Why is Real Estate Tokenization the Next Big Thing in Property Investment?

Real estate tokenization is emerging as a game-changer in the property investment landscape, offering a revolutionary approach that combines the power of blockchain technology with the real estate market. By converting property assets into digital tokens, tokenization makes it possible for investors to buy, sell, or trade shares of a property much like stocks or bonds. This fractional ownership model lowers the barriers to entry, allowing more people to invest in high-value real estate, even with limited capital.

It also provides greater liquidity, as investors can quickly trade their tokens on a secondary market, making it easier to buy or sell property shares. Furthermore, tokenization streamlines transactions, cutting down on paperwork and reducing the need for intermediaries, which can lower transaction costs. As a result, real estate tokenization opens up global investment opportunities, enabling a wider range of people to participate in what was traditionally an exclusive market. With its potential to democratize property ownership and enhance liquidity, real estate tokenization is poised to reshape the future of property investment.

Table of ContentWhat is Real Estate Tokenization?Why Real Estate Tokenization Matters?

Growing Role of Tokenization in Real Estate in 2025

The Process of Investing in Tokenized Real Estate

How to Start a Real Estate Tokenization Business?

How Much Does Tokenization Cost in Real Estate?

Is Tokenization the Future of Real Estate?

ConclusionWhat is Real Estate Tokenization?

Real estate tokenization is the process of converting real estate assets into digital tokens using blockchain technology, allowing these assets to be divided into smaller, tradable units. Each token represents a fraction of ownership in a physical property, such as a residential or commercial building. This process makes it possible for multiple investors to own a share of a property without needing to purchase the entire asset. Tokenization increases liquidity by enabling investors to buy, sell, or trade property shares on digital platforms, often with lower transaction costs and faster execution times than traditional methods.

The real estate tokenization market, valued at USD 2.81 billion in 2023, is expected to grow significantly, reaching approximately USD 11.80 billion by 2031. This growth, fueled by cutting-edge blockchain technology, is projected to result in a strong compound annual growth rate (CAGR) of 9.91% from 2024 to 2031.

It also provides greater transparency, as blockchain ensures that all transactions are securely recorded and accessible for verification. With tokenized real estate, investors can diversify their portfolios with smaller amounts of capital, making property investment more accessible to a broader audience. Additionally, tokenization eliminates the need for intermediaries like banks or brokers, further reducing costs and improving efficiency. As the technology evolves, real estate tokenization has the potential to revolutionize the property investment market, offering more flexibility, transparency, and global investment opportunities.

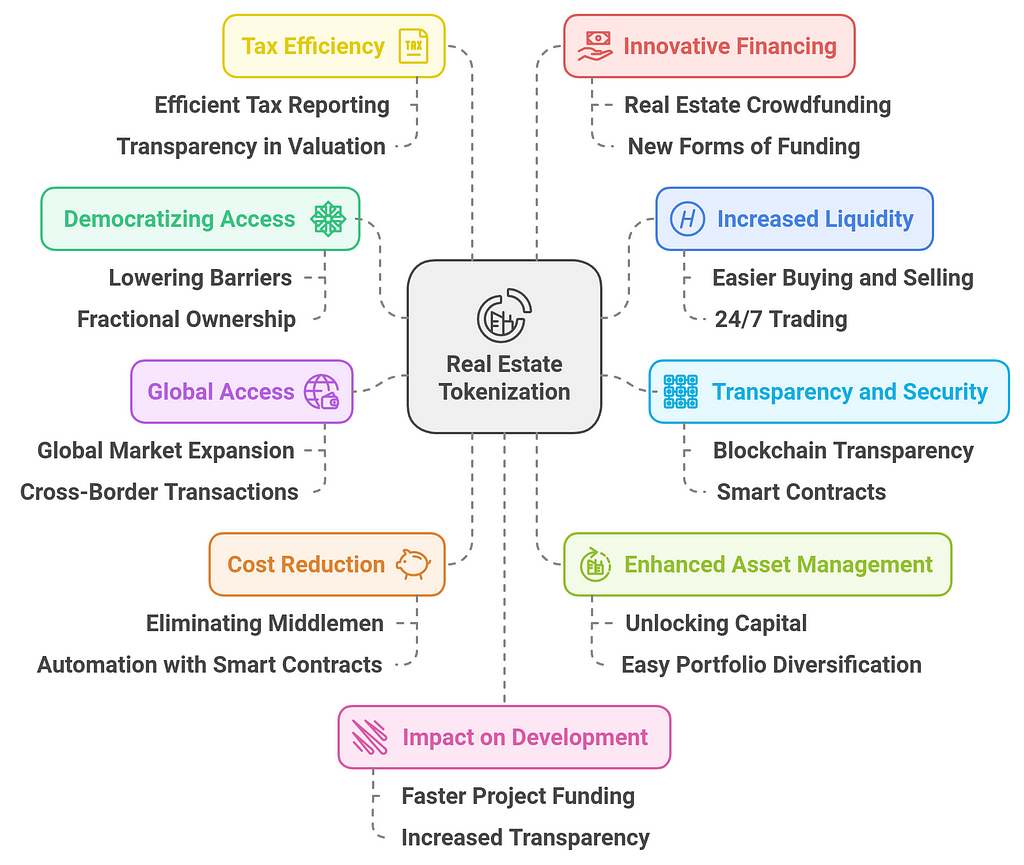

Why Real Estate Tokenization Matters?Real estate tokenization is gaining traction as an innovative way to democratize access to real estate investments, enhance liquidity, and improve transparency in the real estate sector. Tokenizing real estate refers to converting ownership or a portion of ownership of a property into digital tokens using blockchain technology. These tokens represent a share in the value of the property, making it easier to trade and invest in real estate assets. Here’s why real estate tokenization matters:

1. Democratizing Access to Real Estate Investment

1. Democratizing Access to Real Estate Investment- Lowering Barriers to Entry: Traditionally, real estate investments have required significant capital, making them accessible mainly to wealthy individuals or institutional investors. Tokenization allows smaller investors to buy fractional ownership of high-value real estate assets. This opens up opportunities for a broader range of people to invest in real estate, potentially leading to a more inclusive and diverse investment landscape.

- Fractional Ownership: Tokenization divides the ownership of real estate into smaller, tradable units, which means people can invest in a fraction of a property. This allows investors to own a share of large, expensive properties (e.g., commercial buildings or luxury apartments) without needing to purchase the entire asset.

- Easier Buying and Selling: Real estate traditionally has low liquidity because transactions are complex, time-consuming, and require large sums of money. Tokenized real estate can be bought and sold much more easily and quickly on blockchain platforms. This improved liquidity can attract more investors, both small and large, who are interested in the flexibility to enter and exit investments with relative ease.

