Unlocking the Future of Insurance: JumboBlockchain and IoT Integration

By Kyle Liu, Investment Manager at Bing Ventures

The approval of BTC and ETH spot ETFs has ushered in a new era for the crypto and blockchain industry. Along with that, the number of both direct and indirect holders of crypto assets has surged. However, the actual users in the crypto space have yet to enjoy a proportional increase.

Users still face significant barriers to using dApps. Additionally, the flows of user assets, data, and tokens are fragmented across different public blockchains and dApps. This has prevented the explosive growth of crypto’s user base and limited the potential of the Web3 industry.

Intents are an emerging field that promises to revolutionize the Web3 user experience and unleash its real potential.

In this article, we’ll dive into this new vertical by taking dappOS as an example.

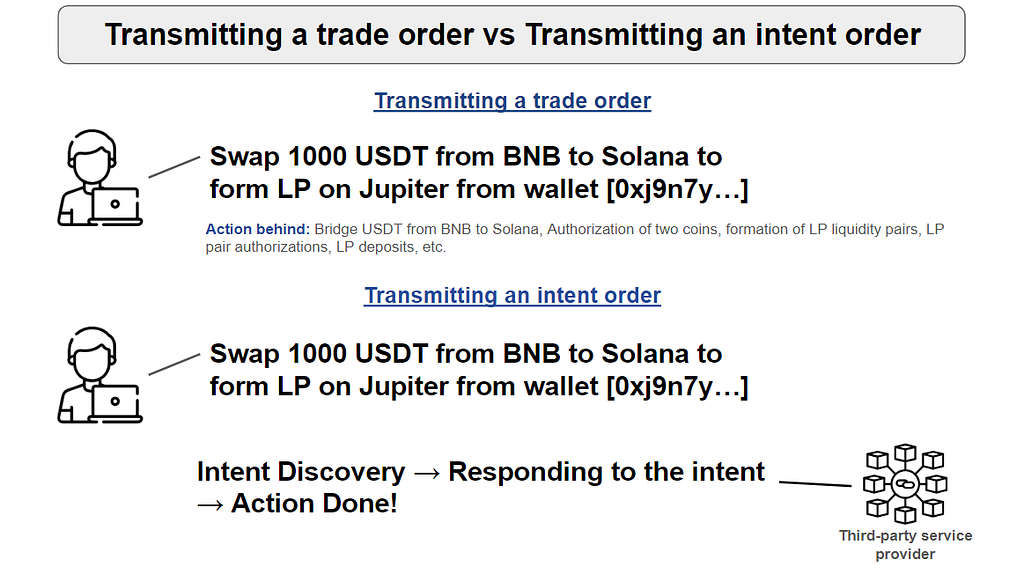

Decoding Intent: A Paradigm Shift in the Blockchain WorldIntents refer to the users’ desired outcomes, disregarding specific execution steps. For example, traditional transaction methods on Ethereum require users to specify every step of the transaction, including interacting with smart contracts, managing randomness, and paying gas fees. This can be complex and inefficient. The concept of intent aims to relieve users of these burdens, allowing them to outsource the transaction creation process to third parties while maintaining control over the transaction.

By abstracting away the technical complexities of blockchain transactions and focusing on user-defined goals, the intent-driven model strives to make blockchain technology as simple and intuitive as traditional Web browsing. The ultimate goal is to ensure that user interactions with blockchain and dApps would feel as seamless as any traditional Web2 service, driving broader adoption of these technologies.

Essentially, an intent-centric model is a technological innovation and a philosophical realignment in the blockchain space toward user empowerment and inclusivity. By emphasizing consistency between Web3 experiences and the familiar ease of use of Web2, it seeks to lower the barriers to entry, laying the foundation for the exponential growth of Web3 users.

Technical Pillars and Implementation PathImplementing intent-centric systems allows users to define their desired transaction outcomes and operations without needing to specify the exact execution steps. Through certain mechanisms, users delegate the execution of intent to the system, smart contracts, or third-party service providers. Whether done automatically or manually, the execution process should reflect users’ original intent while leaving enough room for flexibility and optimization.

