What is a Liquidity Bootstrapping Pool (LBP) in DeFi?

Image by Pabitra Kaity from PixabayIntroduction

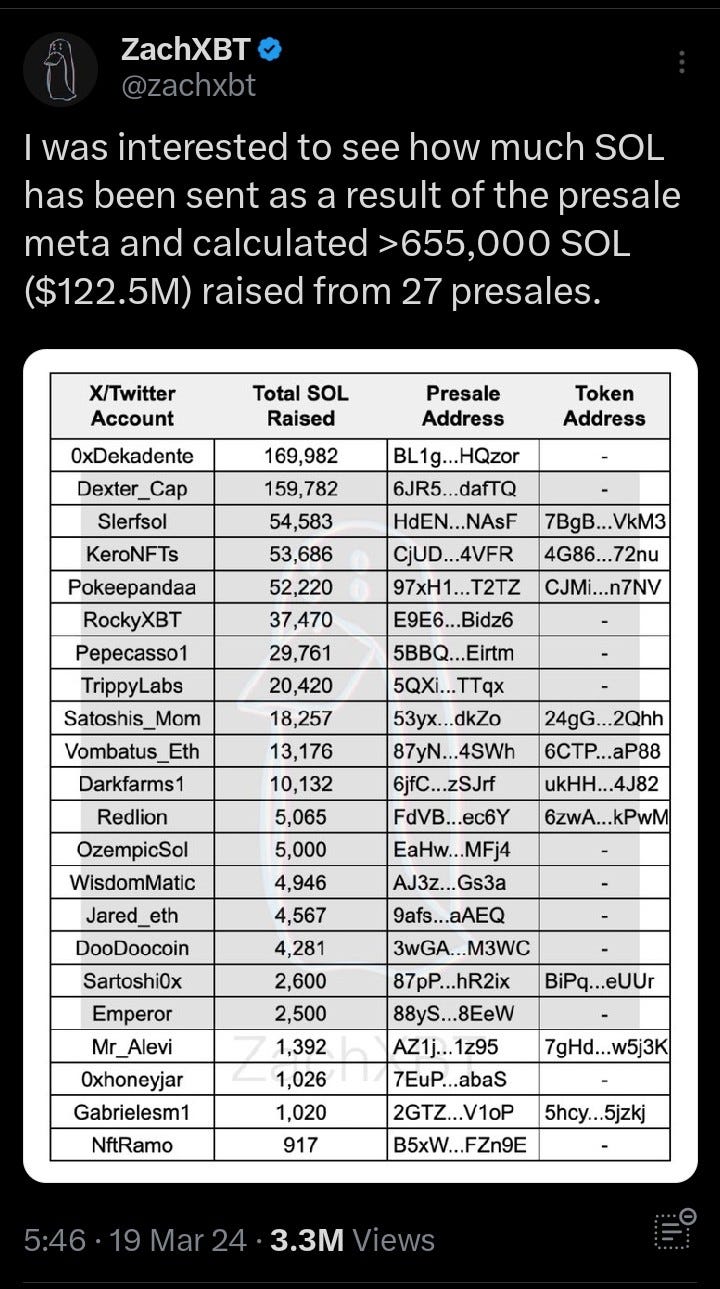

Image by Pabitra Kaity from PixabayIntroductionThe crypto community has witnessed an alarming surge of rug pulls and outright scams in recent token launches. With the Solana meme-coin frenzy as a catalyst, dubious developers and influencers take advantage of the unsuspecting public in the name of pre-sales. There’s also the problem of whales snipping supply at launch.

Popular crypto Twitter detective, ZackXBT, had his hands full tracking so many public sales (many were scams) in a space of just weeks.

ZachXBT on X

ZachXBT on XMany safer ways (for participants) exist to launch tokens, but not all are ideal for every project. LBPs are an alternative that offers a great balance between safety for participants and capital efficiency for teams. Let's dive in.

Understanding LiquidityIn the context of DeFi, liquidity simply means funds (usually project tokens and collateral/stablecoin) that are held on a Decentralised Exchange’s smart contract to facilitate trades.

The lifeblood of any DeFi project is liquidity because it ensures smooth trading of its tokens.

When a trader attempts to buy (or sell) a token in an exchange, adequate liquidity ensures he gets his order fast— and at a good price. This increases trust within the decentralised finance ecosystem.

But how do new projects attract liquidity, especially when their tokens are nascent?

There are many ways to build up that initial liquidity. But they mostly involve fundraising events where some project tokens are sold, e.g., ICOs, IDOs, presales, and private rounds.

What are Liquidity Bootstrapping Pools in DeFi?LBPs, also known as configurable rights pools or smart pools, are innovative mechanisms that help DeFi projects raise liquidity for their tokens in a cost-efficient manner.

Before we go on, it's important to understand how liquidity works on most exchanges.

Automated Market Makers vs. LBPsAMMs are smart contracts in Decentralised Exchanges (DEXs) that hold and facilitate the trading of assets in a liquidity pool. The pool itself is just a combination of two (sometimes more) swappable assets, usually in 50:50 weightings for both assets held.