- 24/7 Trading: Unlike traditional real estate markets, where buying or selling takes time and is constrained by business hours, tokenized real estate can be traded 24/7 on digital platforms, giving investors more flexibility and convenience.

- Blockchain Transparency: Real estate tokenization is based on blockchain technology, which is decentralized, transparent, and immutable. All transactions are recorded on the blockchain, making it easy to verify ownership, track the transfer of assets, and ensure that the property is free from encumbrances. This reduces the chances of fraud, disputes, and errors that can occur in traditional real estate transactions.

- Smart Contracts: Tokenized real estate transactions can be executed using smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. Smart contracts reduce the need for intermediaries (such as brokers or lawyers), speeding up the process and lowering transaction costs, while ensuring that the terms are automatically enforced.

- Global Market Expansion: Real estate tokenization opens up the global market for real estate investment. Investors from anywhere in the world can participate in tokenized real estate transactions without the complexities of international property laws, currency conversions, or geographical barriers. This enables greater diversification of investment portfolios for individuals and institutional investors alike.

- Cross-Border Transactions: Blockchain technology enables faster and cheaper cross-border transactions compared to traditional methods, which can involve high fees, delays, and currency exchange risks. Tokenization can make international real estate investment more accessible and efficient.

- Eliminating Middlemen: Traditional real estate transactions involve many intermediaries, such as brokers, lawyers, and notaries, which add layers of costs and delays. Tokenization can reduce or eliminate the need for many of these intermediaries, thus lowering transaction fees and speeding up the process.

- Automation with Smart Contracts: By using smart contracts, many manual tasks involved in the purchase, sale, and management of properties can be automated, reducing administrative costs and minimizing the potential for human error.

- Unlocking Capital: Property owners can raise capital by tokenizing their real estate holdings and selling fractional ownership in the form of tokens. This can help developers or owners of large properties to unlock capital for new investments or business ventures without needing to sell the entire property.

- Easy Portfolio Diversification: With tokenized real estate, property owners can easily diversify their portfolios by adding fractional investments in different types of properties or geographic locations. This reduces the risk associated with holding only one property or asset class.

- Efficient Tax Reporting: Real estate tokenization can simplify tax reporting. Blockchain records all transactions, making it easy to track gains, losses, and other taxable events. Tokenized assets can streamline the tax filing process by providing clear, real-time data on ownership and asset movements.

- Transparency in Property Valuation: The blockchain ledger can also provide real-time updates on property values, offering greater transparency and reducing discrepancies in property valuation.

- Real Estate Crowdfunding: Tokenization allows for the creation of decentralized real estate crowdfunding platforms, where numerous small investors can collectively fund a real estate project. This model creates new financing opportunities for developers and property owners while providing small investors with access to lucrative real estate investments.

- Access to New Forms of Funding: Developers and property owners can tap into a broader pool of capital through tokenized real estate offerings. Tokens could be structured in various ways (e.g., equity-based, debt-based) to meet the needs of different types of investors, providing more flexibility in terms of financing.

- New Investment Vehicles: Real estate tokenization opens the door to the creation of new investment vehicles that cater to different risk appetites. For example, investors could choose between tokenized shares in commercial properties, residential units, or even niche real estate sectors like vacation rentals or industrial spaces.

- Customizable Investment Options: Investors can choose how much they want to invest in a particular property, the type of return they’re seeking (e.g., dividends from rental income or capital appreciation), and the level of risk they are willing to take. This makes real estate investments more flexible and customizable.

- Faster Project Funding: Tokenization can expedite the process of raising capital for real estate development projects. Developers can tokenize a project and sell fractional ownership to multiple investors, allowing them to access the funding needed for construction and development more quickly.

- Increased Transparency for Stakeholders: Tokenization ensures that all stakeholders (e.g., developers, investors, lenders) can see the exact status of a project, its financing, and how funds are being used, ensuring greater accountability and trust.

Real estate tokenization represents a revolutionary shift in how property is bought, sold, and invested in. By utilizing blockchain technology, tokenization enhances transparency, liquidity, and accessibility while lowering barriers for both investors and property owners. This could transform the real estate market, making it more efficient, accessible, and attractive to a global pool of investors. For both developers and investors, tokenization offers new opportunities for growth, diversification, and financial innovation in the real estate space.

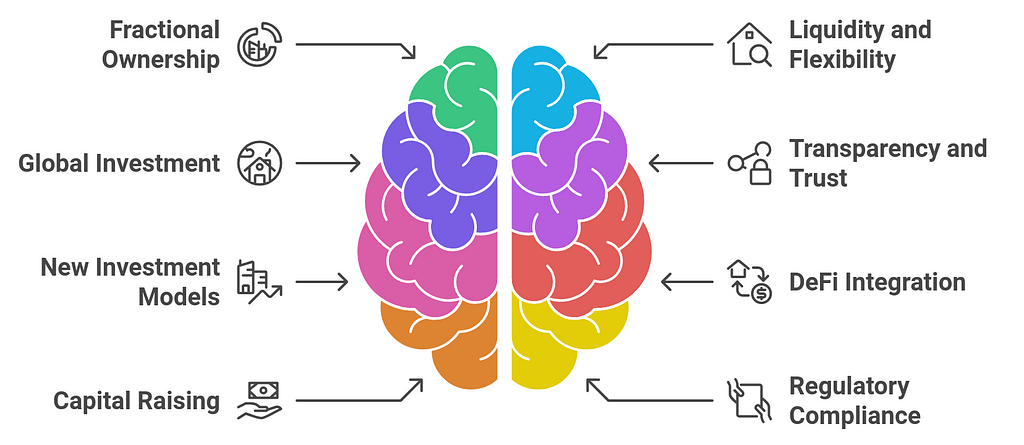

Growing Role of Tokenization in Real Estate in 2025As we approach 2025, tokenization in real estate is expected to play an increasingly pivotal role in transforming the industry, offering new ways to invest, manage, and trade property assets. By leveraging blockchain technology, tokenization provides an efficient, secure, and transparent method for converting real estate ownership into digital tokens. These tokens represent fractional ownership of a property, which can be bought, sold, or traded on blockchain-based platforms. Here are some key aspects of the growing role of tokenization in real estate in 2025:

1. Mainstream Adoption of Fractional Ownership

1. Mainstream Adoption of Fractional Ownership- Wider Access for Small Investors: As tokenization continues to gain traction, it will become a mainstream option for investors seeking to enter the real estate market with less capital. Fractional ownership through tokens allows small investors to purchase portions of high-value properties (such as commercial buildings or luxury residential units) with minimal investment, making real estate more inclusive and democratizing access to property markets.

- Diverse Property Types: Tokenization will expand beyond traditional residential and commercial properties to include more niche real estate types like vacation homes, short-term rental properties, industrial spaces, and even agricultural land. This will give investors more opportunities to diversify their portfolios.