We will use dappOS’s technical architecture as an example to illustrate the intent transaction mechanisms:

- Open Market Mechanism:

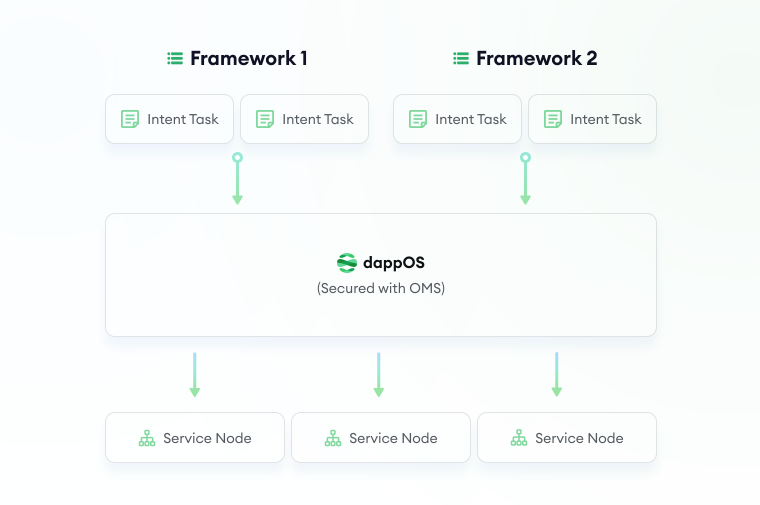

dappOS adopts an open market mechanism that allows service providers to stake collateral when offering intent execution services.

Service providers register as service nodes by staking tokens and selecting the services they are willing to provide. This mechanism ensures dynamic allocation of services and efficient resource utilization.

- Optimistic Minimum Staking (OMS) Mechanism:

The OMS mechanism allows service providers to execute tasks first and verify the results later. This “execute first, verify later” approach greatly speeds up task execution.

Intent tasks are value-specific, meaning users agree to predefined compensation in case of task failure. Service providers only need to stake collateral slightly higher than the total value of the current intent tasks.

- Service Providers:

Service providers are the core component of the dappOS intent execution network. Becoming a service node starts with registration, which requires staking a predetermined amount of tokens in the RegisterManager contract. The staked tokens act as collateral, and the node’s task-handling capacity is proportional to the value of its staked collateral.

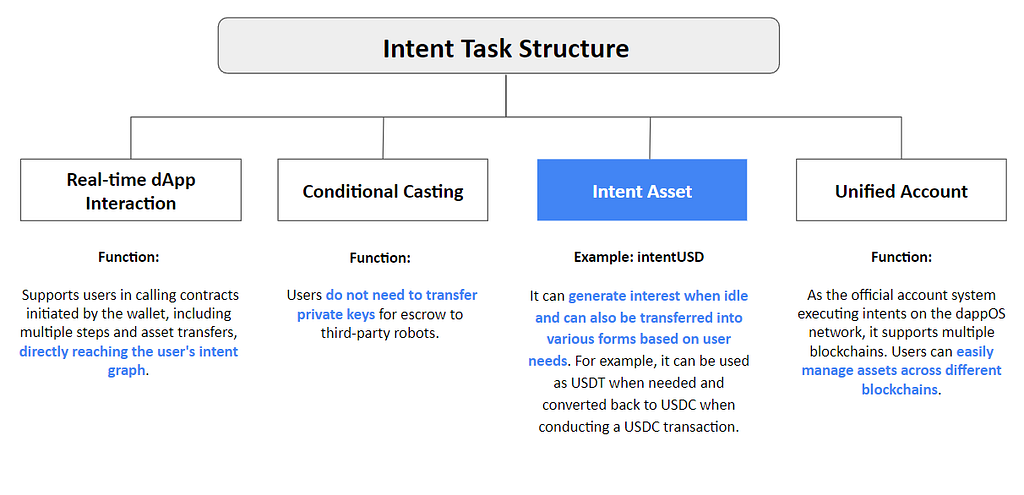

The flexible architecture of dappOS allows service providers to support various value-specific tasks. These tasks are template-based and include the following necessary elements:

- A comprehensive task description: outlining the end user’s goals and the conditions for task completion.

- Completion criteria: establishing the standards for execution validators to verify the task status.

- Required collateral amount: the collateral service nodes need to complete the task. Task schedulers use this information to evaluate each service node’s current collateral and exclude those with insufficient collateral.

- Execution Validators:

Execution validators play a critical role in the network by verifying task execution. If task execution fails, validators are authorized to vote for penalizing the service node, ensuring compensation for users.

Through the POS (Proof of Stake) network mechanism, validators stake tokens to maintain network security and integrity. Active and diligent validators are rewarded, incentivizing their continued participation and network maintenance.