Unlike traditional pools, LBPs use a dynamic weight adjustment system. This interesting setup sees the project token hold a higher weight initially. Over time, this weight gradually shifts towards the stablecoin, allowing for price discovery based on actual trading activity.

1intro's LBPWhy it’s important for token launches

1intro's LBPWhy it’s important for token launchesThis approach has several benefits, including fairer token distribution and more organic price discovery for new DeFi projects.

Trading bots and whales are disincentivized from sniping tokens at launch only to dump them—a common problem with other token launch models. This is because the price of tokens usually starts off high and reduces with time.

Additionally, LBPs offer projects the ability to cap token sales, meaning they can conclude or pause the event when sales reach a specific point. This can help prevent oversubscription, which may negatively affect demand when the token launches formally.

How LBPs Work and How to Participate in OneA liquidity bootstrapping pool has two sections. One section holds the brand-new token launched by a DeFi project. The other section holds the collateral token, usually a stablecoin or more established tokens like ETH or SOL — depending on the blockchain. This collateral acts as a benchmark for the project token's value.

Here's the interesting part, the proportions of these tokens in the pool aren't fixed, unlike in most traditional AMMs (DEXs) with fixed 50:50 weightings. Projects that use LBPs can dynamically adjust the weight of the tokens anywhere between 1:99 and 99:1. Among other advantages, this flexibility means lower capital requirements for creating pools.

Price discovery phaseOver the duration of the LBP event, token weight gradually decreases, while the weight of the collateral increases. And by the end of the LBP, the stablecoin becomes the dominant token in the pool, reflecting the established market value of the project token.

Another interesting thing to note about LBPs is that they are configurable AMMs. An LBP controller can pause the swapping of tokens in the pool if the need arises or set the price to decrease with time/less demand.

The major thing to keep in mind here is that project tokens usually start out expensive and reduce with time.

So for the reasons stated above, when participating in LBPs, you are more likely to get a better price from the midpoint towards the end of the sales. The expectation is that the price settles as demand reduces. However, if the demand surges towards the end of the LBP event, the price can also go up.

Considerations for Participating in LBPsLBPs might be a great way to mitigate rugpulls and whales while allowing projects with fewer resources to create deep pools. But there are a few things to note before you take part in one.

Project ViabilityFirst, LBPs can't guarantee the success of a DeFi project. The project itself needs to have a strong value proposition, a solid development team, and a clear roadmap. Even with a well-executed LBP, if the project lacks fundamentals, its token price might struggle in the long run. You can read my article on how to spot good crypto projects for more insights.

Smart Contract RisksLike any DeFi application, LBPs rely on smart contracts, which are essentially code running on a blockchain. Smart contracts by themselves are not bad, but how they are written matters a lot. Any vulnerabilities in the code could lead to exploits and potential loss of funds. You need to choose LBP platforms with a proven track record of secure operations or successful external audits, at least.

Benefits and the Future of DeFiLBPs are helping improve the way DeFi projects raise capital and launch their tokens. Compared to traditional methods like ICOs or IDOs, below are the advantages of LBPs:

Lower Barriers to EntryTraditional fundraising methods are often necessary due to the significant upfront capital required to create deep liquidity pools on exchanges. This can be a major hurdle for new, innovative projects with limited resources. Hence, they resort to seeking large investments from VCs and private investors before launching.

LBPs lower capital requirements through dynamic weight adjustment, making it easier for promising ideas to get off the ground. Thus, LBPs allow for a more diverse range of projects to emerge and compete for user adoption.

Fairer Token Distribution and Community BuildingICOs and IDOs usually favour early investors or large contributors, leading to a concentrated distribution of tokens. This has caused many rugs as these early token holders dump on new buyers when the token launches officially. Good LBP events, with their dynamic price system and open access, promote broader participation from the community.

Organic Price Discovery and Reduced ManipulationTraditional methods usually set an arbitrary price for the token, which may not reflect actual market demand. This can lead to inflated prices or exploitation by early investors. LBPs address this by dynamically adjusting weights, allowing the market to discover a fair price based on real-time trading activity.

Potential Future Applications of LBPsAt the moment, LBPs are commonly used as a token launch model in DeFi. But the potential applications of LBPs extend beyond that.

Here are a few possibilities:

Secondary Market Liquidity. LBPs could serve as dynamic pools for tokens already in the market. This can improve price discovery and reduce volatility in the secondary market.

Fractionalized Assets. LBPs could be used to launch pools for tokenized versions of real-world assets like real estate or artwork.

Decentralised Fundraising. LBPs could be used by non-profit organizations or social causes to raise funds in a transparent and community-driven manner.

ConclusionLBPs are a significant leap forward in DeFi project launches. Although they are not as widespread as other alternatives, they can pave the way for a more vibrant and innovative ecosystem. As the technology matures and new applications emerge, we could see their use extend beyond token launches. It would be interesting to see how things unfold.

What is a Liquidity Bootstrapping Pool (LBP) in DeFi? was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.