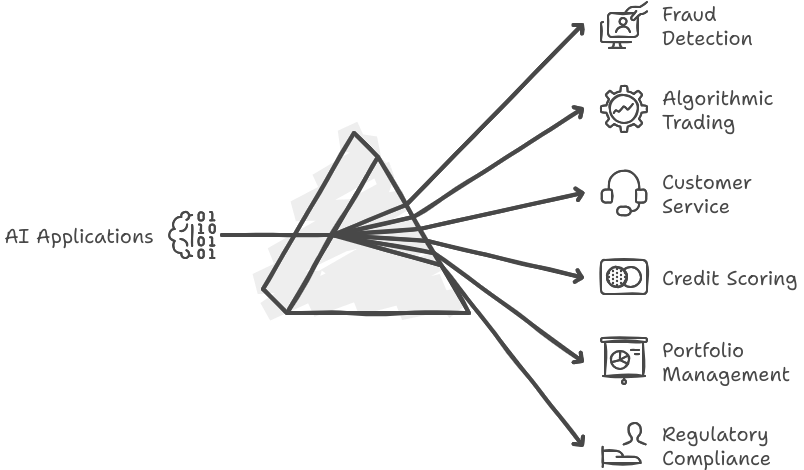

Fig: AI Agents in Finance

Fig: AI Agents in FinanceTheir ability to analyze vast amounts of data in real-time enables financial professionals to make informed decisions faster and more effectively. This technological shift is not only optimizing existing processes but also paving the way for innovative financial products and services. As AI continues to advance, its role in finance will become increasingly integral, driving growth and redefining industry standards. Embracing AI agents is no longer a choice but a necessity for financial institutions aiming to stay competitive in a rapidly changing landscape.

Table of ContentWhat is AI Agents in Finance?Current Applications of AI Agents in Finance

Benefits of AI Agents in Finance

Use Cases of AI Agents in Finance

Challenges and Considerations

Future Trends and Developments

ConclusionWhat is AI Agents in Finance?

AI agents in finance are advanced artificial intelligence systems designed to enhance and automate various aspects of financial operations and decision-making. These intelligent agents utilize machine learning, data analytics, and natural language processing to analyze vast amounts of financial data, providing insights and solutions with unprecedented speed and accuracy. They can perform a range of tasks including risk assessment, fraud detection, trading algorithms, customer service, and financial forecasting.

AI agents are equipped to handle complex and repetitive tasks that traditionally require human intervention, thereby increasing efficiency and reducing errors. By integrating AI agents in finance can improve operational efficiency, enhance customer experiences, and gain deeper insights into market trends and risks. These systems continuously learn and adapt to new data, making them increasingly effective over time. In essence, AI agents represent a transformative force in finance, driving innovation and setting new standards for how financial services are delivered and managed in the modern era.

Current Applications of AI Agents in FinanceAI agents are making significant strides in the finance sector, offering a range of applications that enhance efficiency, accuracy, and decision-making. Here are some key areas where AI agents are currently applied in finance:

1. Fraud Detection and Prevention

1. Fraud Detection and Prevention- Anomaly Detection: AI algorithms analyze transaction patterns to identify unusual activity that may indicate fraud.

- Real-Time Monitoring: AI systems continuously monitor transactions and flag suspicious behavior instantly.

- High-Frequency Trading: AI algorithms execute trades at high speeds based on market data and trends.

- Predictive Analytics: AI analyzes historical data to predict future market movements and inform trading strategies.

- 24/7 Support: AI-powered chatbots provide round-the-clock customer service, handling inquiries and issues efficiently.

- Personalized Recommendations: AI agents offer tailored financial advice and product recommendations based on customer data.

- Dynamic Credit Scoring: AI models evaluate creditworthiness by analyzing a broader range of data points, including social media activity and transaction history.

- Risk Management: AI assesses and predicts financial risks, helping institutions manage and mitigate potential losses.

- Robo-Advisors: AI-driven platforms create and manage investment portfolios based on individual risk profiles and financial goals.

- Performance Optimization: AI tools analyze portfolio performance and make adjustments to maximize returns.

- AML (Anti-Money Laundering) Compliance: AI systems assist in detecting and reporting suspicious financial activities to comply with regulatory requirements.

- Automated Reporting: AI agents generate compliance reports and ensure adherence to financial regulations.

- Market Sentiment: AI analyzes news, social media, and other sources to gauge market sentiment and its potential impact on financial markets.

- Investor Behavior: AI assesses investor sentiment to predict market trends and investor actions.

- Economic Predictions: AI models analyze economic indicators to forecast financial trends and market conditions.

- Revenue and Profit Forecasts: AI helps businesses predict future revenue and profits based on historical data and market trends.

- Expense Tracking: AI tools help users track their spending and manage their budgets more effectively.