- Real-Time Trading: Tokenized real estate will increasingly be traded on blockchain platforms, providing investors with the ability to buy or sell ownership shares in real estate properties in real time. This addresses one of the key challenges of traditional real estate investments, which can take months to liquidate due to the complex nature of transactions.

- 24/7 Market Access: Unlike traditional stock or real estate markets that operate on fixed schedules, tokenized real estate platforms will allow for round-the-clock trading. This shift will give investors more flexibility and convenience, removing geographical and time barriers in real estate investments.

- Cross-Border Investment Opportunities: Tokenization allows investors to participate in real estate markets around the world, overcoming geographic limitations. With real estate tokens, a person in Asia can easily invest in a property in Europe or North America without the complexities of foreign currency exchange, legal hurdles, or intermediaries.

- Reduced Transaction Costs: Blockchain technology eliminates the need for many traditional intermediaries (e.g., brokers, lawyers, notaries), which often add high fees and delays to real estate transactions. This reduction in transaction costs will make global investments more accessible and efficient.

- Blockchain’s Immutable Record: Tokenization leverages the security and transparency of blockchain technology. All transactions involving real estate tokens are publicly recorded and immutable, creating an audit trail that enhances trust among investors. This transparency can help reduce fraud, errors, and disputes, which are common in traditional real estate markets.

- Smart Contracts for Automation: Smart contracts can be used to automate transactions, ensuring that terms are executed automatically when predefined conditions are met. For example, rental income can be distributed to token holders based on a predetermined schedule, and property transfers can occur without the need for manual intervention. This enhances trust and reduces the administrative burden.

- Real Estate Crowdfunding Platforms: Tokenization will give rise to new models of real estate crowdfunding, where groups of investors can collectively fund a development project or purchase a property. With tokenized ownership, these platforms will enable easier and faster investments, allowing smaller stakeholders to pool their capital for large projects.

- Customizable Investment Vehicles: Tokenized assets can be structured in various ways to meet different investor needs. For example, tokens could represent equity stakes, debt, or even hybrid forms of investment. This flexibility will allow developers to tap into a broader pool of capital and investors to choose investment opportunities that align with their risk profile and financial goals.

- Leveraging DeFi for Real Estate: Tokenized real estate will increasingly integrate with decentralized finance (DeFi) ecosystems. Investors could use tokenized property assets as collateral to secure loans or participate in liquidity pools that offer yield or interest. This integration will make real estate more liquid and financially accessible, even for individuals without large capital.

- Tokenized Real Estate as Collateral: As DeFi continues to grow, tokenized real estate assets could be used as collateral for borrowing or lending. This opens up new avenues for financing property purchases and development projects, creating a more dynamic real estate market.

- Faster Access to Capital: Tokenization enables property developers to raise capital more quickly by issuing tokens representing fractional ownership in a project. Rather than waiting for traditional financing (e.g., bank loans, private equity), developers can tap into a global pool of investors interested in fractional ownership, speeding up the funding process.

- Increased Transparency in Fund Allocation: Tokenization offers clear and transparent tracking of how funds are used in property development projects. Investors will have real-time visibility into the progress of a project and how their funds are being allocated, enhancing accountability and reducing the risk of mismanagement.

- Increased Regulatory Frameworks: As tokenization becomes more mainstream, governments and regulators will likely establish clearer frameworks for tokenized real estate transactions. This regulatory clarity will help further legitimize tokenization, making it more attractive to institutional investors and larger real estate companies.

- Compliance with KYC/AML Standards: In response to concerns over fraud and money laundering, tokenization platforms will increasingly implement Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols. This will ensure that the tokenization process remains secure and compliant with financial regulations, which will boost investor confidence.

- Automated Asset Management: Tokenization will allow for greater automation in the management of real estate assets. For example, smart contracts can manage rent payments, distribute dividends to token holders, and track the financial performance of a property in real-time.

- Enhanced Property Reporting: Blockchain records can provide detailed data on property valuations, rental income, and other performance metrics. This transparency will give investors better insights into the performance of their investments and help them make more informed decisions.

- Access to Sustainable Properties: Tokenization could provide a platform for investing in sustainable, green real estate projects. Investors increasingly want to align their investments with their values, and tokenization allows them to easily identify and invest in properties that meet environmental and sustainability criteria.

- Environmental Impact Tracking: Blockchain’s ability to track and record data could be used to verify the sustainability of a property, such as energy efficiency, carbon emissions, or waste management practices. This could make it easier for investors to support eco-friendly and socially responsible real estate projects.

By 2025, tokenization is set to revolutionize the real estate sector, offering a new level of flexibility, liquidity, transparency, and efficiency. With its ability to lower barriers to entry, streamline transactions, and create more diverse investment opportunities, tokenization is poised to change the way investors and property owners engage with the real estate market. As blockchain technology matures and regulatory frameworks evolve, tokenized real estate will likely become a significant and mainstream component of the global investment landscape, driving innovation and growth in the sector.

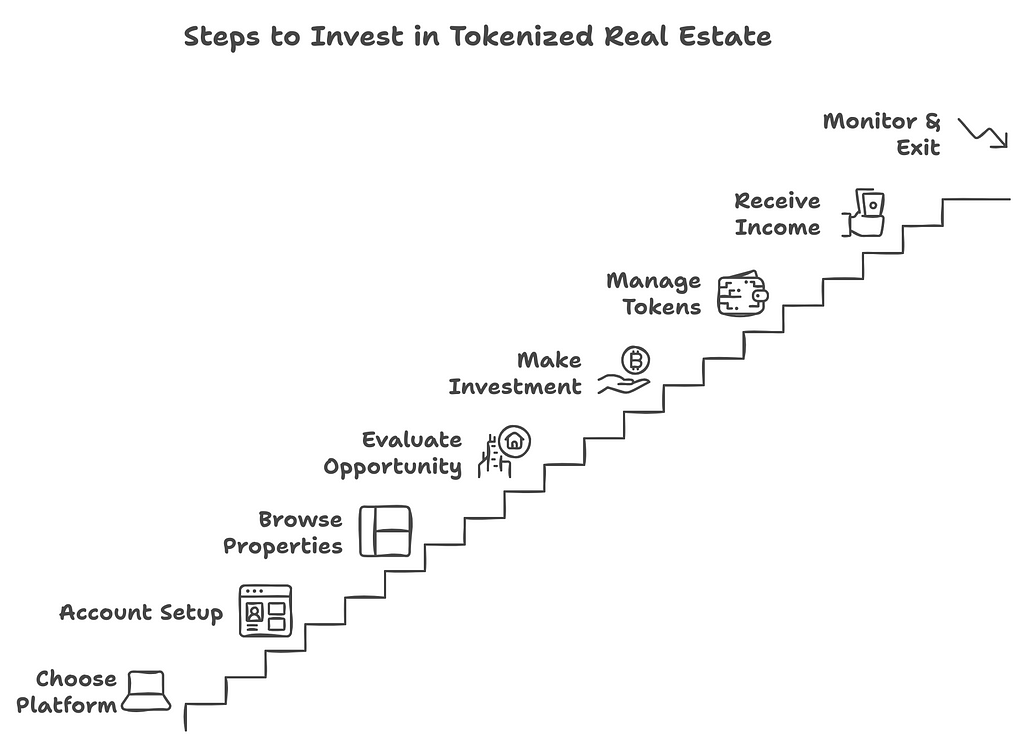

The Process of Investing in Tokenized Real EstateInvesting in tokenized real estate is a relatively new but growing concept that allows investors to participate in real estate markets through blockchain technology. The process involves purchasing digital tokens that represent fractional ownership of a property, typically through a platform that facilitates real estate tokenization. Here’s a step-by-step guide to the process of investing in tokenized real estate:

1. Choose a Tokenization Platform

1. Choose a Tokenization Platform- Research and Select a Platform: The first step is to choose a reliable and reputable tokenization platform. These platforms offer the infrastructure to tokenize real estate assets, allowing investors to buy, sell, and trade property tokens. Examples include platforms like RealT, SolidBlock, and tZERO.

- Verify Legitimacy and Security: Ensure the platform adheres to regulatory standards and offers robust security features (e.g., encryption, multi-factor authentication). Review the platform’s reputation, reviews, and the types of real estate projects they tokenize.

- Account Setup: To start investing in tokenized real estate, you need to create an account on the platform. This usually involves providing basic personal information such as name, email address, and phone number.

- KYC/AML Process: Most tokenization platforms require investors to complete Know Your Customer (KYC) and Anti-Money Laundering (AML) verification processes. This typically involves submitting identification documents (e.g., passport, driver’s license) and sometimes proof of address. This is to ensure compliance with regulations and prevent fraud.

- Property Listings: Once your account is set up and verified, you can browse a list of available tokenized real estate properties. These properties might include residential buildings, commercial real estate, vacation properties, or other types of real estate.

- Investment Information: Each listing will provide detailed information about the property, such as its location, value, expected returns, historical performance, and how many tokens are available for sale. There may also be details on the property’s legal status, maintenance, and management.

- Investment Amount: Tokenized real estate allows you to purchase fractional ownership, meaning you don’t need to buy the entire property. You can invest a small amount relative to the total value of the property. Review the minimum investment requirement and evaluate whether the amount aligns with your budget and investment goals.

- Risk Assessment: As with any investment, assess the risk factors involved. Research the property’s location, market trends, rental potential, and any potential legal or regulatory issues. Tokenized real estate may carry risks related to the management of the property, market volatility, or platform reliability.

- Return on Investment (ROI): Understand the expected ROI, which could come in the form of rental income distributions or capital appreciation. Some platforms provide projected income based on past performance or comparable properties, while others might offer insights into the property’s future appreciation potential.

- Select Tokens: Once you’ve identified a property you’d like to invest in, you can select the number of tokens you wish to purchase. Each token typically represents a fractional share in the property, and the price per token is usually set based on the property’s value and the number of tokens issued.

- Payment Method: Tokenized real estate platforms often allow you to pay for tokens using cryptocurrencies (like Bitcoin or Ethereum) or fiat currencies (like USD or EUR). Some platforms may offer integrations with wallets or payment gateways to facilitate transactions.

- Transaction Confirmation: After making the payment, the transaction is recorded on the blockchain. You will receive confirmation of your token purchase, and the tokens will be transferred to your digital wallet.

- Digital Wallet: Once the transaction is complete, the tokens representing your fractional ownership in the property will be stored in your digital wallet. The wallet may be hosted on the tokenization platform or managed by a third-party provider.

- Smart Contract Management: Many tokenized properties use smart contracts to manage various aspects of the investment. For example, rental income might be automatically distributed to token holders, or capital appreciation may be reflected in the token’s market value. Smart contracts ensure that the terms of the investment are executed automatically and transparently.

- Real-Time Tracking: You will have access to real-time data on your tokenized property investment through the platform’s dashboard. This may include updates on rental income, property value fluctuations, maintenance, and other important metrics.

- Income Distribution: Depending on the platform and the type of real estate tokenized, you may receive periodic rental income or dividends based on the amount of tokens you own. This income is usually distributed according to the terms set in the smart contract.

- Direct Deposit or Digital Wallet: Rental income and dividends can be distributed to your digital wallet, either in cryptocurrency or fiat. Platforms often offer the option to withdraw your income directly to a bank account or reinvest it in more tokens.

- Property Updates: Regular updates regarding the property’s management, rental status, maintenance, and performance are typically provided on the platform. This allows investors to stay informed about how their investments are performing.

- Market Trends: Stay updated on the real estate market trends and the specific property’s performance. This will help you make informed decisions regarding holding, selling, or reinvesting in the tokens.

- Token Sale or Transfer: If you wish to sell your tokens or exit your investment, you can typically list the tokens for sale on the same platform or on a secondary market (if supported). Some platforms allow direct peer-to-peer token transfers, while others may facilitate token sales through their marketplace.

- Liquidity and Exit Strategy: Liquidity depends on the platform and the demand for the specific property’s tokens. While tokenized real estate is more liquid than traditional real estate, it may still take time to find a buyer, especially if the property is illiquid or in a niche market. Consider your exit strategy and the potential for capital appreciation when deciding whether to sell your tokens.

- Tax Obligations: As with any investment, the income and capital gains you earn from tokenized real estate investments may be subject to taxation. Tax regulations can vary depending on your location and the platform you use, so it’s important to consult a tax advisor who is familiar with blockchain and tokenized assets.

Investing in tokenized real estate in 2025 offers a unique opportunity to participate in the real estate market with greater liquidity, lower capital requirements, and enhanced transparency. By following these steps selecting a platform, evaluating opportunities, making the investment, and managing your tokens you can enter the world of tokenized real estate and enjoy the benefits of fractional ownership in high-value properties. As the market matures, tokenized real estate investments will continue to evolve, potentially offering even more advanced features such as automated portfolio management, enhanced secondary markets, and broader access to global real estate markets.

