This Week’s U.S. Economic Data: What to Watch for Crypto Market Prices

The post This Week’s U.S. Economic Data: What to Watch for Crypto Market Prices appeared first on Coinpedia Fintech News

The crypto market is set for a shake-up as three major economic indicators are set to be released on October 24th. Jobless Claims, Manufacturing PMI, and Services PMI – these metrics will provide crucial insights into the health of the US economy.

How will they influence the crypto market and you, the investor?

United States Jobless Claims: An OverviewOn October 12, the Initial Jobless Claims index was at 241,000, a drop from 260,000 recorded on October 5. However, this week, forecasts suggest a slight increase to 247,000—an uptick of 6,000.

A slight rise in jobless claims could signal a slightly weaker job market. If this trend continues, it could, in theory, push the Federal Reserve to consider more interest rate cuts, which could be beneficial for cryptos.

Stability in Sight?

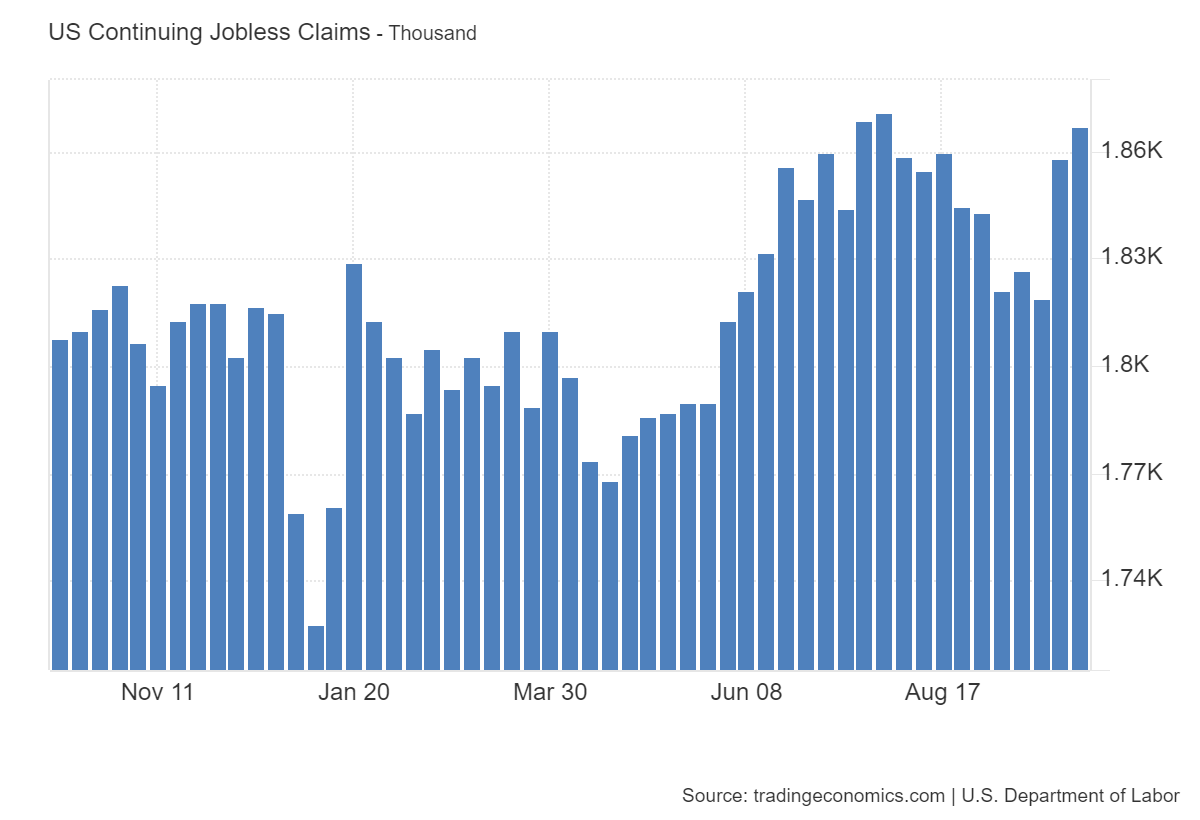

Meanwhile, on October 17, the US Continuing Jobless Claims index was 1.867K – higher than the value of 1861K recorded on October 10. This week, as per TEForecast, the value is expected to drop slightly to 1865K.