- Task Frameworks:

To facilitate pricing and verifying intent tasks, dappOS organizes tasks into different frameworks. Each framework can be custom-designed according to specific needs, including pricing, verification, and compensation mechanisms.

In summary, dappOS allows users to create transactions and delegates them to a specialized third-party participant network while retaining complete control over the process. Simply put, if a transaction specifies “how” to perform an operation, intent defines what the expected outcome of that operation should be. Through intent, users can easily express their desired outcomes. This contrasts sharply with the current imperative transactions where every parameter must be explicitly specified by the user.

Intent-centric dApp Interaction

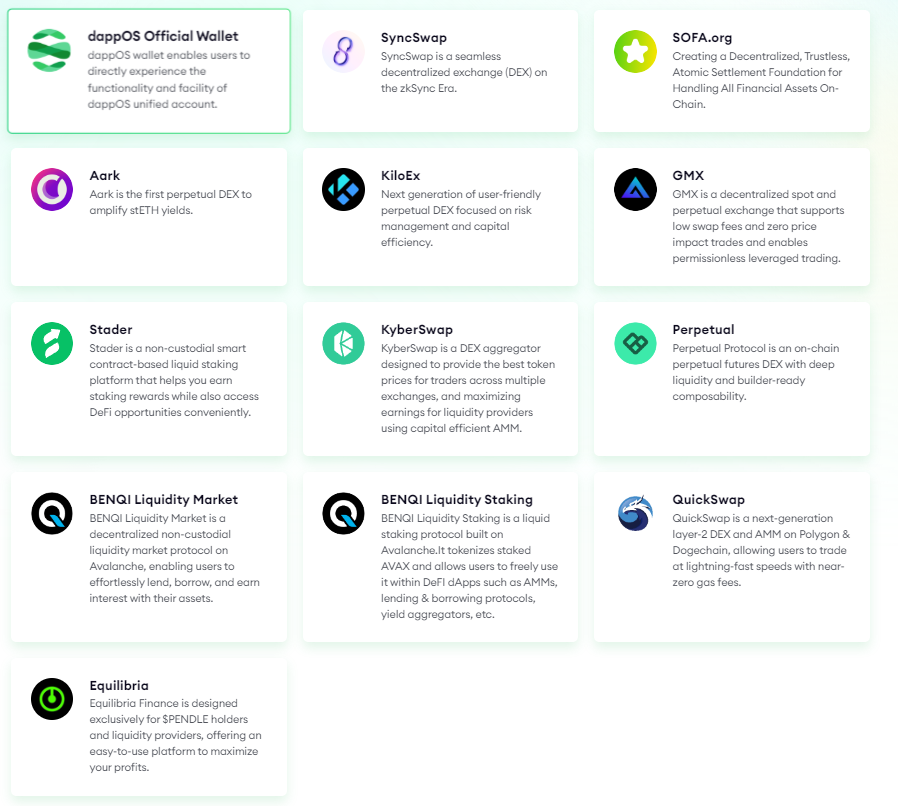

Since the launch of the beta version of dappOS V2, dappOS has integrated with more than 15 dApps, including GMX, Stader, KyberSwap, Equilibia, BENQI, and SyncSwap.

- GMX

The unified account feature of dappOS allows traders and liquidity providers to seamlessly access Avachnche and Arbitrum-based GMX from other chains without manually bridging assets. Benefiting from the solutions provided by dappOS V2, users can trade and purchase GLP or GM (GMX’s liquidity provider tokens) with an intent-centric user experience. The streamlined workflow optimizes execution time by 90% and reduces execution costs by up to 20%. Users can deploy their entire asset balance, regardless of distribution, and confirm complex, interdependent transactions across different chains with a single signature, paying fees in any token.

- Stader

The unified account feature of dappOS allows users to manage their total balance of assets directly. Users can confirm complicated, interdependent transactions across different chains with a single signature, whether sequentially or in parallel. With Stader powered by dappOS, users on Stader stake ETH and receive ETHx, deposit ETHx and ETH into Curve pool to get an LP Token, and continue to stake in Convex Finance to earn CRV and CVX income and complete 15 complex steps with one click. dappOS supports ETHx for gas payment and seamless use in multi-chain applications. The revenue generated by staking and farming is collected by dappOS, enabling users to claim the rewards with one click without having to go to Curve and Convex to claim them separately.