- Savings and Investment Advice: AI provides personalized advice on savings and investment strategies based on user financial behavior.

- Risk Assessment: AI evaluates risk factors and historical data to determine insurance premiums and coverage options.

- Claims Processing: AI automates and speeds up the claims process, reducing the time and cost associated with handling claims.

These applications are transforming the finance industry by improving accuracy, efficiency, and customer experience. As AI technology continues to advance, its role in finance is expected to grow, bringing even more innovative solutions to the sector.

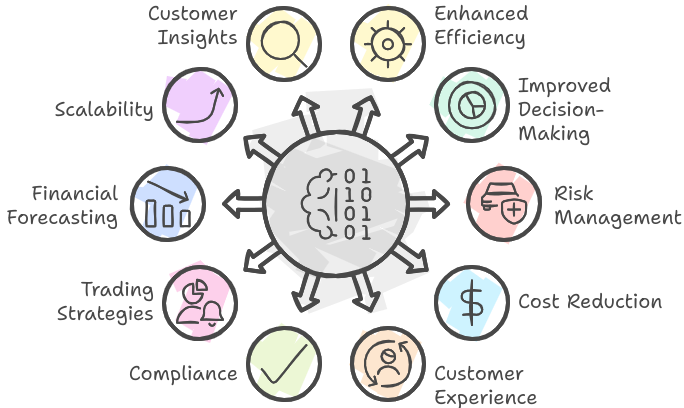

Benefits of AI Agents in FinanceAI agents offer a range of benefits in the finance sector, significantly enhancing operations and decision-making. Here are some key advantages:

1. Enhanced Efficiency

1. Enhanced Efficiency- Automation of Routine Tasks: AI agents handle repetitive tasks such as data entry, transaction processing, and report generation, freeing up human resources for more complex activities.

- Speed and Accuracy: AI processes large volumes of data quickly and accurately, reducing the time and errors associated with manual tasks.

- Data-Driven Insights: AI analyzes vast amounts of data to provide actionable insights, helping financial institutions make informed decisions.

- Predictive Analytics: AI models forecast market trends and financial outcomes, aiding in strategic planning and investment decisions.

- Fraud Detection: AI systems identify and prevent fraudulent activities by analyzing transaction patterns and flagging anomalies in real-time.

- Risk Assessment: AI evaluates various risk factors and provides insights into potential financial risks, enabling better risk management strategies.

- Operational Efficiency: By automating routine tasks, AI reduces operational costs and minimizes the need for extensive manual labor.

- Reduced Errors: AI’s accuracy helps lower the costs associated with errors and corrections in financial processes.

- Tailored Recommendations: AI provides personalized financial advice and product recommendations based on individual customer data and preferences.

- 24/7 Customer Support: AI chatbots offer round-the-clock support, addressing customer inquiries and issues promptly.

- Regulatory Adherence: AI helps financial institutions comply with regulations by automating compliance reporting and monitoring for suspicious activities.

- Anti-Money Laundering (AML): AI systems assist in detecting and reporting potential money laundering activities, ensuring adherence to AML regulations.

- Algorithmic Trading: AI-driven trading algorithms execute trades at high speeds and with precision, optimizing trading strategies and maximizing returns.

- Market Analysis: AI analyzes market data to identify trends and patterns, helping traders make better-informed decisions.

- Economic Predictions: AI models predict economic trends and financial outcomes based on historical data and market conditions.

- Portfolio Management: AI assists in managing investment portfolios, optimizing asset allocation, and adjusting strategies based on performance and market changes.

- Handling Large Data Volumes: AI systems can scale to handle increasing volumes of financial data without a corresponding increase in operational costs.

- Adapting to Growth: AI can easily adapt to growing business needs and complex financial environments, providing consistent support.

- Behavioral Analysis: AI analyzes customer behavior and preferences to provide deeper insights into customer needs and trends.

- Targeted Marketing: AI enables more effective and targeted marketing campaigns by understanding customer segments and their preferences.

- Claims Processing: In insurance, AI speeds up the claims process by automating assessments and approvals.

- Credit Scoring: AI enhances credit scoring models by incorporating a broader range of data, improving the accuracy of credit assessments.

Overall, AI agents in finance provide significant benefits by improving efficiency, reducing costs, enhancing decision-making, and delivering a better customer experience. As technology continues to evolve, the impact of AI on the finance sector is expected to grow even further.

Use Cases of AI Agents in FinanceAI agents are being deployed across various areas of finance to solve complex problems, optimize processes, and provide enhanced services. Here are some notable use cases:

1. Fraud Detection and Prevention

1. Fraud Detection and Prevention- Transaction Monitoring: AI agents analyze transaction data in real-time to detect unusual patterns and prevent fraudulent activities. For example, banks use AI to identify anomalies that may indicate credit card fraud.