A slight drop in continuing claims indicates that the labor market is still stable. If these numbers improve, it may suggest a stronger economy, which could affect investor sentiment.

Manufacturing PMI: Signs of SlowdownIn September, the US Manufacturing PMI index fell to 47.3, the lowest since June 2023, down from over 51 in May 2024. This decline has been consistent since June, raising concerns about a possible economic slowdown.

If the Manufacturing PMI continues to drop, investors might see cryptocurrencies as a safer option against traditional market risks, especially during uncertain times.

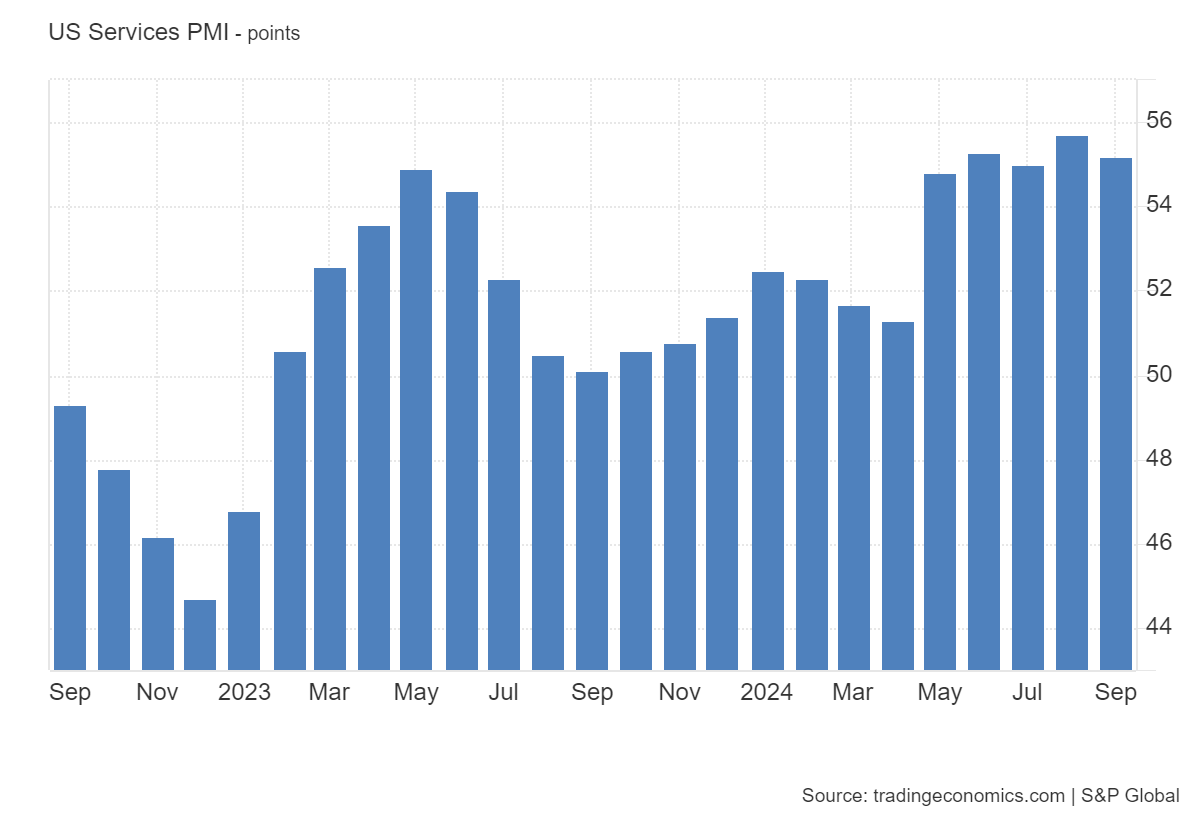

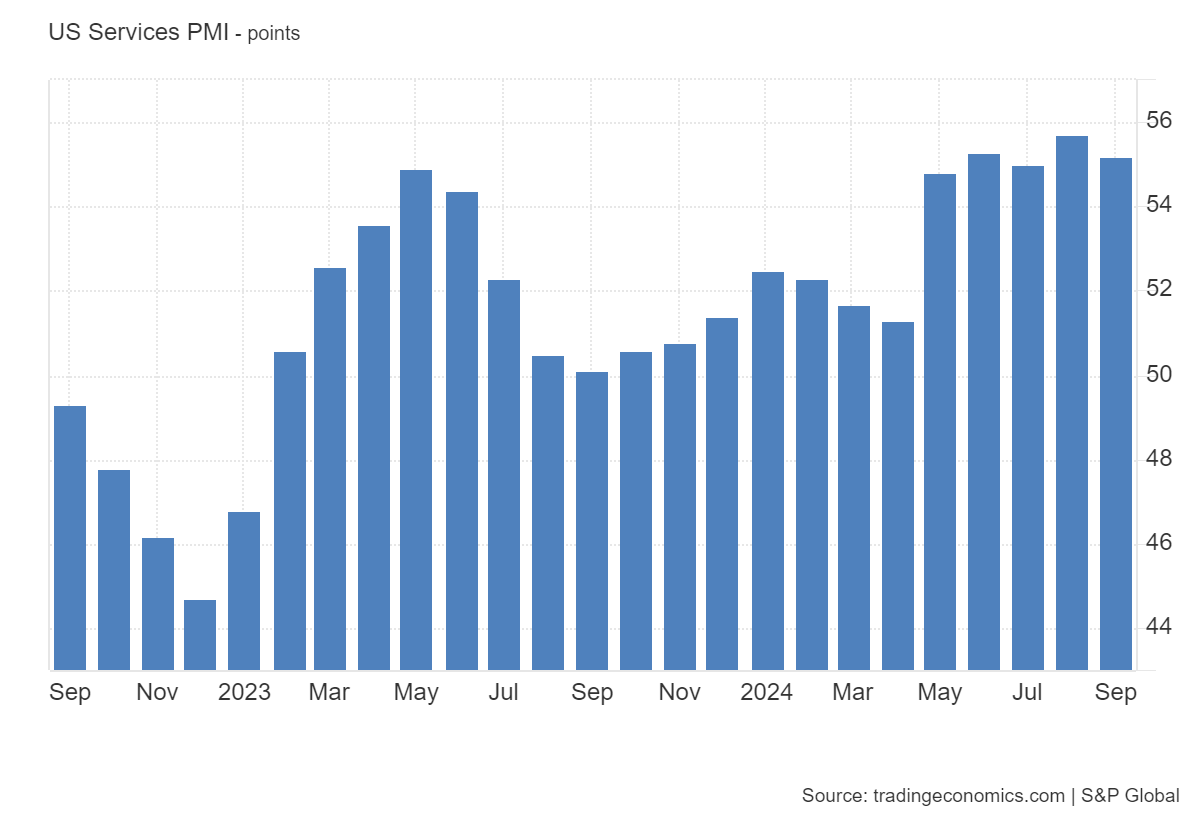

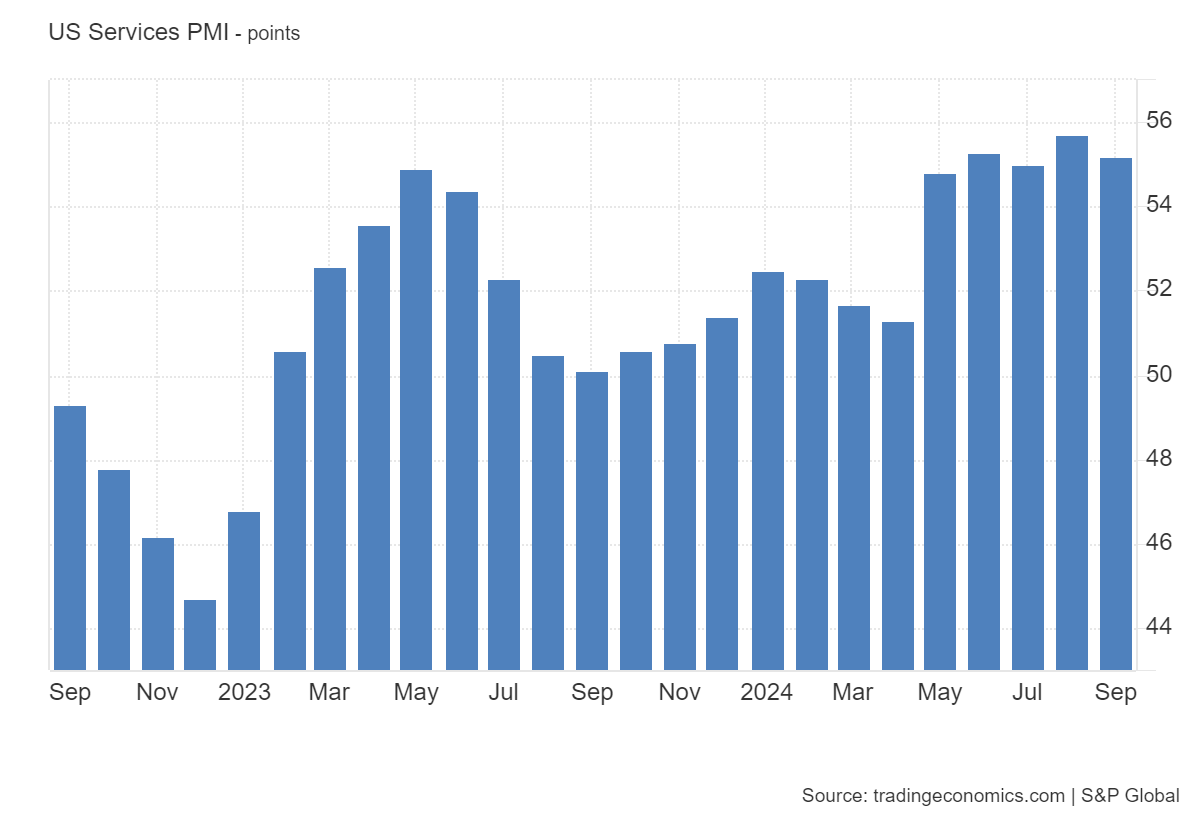

In September, the US Services PMI index recorded 55.2, down from 55.7 in August.

A strong services sector typically indicates a healthy economy; however, a decline here could lessen interest in riskier assets like cryptocurrencies.

Navigating the Ups and DownsIn summary, this week’s economic data is expected to show minor changes, with slight increases in unemployment claims and modest shifts in the PMI indices. It’s important to keep a close eye on these releases—especially the Manufacturing PMI. If the data reveals a weakening economy that deviates from expectations, it could certainly spark renewed interest in the cryptocurrency sector.

.article-inside-link { margin-left: 0 !important; border: 1px solid #0052CC4D; border-left: 0; border-right: 0; padding: 10px 0; text-align: left; } .entry ul.article-inside-link li { font-size: 14px; line-height: 21px; font-weight: 600; list-style-type: none; margin-bottom: 0; display: inline-block; } .entry ul.article-inside-link li:last-child { display: none; }Do you see potential for cryptocurrencies in light of this week’s data?