Winning the 2024 holiday retail season: A macro approach

My first day working at my company was Cyber Monday. Everyone gave me a warm welcome, told me they were busy and let me watch.

As I rolled my office chair from desk to desk and listened to calls, I learned about what Cyber Monday meant to ecommerce.

I’m reminded of this experience as the 2024 holiday season approaches, and I think about the new marketers who will experience the Black Friday through Cyber Monday trial by fire.

Whether it’s your first holiday season or your 20th, continue reading to learn how to achieve the best results for your business or clients.

Let’s examine the holiday ecommerce season through three lenses:

- The consumer.

- The publisher.

- The marketer.

Inflation has heavily influenced this year’s economic outlook.

U.S. Federal Reserve Chairman Jerome Powell announced a half-percentage point cut in interest rates, the first since the COVID-19 pandemic, on Sept. 18.

This rate cut is expected to lower interest rates for consumer loans and other financial products and help keep the job market strong.

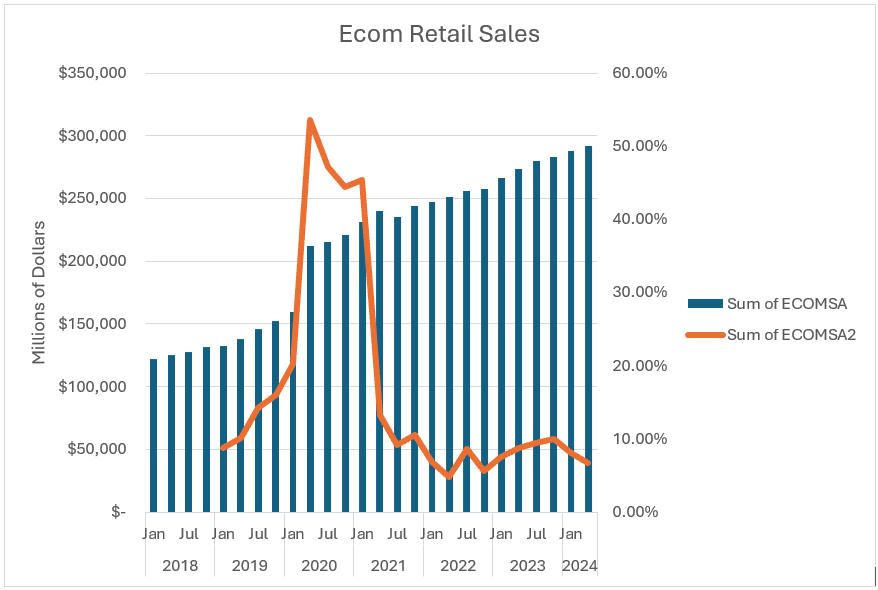

In turn, those positives should also influence an acceleration in consumer spending. As the graph shows, ecommerce retail sales have steadily grown, even as total retail has flattened.

We can expect that businesses with a strong online presence will be positioned to realize big wins this holiday season.

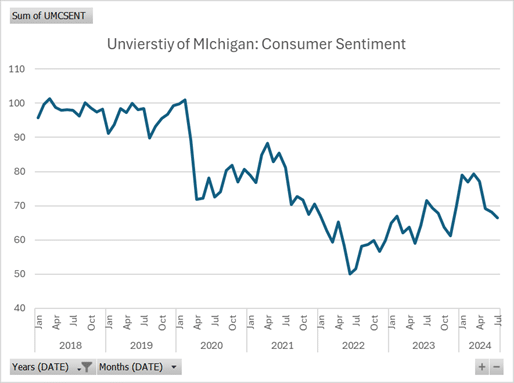

Further anchoring growth in retail spending, a 2024 University of Michigan Consumer Sentiment Survey shows that while consumer sentiment has been up and down, consumers are gaining confidence and spending money online again after bottoming out in 2022.

This data suggests that digital marketers need to be prepared with ample budgets and flexibility to chase demand as it arrives. This begs the question: What will consumers be looking for?

A holiday marketing playbook recently released by Microsoft highlighted these four points that underscore consumer preferences:

- 16% increase in buy now, pay later financing.

- 23% increase in expedited shipping.

- 7% increase in free return, return and exchange policies.

- 24% increase in “freebies” as incentives to complete purchases.

Businesses should mostly pay attention to expedited shipping because, in the U.S., Thanksgiving is coming later this year, which means there are five fewer days than usual to ship gifts before Christmas. That likely means last-minute shoppers will need to get gifts to recipients on time.