- Identity Verification: AI-driven systems use biometric data, such as facial recognition or voice recognition, to verify user identities and prevent fraud.

- High-Frequency Trading (HFT): AI algorithms execute trades at high speeds based on market data and trends, capitalizing on small price movements for profit.

- Market Prediction: AI analyzes historical market data and news to predict price movements and inform trading strategies.

- 24/7 Support: AI chatbots provide round-the-clock customer service, handling inquiries about account balances, transaction details, and more.

- Personalized Assistance: AI systems offer tailored financial advice and recommendations based on individual customer profiles and behavior.

- Dynamic Credit Scoring: AI models assess creditworthiness by analyzing a wide range of data, including financial history, social media activity, and transaction patterns.

- Risk Modeling: AI evaluates risk factors and predicts potential defaults or financial instability, helping lenders make informed decisions.

- Robo-Advisors: AI-driven platforms create and manage investment portfolios based on user risk profiles and financial goals, automatically rebalancing assets as needed.

- Performance Analysis: AI tools analyze portfolio performance, providing insights and recommendations for optimizing investment strategies.

- Anti-Money Laundering (AML): AI systems monitor transactions and flag suspicious activities for further investigation, helping institutions comply with AML regulations.

- Automated Reporting: AI generates compliance reports and ensures adherence to regulatory requirements, reducing the burden of manual reporting.

- Market Sentiment: AI analyzes news articles, social media posts, and financial reports to gauge market sentiment and its potential impact on stock prices.

- Investor Sentiment: AI tools assess investor sentiment to predict market trends and inform investment strategies.

- Economic Predictions: AI models analyze economic indicators and historical data to forecast financial trends, helping businesses and investors plan for the future.

- Revenue Forecasting: AI predicts future revenue and profitability based on historical data and market conditions.

- Risk Assessment: AI evaluates risk factors and historical data to determine insurance premiums and coverage options, improving underwriting accuracy.

- Claims Automation: AI automates the claims process, from initial assessment to final approval, speeding up processing times and reducing administrative costs.

- Expense Tracking: AI tools help users track their spending, categorize expenses, and manage their budgets more effectively.

- Savings and Investment Advice: AI provides personalized recommendations for savings and investments based on individual financial goals and behavior.

- Predictive Analytics: AI models assess and predict the likelihood of fraudulent activities, allowing financial institutions to implement preventive measures.

- Behavioral Analysis: AI analyzes user behavior patterns to identify potential risks and anomalies in financial transactions.

- Data Aggregation: AI consolidates and analyzes vast amounts of financial data to uncover trends, correlations, and insights.

- Real-Time Analysis: AI processes and analyzes data in real time, providing up-to-date insights and information for decision-making.

- Customized Investment Strategies: AI creates tailored investment strategies based on individual risk profiles, preferences, and financial goals.

- Alternative Investments: AI identifies and evaluates alternative investment opportunities, such as cryptocurrencies and private equity.

- Targeted Marketing: AI analyzes customer data to create personalized marketing campaigns and offers, improving engagement and conversion rates.

- Customer Segmentation: AI segments customers based on behavior and preferences, allowing for more effective and targeted financial products and services.

These use cases demonstrate the transformative impact of AI agents on the finance industry, enhancing efficiency, accuracy, and customer satisfaction across various financial services and operations.

Challenges and ConsiderationsWhile AI agents in finance offer significant advantages, they also come with challenges and considerations that need careful attention. One major concern is data privacy and security; the vast amounts of sensitive financial data handled by AI systems must be protected against breaches and misuse. Additionally, the accuracy of AI predictions and decisions depends on the quality of the data fed into these systems, raising concerns about data integrity and bias. There is also the challenge of regulatory compliance, as financial institutions must navigate complex legal frameworks to ensure AI implementations adhere to industry standards and regulations.

Moreover, the reliance on AI can lead to skill gaps within the workforce, as traditional roles evolve or become obsolete. Ensuring transparency and interpretability of AI decisions is another crucial factor, as stakeholders need to understand how decisions are made. Finally, the high costs associated with developing and maintaining advanced AI systems can be a barrier for smaller institutions. Addressing these challenges is essential for realizing the full potential of AI agents in finance while minimizing risks and ensuring ethical practices.