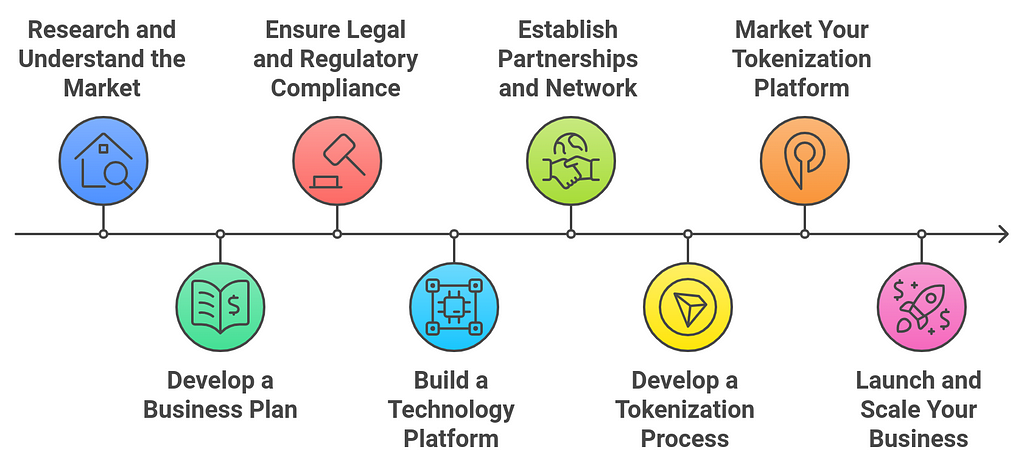

How to Start a Real Estate Tokenization Business?Starting a real estate tokenization business requires a strategic approach, a strong understanding of blockchain technology, and a focus on legal and regulatory compliance. The real estate tokenization business involves converting real estate assets into digital tokens that can be bought, sold, and traded on blockchain platforms. This emerging sector combines the real estate market with blockchain innovation to offer new investment opportunities.

Here’s a step-by-step guide to help you start a real estate tokenization business:

1. Research and Understand the Market- Market Understanding: Before starting, thoroughly understand the real estate tokenization market, including how blockchain works in the real estate sector. This includes understanding the benefits of tokenization such as fractional ownership, liquidity, and transparency, as well as the challenges, such as regulatory hurdles and the technology required.

- Target Market: Define your target marketwill you focus on residential, commercial, or industrial properties? Will you cater to high-net-worth individuals, retail investors, or institutional investors? Research the demand for tokenized real estate in your chosen market segments and geographic areas.

- Define Business Model: Determine how your business will operate. Will you focus on tokenizing existing properties, helping developers tokenize new projects, or creating a marketplace for trading tokenized properties? Define the value proposition you offer to clients whether it’s streamlining the investment process, reducing transaction costs, or offering global access to real estate.

- Revenue Streams: Decide how your business will generate revenue. Some options include charging property owners a fee to tokenize their assets, collecting transaction fees on trades or sales, or earning a percentage of the rental income from tokenized properties.

- Investment Strategy: Outline your strategy for sourcing properties to tokenize. Will you work with developers, individual property owners, or institutional investors? Will you focus on specific property types or geographic areas?

- Financial Projections: Develop detailed financial projections, including initial startup costs (e.g., technology infrastructure, legal fees, marketing), operating expenses, and anticipated revenue streams. This will help guide your business decisions and attract investors or partners.

- Legal Framework: Real estate tokenization operates in a highly regulated space, especially when dealing with securities laws and financial regulations. Consult with legal experts specializing in blockchain, securities law, and real estate to understand the regulatory requirements in your country or region.

- Tokenized Real Estate as Securities: In many jurisdictions, tokenized assets may be classified as securities. Therefore, your business must comply with securities laws such as the U.S. Securities and Exchange Commission (SEC) guidelines or similar regulatory bodies worldwide. This may involve registering with regulators, ensuring compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) laws, and following data privacy regulations.

- Smart Contracts and Agreements: Work with legal professionals to develop legal contracts and smart contracts that govern the tokenized real estate transactions, outlining the rights and obligations of token holders, income distributions, and token transfers.

- Real Estate Laws: Ensure compliance with real estate laws in your target markets, such as property rights, land ownership, and the process for transferring property ownership.

- Blockchain Infrastructure: Choose a blockchain platform to host your tokenized real estate assets. Popular options include Ethereum, Tezos, Binance Smart Chain, or Solana. These blockchains support the creation and transfer of digital tokens, smart contracts, and decentralized applications (DApps).

- Develop a User-Friendly Platform: Build or partner with a development team to create a secure and user-friendly platform where clients can tokenize their properties, investors can browse tokenized real estate assets, and transactions can be executed seamlessly. The platform should include features like a secure wallet for token holders, property listings, and investment dashboards.

- Smart Contracts: Develop smart contracts to automate various functions of tokenized real estate, such as property transfers, income distributions, and ownership rights. Ensure that the smart contracts are secure, transparent, and meet the legal requirements for property ownership and transactions.

- Integration with Payment Systems: Incorporate payment gateways to allow for the easy exchange of fiat or cryptocurrency for real estate tokens. Integration with digital wallets and blockchain networks is essential for smooth transactions.

- Partnerships with Property Owners and Developers: Form relationships with property developers, real estate owners, and institutional investors who are interested in tokenizing their real estate assets. You’ll need to convince them of the benefits of tokenization, such as increased liquidity, fractional ownership, and easier capital raising.

- Collaboration with Legal and Regulatory Experts: Collaborate with legal experts who specialize in blockchain, real estate, and securities law to ensure your tokenization process complies with regulations in all relevant jurisdictions.

- Technology Partnerships: If you’re not able to develop the platform in-house, consider partnering with blockchain technology providers or working with existing real estate tokenization platforms to get started. This could save time and resources in building out the necessary infrastructure.

- Investors and Funding: Secure funding to develop the platform, cover legal expenses, and market your services. This could involve seeking venture capital, partnering with investors, or launching a crowdfunding campaign for your tokenization business.

- Tokenizing Real Estate: Develop a process for converting real estate assets into digital tokens. This process will likely involve appraising the property, creating a legal framework for the asset, determining the number of tokens to issue (and their price), and working with blockchain developers to mint the tokens.

- Fractional Ownership: Decide how much of each property will be tokenized and how fractional ownership will work. Will tokens represent an equal share of ownership, or will they be structured differently? Ensure the process is transparent and well-documented for investors.

- Security and Compliance: Use blockchain’s security features to protect token ownership and ensure that token holders have the proper rights and access to the property. Each transaction and token issuance should be fully traceable on the blockchain.

- Create a Marketing Strategy: Develop a comprehensive marketing plan to promote your tokenization platform to property owners, investors, and developers. Use digital marketing tactics such as SEO, social media, email marketing, and content marketing to attract both users and investors.

- Educational Content: Since tokenization is a relatively new concept, offer educational content such as blog posts, webinars, and whitepapers that explain the benefits of tokenization, how it works, and why it is an attractive option for real estate investors.

- Networking and Events: Attend industry conferences and events on blockchain, real estate, and tokenization to connect with potential clients, partners, and investors. These events are valuable opportunities to network and demonstrate your expertise in the field.