- KyperSwap

dappOS’s unified account feature enables users to trade directly on KyberSwap across different chains without manually bridging assets, increasing asset composability. For example, Ethereum users can directly lend assets from the Avalanche-based lending protocol BENQI and seamlessly use them on KyberSwap. It also supports any token to pay gas fees and task dependency execution with one single signature.

- BENQI

BENQI and dappOS collaborate to enhance the DeFi user experience by integrating the Avalanche-based BENQI DeFi protocol with dappOS’s user-friendly interface. BENQI unlocks liquidity for assets such as BTC, ETH, AVAX, and stablecoins, while dappOS simplifies typically complex Web3 operations like wallet setup and gas fee management. This collaboration enables users to seamlessly manage and utilize assets across multiple chains without manually bridging them. By offering a single interface for cross-chain transactions and supporting gas fee payments with any token, dappOS significantly reduces the steps involved, making DeFi more accessible and intuitive.

- Equilibria

dappOS’s unified account feature allows users to interact seamlessly with Equilibria’s high-yield pools deployed on Arbitrum without manually bridging assets. With Equilibria supported by dappOS V2, users can seamlessly deposit aUSDC and rETH pools from any chain, increasing their yields to 28% APR through an intent-centric user experience. Users can directly deposit ETH into rETH pools without minting or purchasing rETH on decentralized exchanges. PENDLE rewards can be claimed with one click and converted into mainstream tokens like USDT, USDC, ETH, and DAI. dappOS users can deploy their total asset balance across different chains, confirming complex, interdependent cross-chain transactions with a single signature, and pay fees with any token.

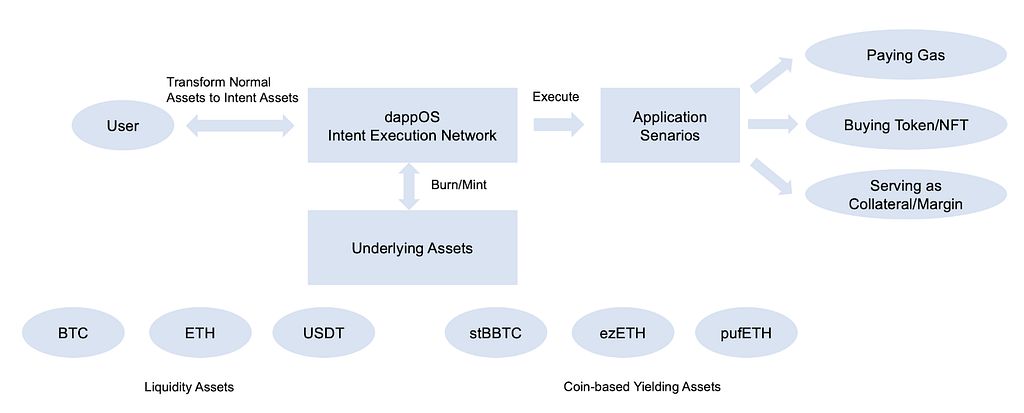

Intent Assets: Revolutionizing Crypto Asset Utilization

dappOS launched a new type of asset, intent assets. They offer high yields while remaining readily usable on-chain at any time.

Intent Assets leverage the unique capabilities of the dappOS execution network to handle complicated settlements in various scenes economically and efficiently, minimizing the complexity and operational burdens on users. When users use intent assets, they can provide regular or intent assets as inputs to the network and outsource settlement tasks to service providers, then expect specific results such as earning yields, completing interactions with dApps, and withdrawing assets to CEX. The intricacies of how these assets are transformed and managed to achieve the desired results are handled by service providers within the network, ensuring that users remain insulated from these complexities.

The first batch of Intent Assets includes intentBTC, intentETH, and intentUSD. For example, holding intentUSD allows users to earn yield based on USDT while maintaining complete flexibility. It can be withdrawn as USDT on exchanges in real-time or used instantly as USDC to supplement the margin on Arbitrum’s GMX. No additional losses are associated with using these assets besides gas fees.

Ecosystem Synergy: The Ripple Effect of Intent-based ArchitecturesdappOS’s partnerships with the five protocols mentioned above showcase the expected benefits that intent-based systems bring to dApps.

- Unified Account Management: dappOS’s unified account feature allows users to directly manage their total asset balance, which can be used across any dApp on different chains. This centralized management approach significantly simplifies asset management, improving liquidity and utilization efficiency.

- Seamless Cross-chain Operations: Whether it’s partnering with GMX, Stader, KyberSwap, BENQI, or Equilibria, dappOS’s seamless cross-chain functionality allows users to operate directly across different chains without manually bridging assets. This seamless experience reduces operational steps, saving time and costs.