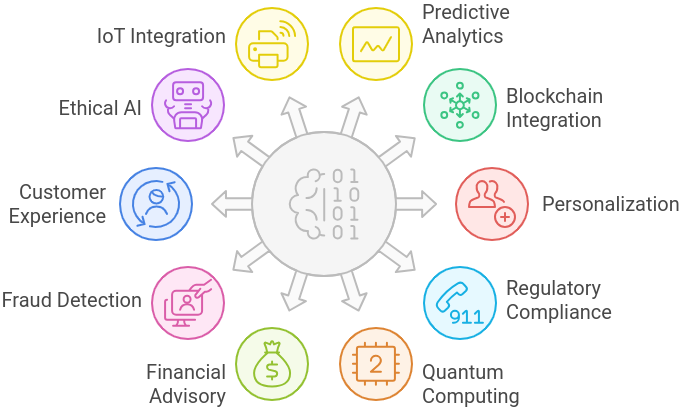

Future Trends and DevelopmentsThe future of AI in finance is poised for significant advancements as technology evolves and new trends emerge. Here are some key future trends and developments to watch for:

1. Advanced Predictive Analytics

1. Advanced Predictive Analytics- AI-Driven Forecasting: Enhanced AI algorithms will provide more accurate financial forecasts and market predictions, incorporating real-time data and advanced modeling techniques.

- Behavioral Insights: AI will analyze customer behavior and market sentiment to refine predictive models and improve decision-making.

- Smart Contracts: AI and blockchain integration will streamline smart contract execution, enhancing transparency and reducing fraud.

- Decentralized Finance (DeFi): AI will play a role in optimizing DeFi platforms by improving risk management and automating financial processes.

- Hyper-Personalized Services: AI will deliver highly personalized financial products and services based on individual preferences, financial behavior, and goals.

- Customized Financial Planning: AI-driven tools will offer tailored financial advice and planning solutions, adapting to changes in users’ financial situations.

- RegTech Solutions: AI will support regulatory technology (RegTech) by automating compliance processes, monitoring regulations, and ensuring adherence to evolving financial regulations.

- Automated Reporting: AI will enhance the efficiency of regulatory reporting and audit processes, reducing the risk of non-compliance.

- Advanced Algorithms: The advent of quantum computing will enable more complex and faster financial modeling and risk analysis.

- Enhanced Security: Quantum computing could revolutionize cryptographic techniques, improving data security and encryption in financial transactions.

- Robo-Advisors 2.0: The next generation of robo-advisors will leverage AI to offer more sophisticated investment strategies and portfolio management.

- AI Financial Planners: AI-driven financial planners will provide comprehensive financial advice, including tax planning, retirement planning, and investment management.

- AI-Enhanced Security: Advanced AI techniques will improve fraud detection by analyzing larger datasets and identifying more complex patterns of fraudulent activity.

- Adaptive Fraud Prevention: AI systems will continuously adapt to new fraud tactics and threats, enhancing security measures.

- Voice and Conversational AI: Enhanced AI-driven voice and conversational interfaces will improve customer interactions and support in financial services.

- Sentiment Analysis: AI will analyze customer feedback and sentiment to enhance service quality and address issues proactively.

- Bias Mitigation: There will be an increased focus on developing ethical AI systems that minimize biases and ensure fair decision-making in financial applications.

- Transparency and Explainability: AI systems will incorporate transparency and explainability features to provide clear insights into decision-making processes.

- Smart Financial Devices: AI will integrate with IoT devices to provide real-time financial insights and manage personal finances through connected devices.

- Data Collection and Analysis: IoT devices will generate data that AI systems can analyze to offer personalized financial advice and services.

- Dynamic Asset Management: AI will offer dynamic asset management solutions, adjusting portfolios in response to market changes and individual preferences.

- Alternative Investments: AI will help identify and evaluate alternative investment opportunities, such as cryptocurrencies and startups.

- ESG Analysis: AI will support environmental, social, and governance (ESG) analysis, helping investors make sustainable and socially responsible investment decisions.

- Impact Measurement: AI will assist in measuring the impact of investments on sustainability goals and corporate social responsibility.

These future trends and developments highlight the ongoing transformation of the finance industry through AI, driving innovation, efficiency, and enhanced customer experiences. As technology continues to advance, the role of AI in finance will become even more integral, shaping the industry’s future.

ConclusionIn conclusion, AI agents are revolutionizing the finance industry, marking a significant shift toward more intelligent and efficient operations. Their transformative impact extends from automating routine tasks to providing sophisticated predictive analytics, which enhances decision-making and reduces operational risks. By leveraging AI, financial institutions can achieve greater accuracy in forecasting, more effective fraud detection, and streamlined customer interactions. This evolution not only improves existing processes but also unlocks new opportunities for innovation in financial services.

As technology continues to advance, the integration of AI agents will become increasingly crucial for institutions seeking to maintain a competitive edge and meet the evolving needs of their clients. Embracing AI represents a strategic move toward a more dynamic and responsive financial ecosystem, where data-driven insights and automation drive growth and efficiency. The future of finance is undeniably intertwined with the capabilities of AI, promising a new era of industry transformation that is both exciting and essential for continued success.

AI Agents in Finance: A New Era of Industry Transformation was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.