Dig deeper: Seasonal PPC: Your guide to boosting holiday ad performance

Get the newsletter search marketers rely on.

Business email address Sign me up! Processing... The publisherTo examine the publisher’s perspective, let’s talk about Microsoft Ads first.

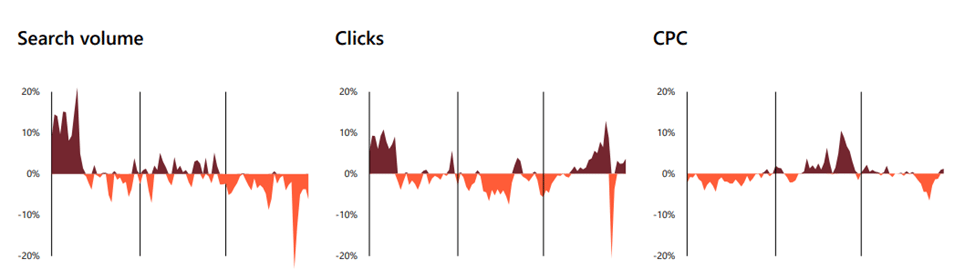

The playbook previously mentioned showed data indicating that “search volumes” will climb more significantly in October than in December. That means consumers are doing holiday research earlier than in past years.

Meanwhile, the data also shows that cost-per-click (CPC) growth peaks in November.

Although I recommend following revenue rather than clicks when thinking about budget phasing, this data does point to a possible disconnect between consumer behavior and digital marketers’ ad buying behavior.