- Simplification of Complex Operations: dappOS allows users to confirm complex, interdependent cross-chain transactions with a single signature, whether these transactions occur sequentially or in parallel. This functionality significantly enhances transaction security and efficiency, reducing the operational burden on users.

- Flexible Fee Payments: Users can pay gas fees with any token, without needing to hold specific tokens on specific chains. This flexibility improves the convenience of operations, allowing users greater freedom in conducting cross-chain transactions.

- Reward Management and Conversion: dappOS enables users to claim staking and liquidity farming rewards with one click and convert them into mainstream tokens like USDT, USDC, ETH, and DAI. This feature simplifies reward management processes, improving operational convenience and efficiency.

Intent-based systems are quietly sparking a revolution. This new concept is not just a tool to simplify user operations but a catalyst reshaping how the entire Web3 ecosystem interacts and how value flows. We believe that the ripple effect of intent-based systems, represented by dappOS, will manifest across several key dimensions:

- A New Frontier for Financial Innovation: Intent-based systems and intent assets are opening up new frontiers for financial innovation. Imagine a derivatives market based on user intent: traders could speculate or hedge against intents such as “users will transfer more than $1 million across chains within the next 30 days.” This not only provides investors with new risk management tools but could also give rise to an entirely new prediction market ecosystem.

- A New Engine for the Data Economy: Intent data is becoming one of the most valuable assets in the Web3 world. By profoundly analyzing user intent data, we can gain insights into market sentiment, predict capital flows, and even identify emerging DeFi trends. These insights are invaluable to DeFi protocols, DEXs, and CEXs, offering immense strategic value.

- The Super Adhesive of the Cross-chain Ecosystem: Intent-based architectures and intent assets will become the critical glue connecting different blockchains. Users can seamlessly execute complex cross-chain operations through standardized intent protocols without worrying about underlying technical details. This increases capital efficiency and paves the way for genuinely cross-chain DeFi applications. We anticipate that cross-chain transaction volume processed through intent protocols will become mainstream.

“Intents” is still an early-stage concept full of potential. Building an intent layer for a fully intent-centric world faces significant challenges, not only in terms of system complexity. As underlying blockchain technology develops and projects mature, the focus will shift from infrastructure to applications and user-friendliness, with intent-centric projects becoming a focal point for the entire industry’s development.

The key lies in the network effects of intent infrastructure: as the number of DeFi protocols connecting to the intent network increases, the improvement in user experience will grow exponentially. Our model predicts that when the number of connected protocols reaches a critical mass (estimated to be 50–100 mainstream DeFi protocols), user growth rates will experience a significant inflection point. We expect this inflection point to occur around Q3 2025 based on current growth trends. More importantly, intent assets create an entirely new value layer: the intent data layer. This layer connects different blockchains and deeply integrates on-chain and off-chain data. This will provide significant alpha opportunities for market makers, traders, and DeFi protocols.

From a technical perspective, AI-driven intent parsing and execution will be the next breakthrough. By the next bull market, we expect simple cross-chain operations will be primarily handled automatically by AI systems, significantly reducing user operational difficulty and transaction costs. This will boost the activity of existing crypto users and attract many Web2 users into the Web3 world.

In summary, intents represent the next evolutionary stage of Web3. They simplify user experiences and, more importantly, create an entirely new value capture model. For investors, early participation in intent-centric ecosystems will be vital to capturing this immense opportunity. We strongly recommend closely following developments in this space, especially projects leading in cross-chain operations, AI-driven execution, and intent data analysis.

About Bing VenturesBing Ventures is a pioneering venture capital and research firm affiliated with crypto exchange BingX. Founded in 2021, it aims to support transformative blockchain and crypto ventures and outstanding fund managers driving the next wave of innovations.

With a sector-agnostic, value-investing approach, it has a portfolio of more than 50 companies spanning infrastructure, DeFi, GameFi, Web3, and more, including, among others, Avail, Berachain, Manta Network, Pixelmon, Unisat, and Solv Protocol.

Bing Ventures is also a Limited Partner (LP) of several leading crypto funds, including those managed by Hack VC, Bankless Ventures, Maven 11 Capital, IOSG Ventures, and Figment Capital.

For more information, visit Bing Ventures’ Official Website | LinkedIn | Twitter.

Intents: A Revolution to the Next Stage of Web3 was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.