- Beta Testing: Before fully launching, conduct a beta test of your platform with a small group of users to ensure that it functions correctly, is user-friendly, and meets security standards. Gather feedback to refine the platform and processes.

- Launch the Platform: Once the platform is fully developed, tested, and legally compliant, launch it to the public. Focus on attracting property owners and investors to use your service.

- Customer Support: Provide excellent customer service to guide users through the process of tokenizing real estate, investing in tokens, and managing their assets. Create a support team to address user inquiries and issues promptly.

- Scale the Business: Once established, consider expanding your platform to offer tokenization for different types of properties or entering new geographic markets. Leverage partnerships with more developers, real estate agents, and institutional investors to grow your business.

Starting a real estate tokenization business in 2025 requires a combination of legal expertise, blockchain technology knowledge, and a strong understanding of the real estate market. With the right platform, partners, and strategy, you can build a business that offers a cutting-edge way for investors to access real estate opportunities and for property owners to unlock liquidity. By focusing on compliance, transparency, and innovative technology, your real estate tokenization business can take advantage of a rapidly growing market and transform the way people invest in real estate.

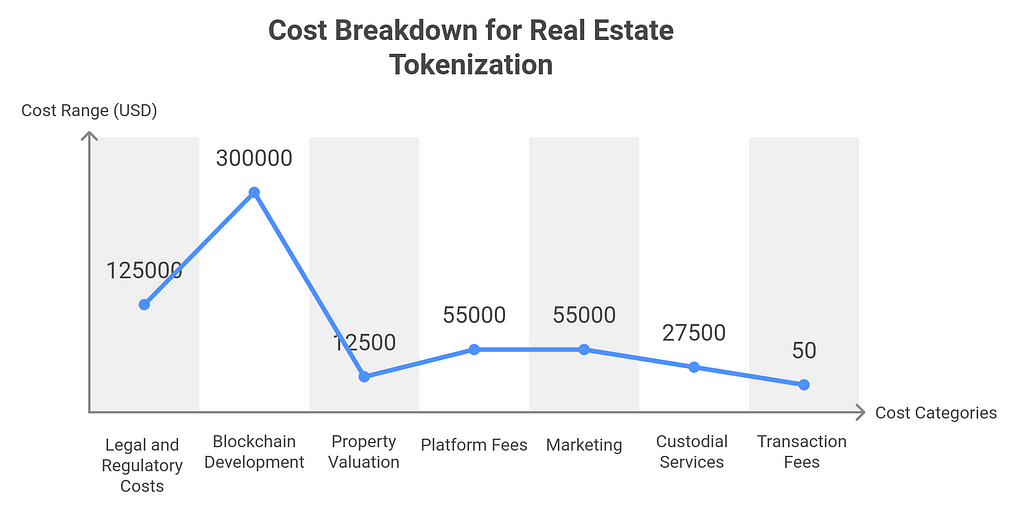

How Much Does Tokenization Cost in Real Estate?The cost of tokenizing real estate can vary widely depending on several factors, including the complexity of the project, the size of the property, the jurisdiction, and the technology used. Tokenization involves several key steps, each of which can incur different costs, such as legal fees, blockchain development, regulatory compliance, and platform fees. Here’s a breakdown of the potential costs and duration involved in real estate tokenization:

1. Legal and Regulatory Costs

1. Legal and Regulatory Costs- Legal Fees for Structuring the Tokenization: Legal work is essential in tokenizing real estate, especially in ensuring compliance with securities laws, drafting smart contracts, and preparing offering documents. Legal fees can include:

- Drafting legal frameworks for tokenization

- Compliance with securities laws (e.g., Reg D, Reg A+, or other local regulations)

- Creating investor agreements and contracts

Cost Range: $50,000 to $200,000+ Duration: 2 to 6 months (depending on jurisdiction and complexity)

Notes: Legal costs are often one of the largest expenses in tokenization, as the process requires lawyers who specialize in both real estate and blockchain technology to ensure the tokens comply with local and international securities regulations.

2. Blockchain Platform Development and Smart Contract Creation- Blockchain Development: Developing the platform to manage the tokenized assets can be costly, especially if you want a custom-built platform with user-friendly features for investors and property owners.

- Smart Contracts: Smart contracts are the digital agreements that facilitate transactions, payments, and transfers on the blockchain. These require developers to write, audit, and deploy.

Cost Range:

- Platform development: $100,000 to $500,000+ (for a custom-built platform)

- Smart contract creation: $10,000 to $50,000+ Duration: 3 to 9 months (for a fully functional, custom platform)

Notes: If you’re using an existing tokenization platform (e.g., Polymath, Harbor, or RealT), the costs for platform development may be significantly lower, as you’re leveraging an existing solution.

3. Property Valuation and Appraisal- Property Appraisal Fees: Before tokenization, a professional property valuation is necessary to determine the property’s market value, which will be divided into tokens. This is critical for determining the token price.

Cost Range: $5,000 to $20,000 per property (depending on the property’s size and location) Duration: 1 to 2 weeks

Notes: Property appraisers must be independent and certified to ensure compliance with legal requirements, especially when dealing with fractional ownership.

4. Platform Fees and Ongoing Maintenance- Tokenization Platform Fees: If you’re using a third-party tokenization platform, they will charge fees for listing and tokenizing the property. These fees can vary based on the platform and the level of service.

- Ongoing Maintenance: There will also be ongoing fees for platform maintenance, security, and updates to ensure the platform remains secure and compliant.

Cost Range: $10,000 to $100,000+ annually (depending on platform and scale) Duration: Ongoing

Notes: These costs are typically recurring, as the platform will need to handle transactions, updates, and customer support.

5. Marketing and Investor Outreach- Marketing Costs: Attracting investors to buy tokens involves marketing efforts like creating a website, producing educational content, advertising, and engaging in outreach. These efforts are necessary to promote the tokenized asset to a broader audience.

Cost Range: $10,000 to $100,000+ Duration: 1 to 3 months for initial marketing campaigns

Notes: Marketing costs vary depending on the complexity of your marketing strategy and the type of real estate asset being tokenized.

6. Custodial and Administrative Services- Custody Services: You may need custodial services to manage the underlying real estate assets, ensuring that the property is legally held in a way that aligns with the tokenized shares. These services could be provided by a third-party firm or integrated into the platform.

Cost Range: $5,000 to $50,000 per year (depending on the size and complexity of the assets) Duration: Ongoing

Notes: Some tokenization platforms offer custody services as part of their overall package, which can reduce these costs.

7. Transaction Fees- Blockchain Transaction Fees: Depending on the blockchain platform used (e.g., Ethereum, Binance Smart Chain), there will be transaction costs (gas fees) for creating and transferring tokens.

Cost Range: Typically low per transaction, ranging from a few cents to $100+ per transaction (depending on blockchain and network congestion) Duration: Per transaction (ongoing)

Notes: These fees are lower than traditional real estate transaction fees but should be considered in the cost structure.