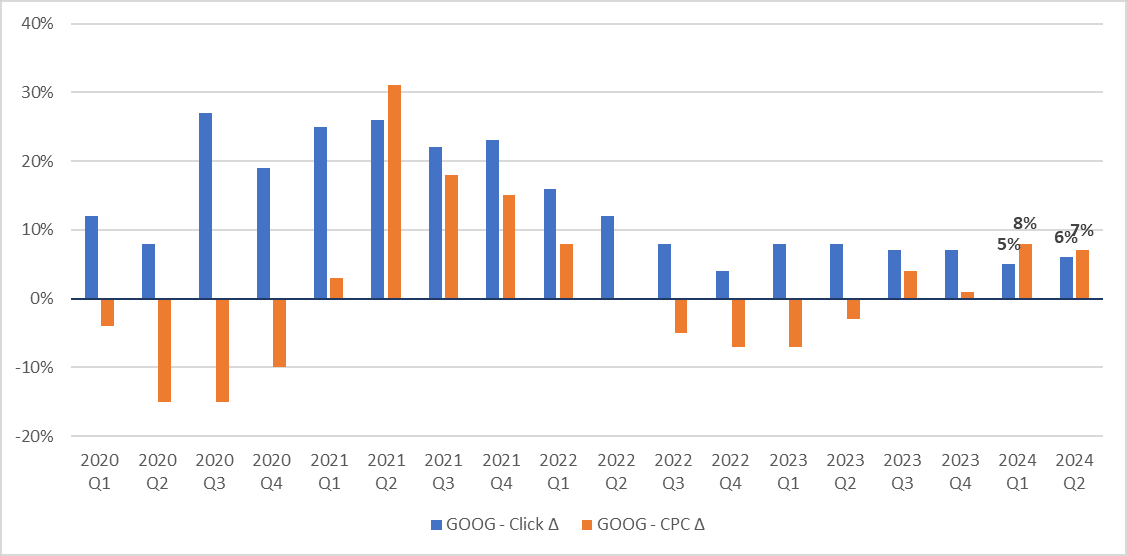

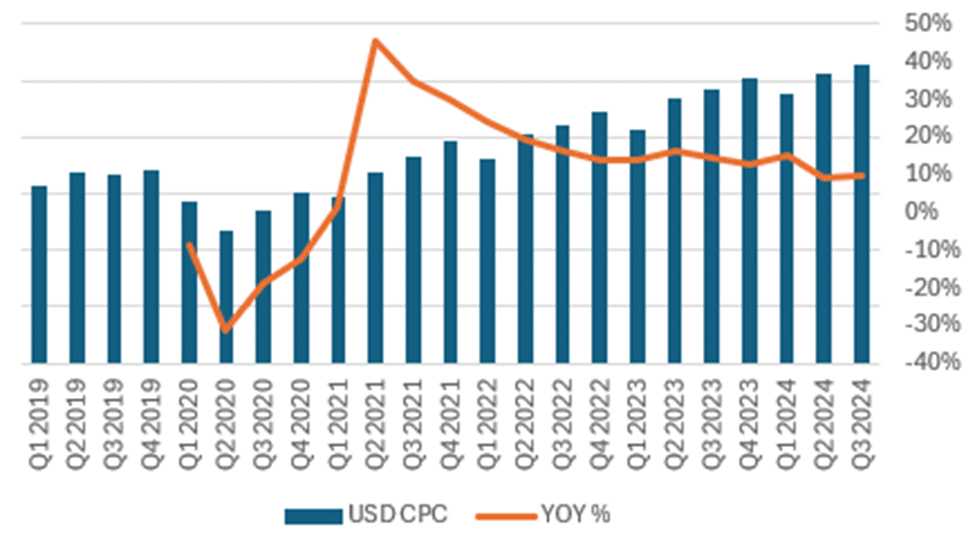

Now, let’s look at some Google data. According to its 2024 quarterly reports, paid click and CPC growth have been relatively healthy, and there’s no indication that the trend is going to reverse anytime soon.

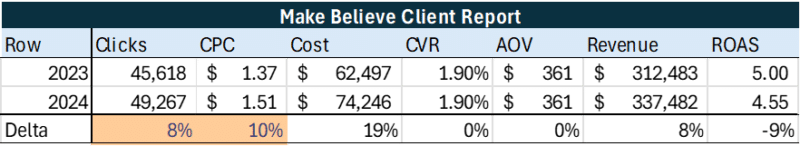

Therefore, if there are about 8% more paid clicks in Q4 and paid click prices are up about 10% year-over-year (YOY), that should spell some top-line growth and margin losses assuming conversion rate (CVR) or average order value (AOV) remain steady, as per the hypothetical chart seen here.

But how confident can we be in Google’s data? There are two points that reinforce it. The first is our agency’s own data, which shows similar CPC changes.

Source: Logical Position

Source: Logical Position

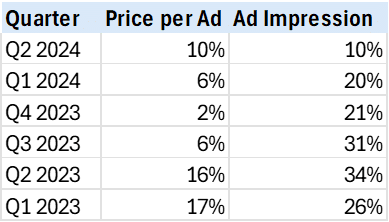

The second is Google’s favorite buddy, Facebook. It shows a similar rebounding in ad prices, indicating marketers are pushing more money into both platforms as they chase growing consumer demand.

With this data, we expect strong consumer demand in the coming holiday season, which will be presented to publishers in the form of increased ad inventory and increased ad prices.

So, how does that impact the marketer?

Dig deeper: 2024 holiday marketing: Top SEO and PPC tips for a short shopping season

The marketerTaking a macro perspective, marketers should do what they do best – crush it.

To help shore up your approach and avoid any mishaps, here are some tips to follow:

- If running Broad Match, Search Partners, DSAs or Performance Max (everyone is probably running at least one), look at how they were impacted by the holidays last year. (If you don’t have data from last year, look at past sales events.)

- Anything running targeting run by AI is susceptible to getting too loose when given newly increased budgets or more aggressive targets. Make sure negative keyword (NKW) lists are robust and watch closely after making any changes.

- Don’t get sold on “Black Friday Deals” keywords. Unless you have the squeeze pages/offerings that can cover such broad searches, users will bounce.

- If you are working from a “limited by budget” campaign status, you may want to reevaluate, otherwise you risk letting the highest value clicks of the year go to competitors.

- It’s likely common practice, but always say “no” to display expansion.

- While a single day cannot break your holiday success, remember that each day is more important than ever, considering the condensed shopping window that this year brings.

- Ensure that budget phasing accounts for that.

- Follow the “Batman” approach. A well-managed account should look like this at the end of the quarter:

Can you see him? The little Batman? This approach means that cost should follow revenue.

Stick to this strategy even when publishers try to sell you on the idea that spending early to get into the consideration window is important.

Their motive is to drive up ad premiums during lower ROI times. Stay strong for the benefit of your businesses and clients.

Make it a winning seasonAs a fan of the “Game of Thrones” TV series, I’m reminded of the words of Lord Ned Stark, “Winter is coming.”

With that, ecommerce is positioned for a strong 2024 holiday season. Make sure your budgets are uncapped, targets are right, NKW lists are strong and then, just ride the wave.

Clients will be happy. Bonuses will be big. And, I’m confident, you’ve got this!

Dig deeper: Ecommerce PPC: 4 optimizations to do before the holiday season