Total Estimated Costs for Tokenizing Real Estate- Small/Low-Value Property: Tokenizing a smaller property or single-unit asset might cost between $100,000 and $300,000 in total, depending on the complexity.

- Mid-Range Property: For a larger property or a more complex project with multiple investors, the cost may range from $300,000 to $800,000+.

- Large, High-Value Property: For large commercial developments or multi-property tokenization projects, costs can easily exceed $1 million, especially if you’re building a custom platform or requiring significant legal and compliance work.

The overall duration to complete the tokenization process for real estate typically ranges from 3 to 12 months, depending on the complexity of the project, the property involved, and regulatory requirements. Smaller or simpler projects could be tokenized more quickly (3–6 months), while large-scale or complex properties may take longer (6–12 months or more).

Tokenizing real estate can be a costly and time-consuming process, but the potential benefits such as fractional ownership, liquidity, and global access to real estate investmentscan make it a highly attractive option for both property owners and investors. The costs will vary based on the scale and complexity of the project, but a budget of $100,000 to $1 million or more is typical for tokenizing real estate assets, with a timeline of several months to a year.

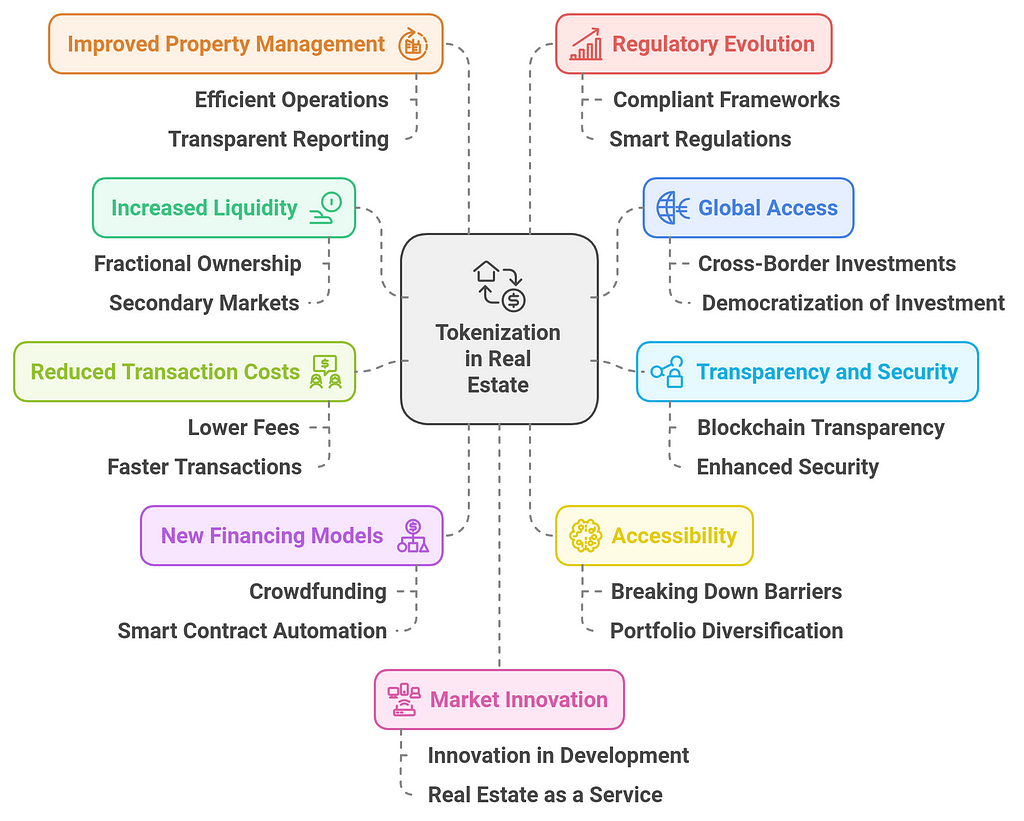

Is Tokenization the Future of Real Estate?Yes, tokenization is increasingly seen as a significant part of the future of real estate. The integration of blockchain technology into the real estate sector has the potential to revolutionize how properties are bought, sold, and managed. Tokenization allows real estate assets to be broken down into smaller, tradable units, known as tokens, which represent fractional ownership of a property. This offers numerous advantages that could reshape the industry over the next decade. Here’s why tokenization is considered the future of real estate:

1. Increased Liquidity

1. Increased Liquidity- Fractional Ownership: Tokenization allows real estate to be split into smaller units (tokens), making it accessible to a wider range of investors. This fractional ownership eliminates the need for large capital outlays typically required for real estate investment, opening up the market to retail investors.

- Secondary Markets: Blockchain enables the creation of secondary markets where tokens can be traded, which increases liquidity compared to traditional real estate investments that are often illiquid. Investors can buy and sell tokens more easily, enabling faster exits and more dynamic investment opportunities.

- Cross-Border Investments: Tokenization removes geographic barriers, enabling international investors to access real estate markets around the world. Whether you’re interested in high-value properties in New York or emerging markets in Asia, tokenized real estate allows seamless cross-border transactions, which is a game-changer for global investment.

- Democratization of Investment: Investors from different parts of the world can buy tokens representing properties in markets they would otherwise be unable to access due to regulatory constraints or lack of local knowledge.

- Blockchain’s Transparency: Blockchain technology provides an immutable ledger of transactions. Each token and its ownership are recorded on a public blockchain, providing a transparent record of ownership, transaction history, and asset performance. This transparency can help reduce fraud, disputes, and other risks associated with real estate transactions.

- Enhanced Security: Real estate tokenization offers improved security due to the inherent characteristics of blockchain technology. Tokenized assets are less susceptible to fraud, and the use of smart contracts can automate processes like transfers and rental distributions, ensuring that all parties adhere to agreed terms.

- Lower Fees and Intermediaries: Tokenization reduces the reliance on intermediaries such as brokers, banks, and title companies, which typically charge high fees in traditional real estate transactions. The automation provided by smart contracts can streamline processes such as property transfers, tax management, and income distributions, reducing the cost of doing business.

- Faster Transactions: Blockchain transactions occur much faster than traditional real estate transactions, which can take weeks or months. Tokenized transactions can be completed in a matter of hours, accelerating the buying, selling, and transferring processes.

- Crowdfunding and Syndication: Tokenization can enable new forms of crowdfunding and real estate syndication, where multiple small investors pool their resources to invest in larger, more expensive properties. Tokenization simplifies the management of these collective investments, making it easier to distribute income and handle investor relations.

- Smart Contract Automation: By automating financial and legal agreements via smart contracts, tokenization can create more efficient financing models. Investors could automatically receive rental income, profit shares, or interest from real estate assets, all tracked through blockchain.

- Breaking Down Barriers: Traditional real estate investments often require significant capital upfront, which limits access to only wealthier individuals or institutional investors. Tokenization lowers these barriers, allowing people to invest with smaller amounts, potentially as little as a few hundred dollars.

- Portfolio Diversification: Investors can diversify their portfolios by purchasing fractions of multiple properties, reducing exposure to risk compared to investing in a single real estate asset. This increased diversification can be particularly attractive to smaller investors.

- Efficient Operations: Blockchain and tokenization can streamline the management of real estate assets. Property managers can use smart contracts to automate rental agreements, maintenance schedules, and payments. Token holders can receive income distributions automatically, reducing administrative overhead.

- Transparent Reporting: Blockchain’s transparent nature ensures that investors have real-time access to data regarding property performance, including rental yields, occupancy rates, and maintenance costs. This transparency improves investor confidence and provides more accurate financial reporting.

- Compliant Frameworks: As the legal landscape around blockchain and tokenization continues to evolve, governments and regulators are working to create frameworks that support tokenized real estate. This regulatory clarity will likely make tokenization a more viable and attractive investment vehicle in the future.

- Smart Regulations: Future regulations could establish clearer rules for how tokenized assets are classified (e.g., securities vs. commodities) and how tokenized property transactions are taxed. Once these frameworks are in place, tokenized real estate could become mainstream and fully integrated into global financial systems.

- Innovation in Real Estate Development: Tokenization could encourage new methods of real estate development. Developers might seek funding through tokenized crowdsales or use tokenization to sell partial stakes in projects. This could change how developments are funded and structured, potentially lowering the cost of development and opening up opportunities for smaller investors to participate.

- Real Estate as a Service: Tokenized real estate could evolve into a more flexible asset class, with “real estate as a service” models emerging. For instance, token holders could participate in property use, like renting or booking time in co-working spaces or vacation homes, increasing the utility of tokenized assets.

- Legal and Regulatory Hurdles: In many regions, real estate tokenization is still a gray area in terms of regulatory clarity, and laws governing securities, tax, and real estate transactions need to catch up with blockchain technology.

- Market Adoption: Tokenization of real estate is still in its early stages, and its widespread adoption requires both real estate professionals and investors to trust and understand the technology.

- Liquidity Concerns: Although tokenized real estate offers enhanced liquidity compared to traditional real estate, it still depends on market demand for tokens. A lack of secondary market participants could limit liquidity in some cases.

Tokenization is poised to become a key part of the future of real estate by making property investment more accessible, liquid, and efficient. With the potential to lower transaction costs, democratize access to real estate, and create new financing models, tokenization could revolutionize the way we invest in, own, and manage property. However, challenges related to legal regulation, market education, and infrastructure need to be addressed before tokenization reaches its full potential.

As blockchain technology matures and real estate professionals and investors become more comfortable with the concept, tokenization will likely play an increasingly important role in reshaping the global real estate market.

ConclusionIn conclusion, real estate tokenization is set to transform property investment by offering unmatched accessibility, liquidity, and efficiency. By allowing fractional ownership, it opens the doors of real estate investment to a much broader audience, including those who previously couldn’t afford high-value properties. The ability to trade tokenized shares of real estate on digital platforms makes the market more fluid, enabling quicker exits and diversified portfolios for investors. Additionally, the use of blockchain technology ensures secure, transparent transactions, reducing the need for traditional intermediaries and lowering costs.

This innovation not only enhances the global reach of real estate markets but also streamlines the process of buying, selling, and managing property assets. As tokenization continues to gain traction, it will likely become a dominant force in the industry, providing both retail and institutional investors with new opportunities to invest in real estate. Ultimately, real estate tokenization is not just a trend, but a fundamental shift that will reshape the investment landscape for years to come.

FAQs1. What is real estate tokenization?Real estate tokenization involves converting a property into digital tokens on a blockchain. These tokens represent fractional ownership of the property, allowing investors to buy and sell shares of real estate in a much more liquid and accessible way than traditional property investments.

2. Why is real estate tokenization gaining popularity?Tokenization offers enhanced liquidity, lower entry barriers, and the ability to fractionate property ownership. It democratizes real estate investment, allowing small investors to participate in large-scale property markets that were previously out of reach. Additionally, blockchain technology offers transparency, security, and efficiency.

3. How does tokenization benefit small investors?Tokenization allows small investors to buy fractions of high-value properties, which were traditionally out of reach due to high capital requirements. This enables broader participation in real estate markets and helps diversify investment portfolios without needing substantial capital.

4. What are the advantages of tokenization over traditional real estate investment?Tokenization offers several benefits, including:

- Fractional ownership: Investors can own a percentage of a property rather than a whole asset.

- Liquidity: Tokens can be bought or sold on secondary markets, making real estate more liquid.

- Global access: Investors can buy tokens from anywhere, bypassing geographic barriers.

- Lower transaction costs: The use of blockchain and smart contracts reduces the need for intermediaries, decreasing fees.

Virtually any type of real estate can be tokenized, including residential, commercial, industrial, and even agricultural properties. Tokenization is particularly attractive for high-value assets, such as luxury real estate, large commercial buildings, and developments that can be split into smaller ownership units.

6. How do tokens represent real estate ownership?In tokenization, each token represents a fractional share of ownership in a property. The token is tied to the legal rights of the underlying asset, typically through a smart contract. Token holders receive benefits such as rental income, capital appreciation, or a share of the proceeds when the property is sold.

7. What legal and regulatory challenges does tokenization face?Tokenization faces regulatory challenges in different jurisdictions, particularly concerning securities laws. In many countries, tokenized assets must comply with existing financial regulations. Legal clarity is crucial for ensuring that tokenized assets are properly categorized (e.g., as securities or commodities) and meet the necessary regulatory requirements.

8. How does tokenization impact property developers?Tokenization provides property developers with new ways to raise capital. Instead of relying on traditional financing methods, developers can offer fractional ownership in their projects, allowing multiple small investors to participate. This can reduce the dependency on large-scale investors or banks, making it easier to fund new developments.

9. What are the risks of investing in tokenized real estate?While tokenization offers many benefits, there are risks involved, including:

- Regulatory uncertainty: Lack of clear regulations in some regions can pose legal risks.

- Market volatility: Real estate markets may experience fluctuations that affect tokenized assets.

- Platform risk: Investors need to trust that the platform facilitating the tokenization is secure, reliable, and well-managed.

The future of real estate tokenization looks promising. As blockchain technology matures and regulatory frameworks become clearer, tokenization could become a mainstream investment method. It’s expected that tokenization will continue to democratize access to real estate markets, reduce transaction costs, and provide more efficient and transparent investment options.

Why is Real Estate Tokenization the Next Big Thing in Property Investment? was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.